Intel (NASDAQ: INTC) stock price has been under pressure over the last couple of months amid increasing competition from AMD. INTC shares plunged from 52-weeks high of $58 at the beginning of the second quarter to $46 at present.

Investors believe that three innovative products from AMD could snatch a big market share from Intel. This is evident from Google’s move from Intel product to AMD’s Epyc processors for its data centers.

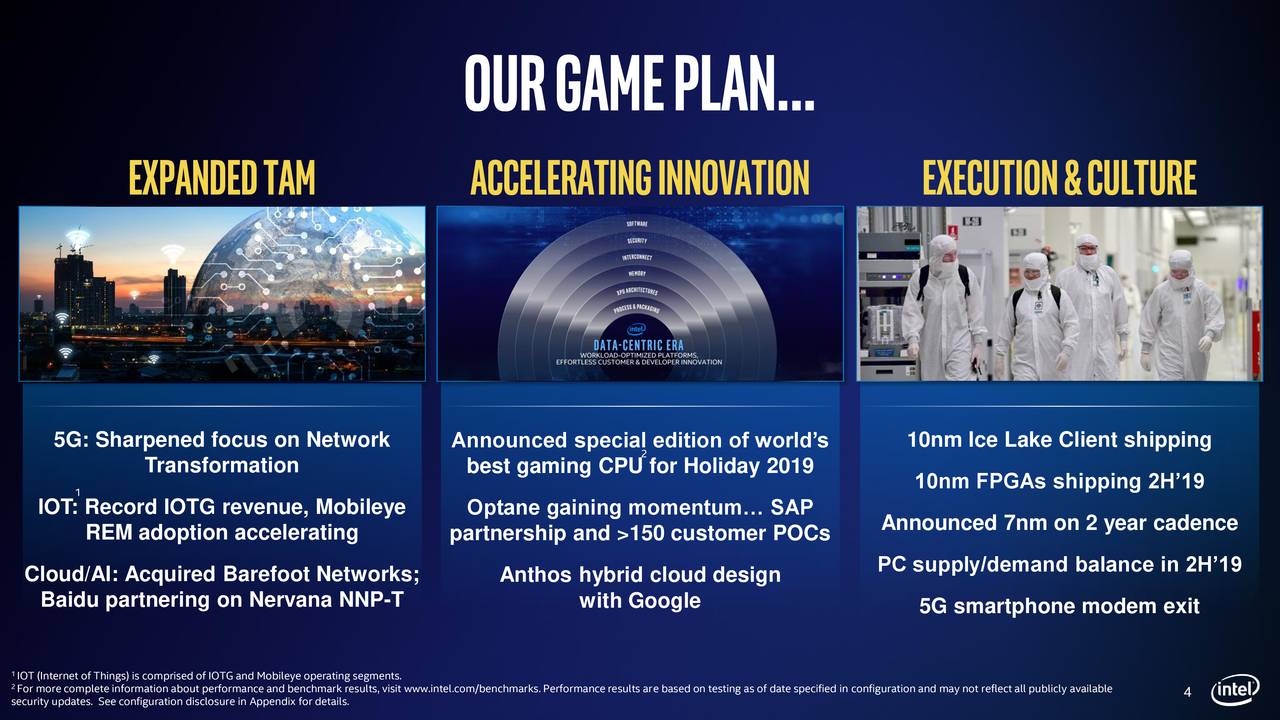

Oppenheimer’s Richard Schafer says, “The $1B sale of the smartphone modem business to Apple removes an EPS/FCF drag on Intel. However, it won’t be accretive since any cost savings will go towards pulling in 7nm/10nm investments to prevent further share loss.”

Some other market pundits such as Credit Suisse’s John Pitze believe that Intel shares are undervalued following the recent selloff. Pitze claims that Intel stock price losses are manageable amid increased R&D spend along with other driving factors such as AI and machine learning.

Meanwhile, BofAML has increased INTC price target from $57 to $62 and SunTrust raised its target to $58 from $54.

Although its revenue of $16.51 billion dropped 3% from the year-ago period, the revenue increased from the previous quarter.

Its Q2 revenue of $8.84 billion from the biggest business segment, the Client Computing Group, has beaten analysts’ consensus estimate of $8.13 billion. The data center revenue of $4.98 billion increased from analysts estimates of $4.89 billion.

Commenting on the market environment the CEO Swan said, “Trade uncertainties created anxiety across our customers’ supply chain and drove a pull-in of client CPU orders into the second quarter. We also halted shipments to certain customers in response to the U.S. government’s revised entity list.”

The company has recently sold its modem business to Apple for $1 billion. The proceeds from modem business sale would help it in investing in growth opportunities. Intel expects an acceleration in its quarterly revenues. It anticipates Q3 revenue to stand around $18 billion, higher from analysts expectation for $17.72 billion. Therefore, the Intel stock price could receive support from improving financial numbers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account