Lucid Motors (NYSE: LCID) stock is trading sharply lower in US premarket price action today after the company missed both the topline and bottomline estimates for the first quarter of 2023 and also toned down its 2023 delivery guidance.

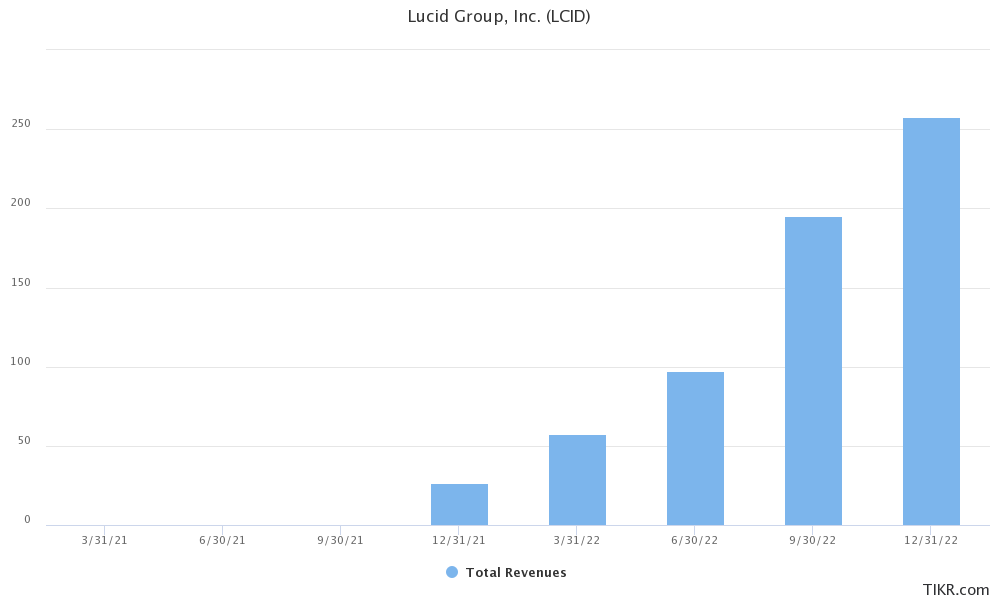

Lucid Motors reported revenues of $149.4 million in the quarter which was below the $209.9 million that analysts were expecting.

The company produced 2,314 cars in the quarter and delivered 1,406 of these. The metrics were below the fourth quarter where it had produced 3,493 vehicles and delivered 1,932. Lucid Motors’ Q1 deliveries fell well short of the 2,000 that analysts were expecting.

Lucid Motors misses Q1 2023 earnings estimates

LCID reported a per-share loss of 43 cents – which was much wider than the per-share loss in Q1 2022 – and also higher than what the markets were expecting.

In his prepared remarks, Lucid Motors CEO Peter Rawlinson said, “We are on track to produce over 10,000 vehicles in 2023, with company-wide initiatives ongoing that will enable Lucid to pivot to higher volumes as market conditions allow.”

Notably, during the previous quarter, the company provided a 2023 delivery guidance of between 10,000-14,000 vehicles. It has now toned down the guidance and expects it to be near the lower end of the guidance.

Incidentally, when it went public in 2021 through a reverse merger with Churchill Capital IV, Lucid guided for 2023 deliveries of 49,000. However, like fellow EV startups, it is also struggling with meeting those forecasts that looked lofty at the onset only.

LCID lowers 2023 delivery guidance

In response to a retail investor’s question on the production guidance, Rawlinson said, “I acknowledge and emphasize with the frustration, and I take this very seriously. Under-promising and over-delivering isn’t about setting low standards or being complacent. It’s about being realistic and proactive.”

He pointed to the supply chain issues, macroeconomic slowdown, higher interest rates, and changes to the federal EV tax credit for falling behind on the guidance.

Rawlinson added, “When we guide, we do so with absolute honesty and integrity to the very best that we are able to estimate. And I truly emphasize with our shareholders who are here with us through the long run.”

Lucid to deliver vehicles to Saudi Arabia later this year

Saudi Arabia’s PIF (public investment fund) is Lucid Motors’ biggest stockholder and has placed an order for upto 100,000 cars with the company.

Responding to an analyst question on the delivery timeline for these cars, Rawlinson said, “We are in active dialogues. We’re in the process of building out the specs for the first vehicles that they want to receive later this year.”

The company is also building its second factory in the kingdom and said that the facility to build 5,000 cars is “nearly complete and equipment installation will begin next month.”

Lucid Motors stock soared earlier this year on rumors that Saudi Arabia is considering taking the company private. During the previous earnings call, the company refused to comment on the rumors.

This time around, Lucid CEO Sherry House said, “The PIF has been a committed investor and a strategic partner for many years, and we’re very grateful for their partnership and support.”

Lucid has enough cash to fund operations until Q2 2024

Lucid Motors ended the first quarter with total cash of $3.4 billion and total liquidity of $4.1 billion – which it said would fund its loss-making operations until at least Q2 2024.

Last year, the company raised $1.5 billion through a stock sale where PIF also invested over $900 million.

Startup EV companies including Lucid Motors are burning a lot of cash and need to raise cash at regular intervals. Earlier this year, Rivian Motors also issued a convertible bond to boost its balance sheet.

Gravity SUV set for 2024 launch

Lucid Motors said that it would begin the production of its Gravity SUV late next year. Rawlinson said, “We will unveil our Gravity SUV later this year ahead of its launch in 2024 and we cannot wait for everyone to experience it.”

It currently offers the Air luxury sedan. During the earnings call, Rawlinson stressed multiple times that while many think that the Air is a $200,000 car, the starting price of only about $87,000.

He said, “It’s probably conceivable that people think of it as a $300,000 car dollar count because it’s so amazing, but actually, it’s much more attainable, and we need to spread that word as well.”

During the earnings call, Rawlinson said that multiple OEMs are interested in its hardware and software technology. However, despite probing questions from analysts, he did not divulge more details.

Lucid Motors is working on brand awareness and cost cuts

During the previous earnings call, Rawlinson rued the low brand awareness for Lucid Motors and said increasing brand awareness and cutting costs were his priorities for 2023.

During the Q1 2023 earnings call, he said that “we continue to make strides in growing our brand awareness.”

Rawlinson said that “at the 2023 New York International Auto Show, Lucid Air was crowned the 2023 World luxury car. Lucid Air was also named to be the U.S. News & World Report 2023 best hybrid and electric cars lists for best luxury electric car. Now these awards reinforce our belief that Lucid not just the best EV in the world, but the best car available in the world today.”

The company has also lowered its cost base and announced layoffs.

Meanwhile, Lucid Motors as well as Rivian have stopped providing reservation numbers in a sign that the demand is probably not as strong. Incidentally, Lucid reported a fall in reservation numbers for two quarters before it announced that it won’t provide the metric going forward.

LCID stock is down over 8% in US premarket price action today as markets give a thumbs down to its earnings miss and guidance cut.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account