OP-ED: This in-depth opinion article is written by someone who is not affiliated with the LearnBonds editorial staff. Edited by Justin B.

More than a decade ago, Satoshi Nakamoto, the mysterious inventor of the modern-day crypto-hawala published his white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System”. The choice of the term itself already alludes to something BitTorrent-like but for a kind of primitive techno-medieval coinage economy in the periphery of things.

I recall myself reading the white paper some time around 2010 or 2011 and thinking it really interesting and at the same time bizarre and quaint in many ways and assumptions contained. There is also not much we can assume about the author’s motives, him being anonymous and having kept it that way.

The Bitcoin Issue

Satoshi Nakomoto will likely always stay anonymous with nothing ever conclusively proven about his true identity. But there are things that could be assumed or even concluded based on the information and clues available. Granted, there is way too much nonsense and the misconception that seems to float around the matter, surrounding it with discourse poisoning miasma and breeding ever stranger delusions. For one, Bitcoin never had a “vision”. And the frequently changing narratives demonstrate this clearly. Having gone from means of exchange to virtual gold and store of value, sound money and appeals to Austrian economics, “sound money” and even claims of it becoming world reserve currency among others.

And this whole theater of peculiar nonsense may actually not be entirely a coincidence, but a social engineering tactic as well. And it should be fairly obvious that Bitcoin is nothing but an unregulated financial instrument and a rogue money vehicle, one with very peculiar properties and not immediately obvious purpose. A strange technological artifact that might perplex even future alien archaeologists. Since it is very likely that Bitcoin was never even meant to scale for mass adoption, but rather open up a channel reserved for specific capital flows to pass through. It may be also that the bizarre notions in the white paper have also been deliberate and with a hidden purpose. After all, one thing Bitcoin can be said to be for sure is what French philosopher Gilles Deleuze called a “war machine” — a force standing in direct opposition to the state apparatus:

“As for the war machine in itself, it seems to be irreducible to the State apparatus, to be outside its sovereignty and prior to its law: it comes from elsewhere. Indra, the warrior god, is in opposition to Varuna no less than to Mitral He can no more be reduced to one or the other than he can constitute a third of their kind. Rather, he is like a pure and immeasurable multiplicity, the pack, an irruption of the ephemeral and the power of metamorphosis. He unties the bond just as he betrays the pact. He brings a furor to bear against sovereignty, a celerity against gravity, secrecy against the public, a power (puissance) against sovereignty, a machine against the apparatus.”

When accounting Bitcoin’s decade long epic of fueling black market economies bankrupting exchanges, use in money laundering operations, unnatural market price swings and frequent bubble formations, and let’s not forget the 2017 pumpathon which made the books of history of financial bubbles as perhaps surpassing even the Tulip mania, going from 1 to 20 000 USD in the span of a few months (obviously not due to any organic process or activity) and thereby pushing over the “crypto craze” that followed in the height of its epileptic seizure, marked by scammy ICOs in a perpetual Keynesian beauty circus of daily “pump and dump” operations and all the rest. And we also know that this too had most likely been also deliberately orchestrated by people with long experience in high-level financial fraud and other criminal activities.

Perhaps the greatest trick the devil ever pulled was convincing the world that Bitcoin is decentralized? Since there aren’t that many ways in which it actually is (except to the extent of being a peer-to-peer network) and on top of that, it seems very likely that there is a shadowy behind-the-curtains crypto-political machination going on. Since, for instance, how is Bitcoin actually valuated in fiat? Who decides and by what means and mechanisms is that relationship established?

Well, again, it’s not the invisible hand of a perfectly rational and self-regulating free market that sorts itself out so long we trust in our primal greed and not let ethics come in the way, but various machinations taking place intended to cause certain events. All of which appears to be done ruthlessly and almost as if intending to make a cruel mockery out of it.

Hello, Is It You, Satoshi?

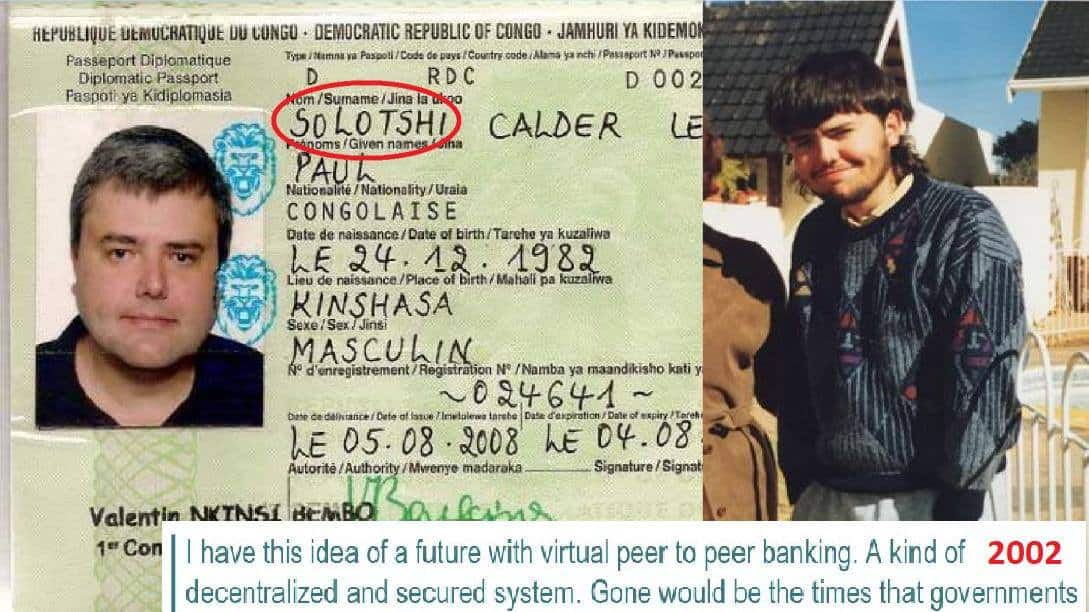

Now, earlier this year a new Satoshi candidate surfaced from the shadows of organized crime, one that at the very least gives us another piece of the puzzle in the story. A remarkably talented and intelligent programmer and cryptographer turned carter drug boss, gun runner and DEA informant, Paul Le Roux came to attention after the publication of Evan Ratliff’s “The Mastermind” where he investigates the almost unbelievable story of the scale of his operations and the audacity of their execution.

Le Roux was born in Rhodesia (today’s Zimbabwe) in 1972 but moved to South Africa in the early 1980s. He developed a keen interest for computers and programming from an early age and eventually went on to develop E4M in 1999 – an open-source disk encryption software (also TrueCrypt that is based on E4M codebase, but he denies involvement with it).

He seems to have been spending a lot of time trolling on USEnet message boards throughout the ’90s and was once arrested for selling pornography online at the age of 16. Now, to those who remember the 90’s and USEnet and the Internet culture at the time, this is an important piece of the puzzle because this is probably where he developed many of his tactics.

Social engineering was a popular technique in a hacker’s arsenal in the 90’s – the practice of using technological media for psychological manipulation of people to trick them into performing actions (Kevin Mitnick resorted to social engineering techniques regularly). Le Roux also appears to have been a master manipulator, well aware of people’s motivations and drives.

When looking at somebody like Le Roux and wondering how did somebody like him become that, the answer is that he was in an important way a product of the Internet then. That is, the Internet before it started to suck, before its corporate and government capture and its rearrangement in a way that makes the user the product, disassembled and cataloged at every step of the way according to whatever personal information it could be gathered and then sold off in markets that trade in behavioral patterns and human futures.

No, Le Roux was the result of another Internet, one still relatively open seas and fairly decentralized in comparison, populated by various digital tribes and subcultures, allowing for a degree of anonymity that shaped a different mindset at the time. Saying this as somebody who had in his time been intimately familiar with certain shady Internet cultures, among which the Hive and similar. And I can testify that there were quite a number of people like Le Roux around in such places (now they’ve of course retracted back to the shadows) – that is, highly intelligent and competent in particular areas, most often having graduated computer science or electrical engineering, chemistry or natural sciences.

And similarly, none of it is just about making money from crime, but equally about the experiment, the challenge, the thrill, and the kick one gets from succeeding in attempting something nobody had even thought of before. In other words, the same mindset as Le Roux’s. It were such places too where cross-continental supply chains for MDMA and LSD would get formed and various partnerships established. Again, just how Le Roux operated.

Pharmaceutical Drugs Business

In the early 2000’s he decided to start his online pharmaceutical drugs business — a gray area at the time, mostly dealing with Viagra, some weaker opiates like Vicodin and other such drugs. Perhaps some of you remember those times when these online pharmacies were spreading up like cyanobacteria in polluted waters. E-commerce was thriving then and Le Roux’s enterprise quickly picked up momentum and soon he was even having a customer support call center in Jerusalem work for him. It is said that at some point Le Roux’s operations covered more than half the drugs sold online. Which is already profits in the millions.

The very opening of the Bitcoin white paper directly states the problem it seems set to solve: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” Which is precisely what a thriving and highly profitable online black market economy needs to operate and the nature of the Internet makes possible, so long as enough desire to is incited to institute it. And regardless of whether or not Le Roux is Satoshi, the fact is they both come from similar backgrounds and have similar mindsets.

In order to acquire an even better understanding of things in context, it’d perhaps be useful to explain how the drug trade constitutes complex adaptive systems. That is networks of dynamic interactions whose relationships are neither parts or pieces nor aggregations of things, but collective ensambles of self-organized behavior that mutate and adapt themselves to changing circumstances or said otherwise, always find a way.

Prohibition and wars on drugs fail for exactly those reasons. So long as demand, supply will always find a way. But it’s not just that. Taking heroin for instance, as an archetypal example. We have the opium poppy plant grown and then the acquisition of certain watched chemicals from whatever other sources the enter the picture, then the trafficking along trust lines of one Muslim to another, from Afghanistan all the way to Albania and to the European end-user. In every step of the way with money changing hands, there are serious interests involved and certain criminal groups enriching themselves with more influence and social power.

Another thing worth mentioning is that drug money, as some intelligence agencies know too well, because of being untraceable piles of cash all at once, tend to naturally flow towards the funding of wars and regime changes and paying for stockpiles of weapons and ammunition which are never accounted for. This also largely because of prohibition and perhaps being kept so for precisely those reasons.

So, there are powerful forces at play here and actors who require steady streams of capital flows not registering on the global radar. And when one pathway gets blocked off, as we just said, in a complex adaptive system necessity figures a way around the constraints and reroutes and opens up a sideway. And how many such necessities from such adaptive systems does Bitcoin satisfy? Not sure, but it wasn’t designed for buying cups of coffee at Starbucks or as your grandma’s pension fund store of value, that much is clear.

Back to LeRoux and the Parallels with Satoshi

The way LeRoux operated when he needed something or somebody was they’d find them on the Internet and hire them but never directly and face to face. Most of them much of the time didn’t even know who they were hired by and why were they doing what they were. For example, one time he set out to build a missile guidance system he then sold to Iran and hired some Romanian engineers for the purpose that he found via Craiglist.

Satoshi developed the first Bitcoin prototype as a minimal viable product (MVP), but he then collaborated with other developers and never revealed his identity. And additionally, developing a specification into a working product is not enough, there is also the feat of bootstrapping the network and making people want to use it, let alone becoming the monstrosity it went on to develop into.

And it is, in retrospect, amazing. Let’s just consider for a moment the proposed solution to the double-spend problem – that is, the issue with any electronic cash until then that stems from the nature of digital media itself to easily be copied, corrupted, destroyed, etc.

So, the way to address this in Bitcoin is by having a network of validators of transactions called miners who ensure no double-spends take place by competing to get the next block and pocket transaction fees by incessantly hashing everything many times over and over. This includes the entire record of everything before at trillions of hashes per second, locked in an arms race of coming up with ever more efficient custom hardware controllers. These controllers are especially designed to do specific mindless computations of senseless waste (by now as much as entire developed nations and it has also been known to interfere with the LED spectrum in some places) in order to be able to “prove” it has so as to pocket the fees of bitcoins in providing that service.

One has to admit, that is quite the spectacular solution to a problem of that nature. And no wonder too the centralizing effects of such madness, after all. Much of it spread around mining farms verifying transactions in the backwaters of some authoritarian kleptocracy or hidden out of sight somewhere rural China, thousands of thousands of dedicated controllers roaring with mindless computations in securing the sacred ledger and keeping track of chains of ownerships. And for sure, that’s never meant for mainstream adoption, nor meant neither intended to scale or God forbid make the world a better place. And all it takes for us to call Bitcoin green in face of that is to just be getting rich off Bitcoin, according to numbers on the screen anyway.

A creation as deceptive and destructive seems to have Le Roux’s signature and fingerprints all over it. And it’s not too likely that there are many people around the globe who, like Le Roux, have the reasons, the need, the skills, knowledge, and inclination to pull something like Bitcoin off and manage to make a fool out of everybody in the process. Not least of all also because most of his enterprises have been similarly grandiose in the seeming impossibility of their execution.

The bitcoins from Satoshi’s address have not moved since 2012, which also coincides with Le Roux’s arrest, so the coincidences and parallels quickly pile up and there can’t be too many people with that profile around, but even if Le Roux might not be the author of the Bitcoin white paper, as mentioned already, they certainly come from the same place, background, and very similar mindset. Or it might be that Satoshi Nakamoto had been a conspired between more than a single person. But even more bizarre (or not) seems the fact that Craig Wright had filed a Motion for Protective Order in the Florida courts against Le Roux earlier this year, afraid of what “these criminals and their associates” would do to him should they learn of his involvement in their apprehension and incarceration”, as the case reported in full detail here.

We wait for the plot to thicken.

Additional sources:

- https://bennettftomlin.com/2019/05/05/untethered-tether-old-developments/ – investigating the tether connections and associations;

- https://magazine.atavist.com/the-mastermind – “The Mastermind” by Evan Ratliff, which documents LeRoux’s story;

- https://www.youtube.com/watch?v=MTeonvkHKDk – Michael Mann, Elaine Shannon, Lou Milione & Tommy Cindric Speak On “Hunting LeRoux”.

OP-ED: This in-depth opinion article is written by someone who is not affiliated with the LearnBonds editorial staff. Edited by Justin B.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account