Swift Capital Loan Review 2020 – READ THIS BEFORE Applying!

As anyone in business would agree, getting good financing is often a daunting task. Swift Capital, currently known as LoanBuilder, focuses on providing small business loans.

As anyone in business would agree, getting good financing is often a daunting task. Swift Capital, currently known as LoanBuilder, focuses on providing small business loans.

But before you take out a loan with the platform, it would be wise to take some time to understand how it works.

In this comprehensive review of the lender, we undertake a thorough analysis of the platform and its services.

Read on to find out whether or not it is the best choice for you.

-

- 1. First, you need to fill out the pre-qualification questionnaire to check eligibility.

- 2. Next, fill in your personal information such as your home address and other required details.

- 3. Finally, you will need to verify your identity by submitting details such as your social security number, date of birth, your federal tax identification and the percentage of the business that you own.

-

- 1. First, you need to fill out the pre-qualification questionnaire to check eligibility.

- 2. Next, fill in your personal information such as your home address and other required details.

- 3. Finally, you will need to verify your identity by submitting details such as your social security number, date of birth, your federal tax identification and the percentage of the business that you own.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Swift Capital (LoanBuilder) offers short-term business loans ranging from $5,000 to $500,000 for terms ranging from 3 months to 1 year. They come with a one-time fee rather than an interest rate. You will need to give a personal guarantee and make weekly repayments for the loan.

Swift Capital (LoanBuilder) offers short-term business loans ranging from $5,000 to $500,000 for terms ranging from 3 months to 1 year. They come with a one-time fee rather than an interest rate. You will need to give a personal guarantee and make weekly repayments for the loan.What is Swift Capital?

Swift Capital currently goes by the name LoanBuilder and is a PayPal service. It is a business loan provider operating under Swift Financial LLC. Swift Financial has been in existence since 2008 and has the objective of providing quick access to funding for small businesses.

Swift Capital has built on this mission, helping qualifying businesses to design the type of loans that fit their unique needs. Furthermore, it approves businesses for funding on the basis of the manner in which they manage their operations.

PayPal acquired Swift Financial in 2017 with a view to help more and more businesses achieve their dreams. Thanks to the acquisition, it is now easier for borrowers on Swift Capital to operate a PayPal Business account so as to drive their businesses further. Note, however, that it is not mandatory for businesses to have this type of account to apply for loans.

Swift Capital has its headquarters in San Jose, California and offers businesses in all 50 states and Washington DC access to funding.

Pros and Cons of a Swift Capital Loan

Pros

- One-time fixed fee over the loan lifetime

- No application, origination or stacking fees

- Fast turnaround (one business day)

- There is an option for customizable terms

- Access to a dedicated representative

- Low borrower requirements

- Wide range of loan amounts from $5,000 to $500,000

- Widespread coverage

- Automatic loan repayments

- Lots of positive reviews on the platform

Cons

- The loan cost from the loan configurator is not guaranteed and only after a hard credit check can you get a precise cost

- Access to the loan requires a personal guarantee

- The requirement for weekly payments can be challenging

- No live chat feature on the site

Comparing Swift Capital to online Installment loan service providers

Swift Capital is an online financing platform specializing in offering short-term business loans. Swift Capital is nonetheless not your typical lender as most of its loans are funded by WebBank. It is also biased towards businesses that support PayPal funding of their transactions. But how does it compare to such other short term loan providers as Advance America, Oportun, and Ace Cash Express?

Swift Capital

- Borrow business loans of between $5,000 and $500,000

- Minimum credit score 550 FICO

- Loan interest rate ranges from 2.9% to 18.72%

- Loan repayment periods of between 13 weeks and 12 months

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Weekly and monthly payback installments

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

How does a Swift Capital loan work?

Swift Capital focuses on offering businesses fast funding, in as little as a day, to handle emergency expenses. The best part about its loans is that you do not need to force your business to fit into a loan that it not ideal. Rather, it offers a customization option which allows you to take out funding that perfectly matches your ideals.

Loans on the platform range from $5,000 to $50,000 and loan terms range from 3 months to 1 year. Business operators can apply for the loan to handle virtually any legit business purpose. You can make your application online and get funds the next business day. Note that loans from this lender get financing from WebBank, which is a member of the FDIC.

Besides speed, a major highlight of the lender has to do with its costs. These come in the form of a one-time fixed amount over the entire life of your loan. There are no other fees to pay unless you have returned payments for which you have to pay a non-sufficient funds penalty. This makes it easy to calculate the total loan cost.

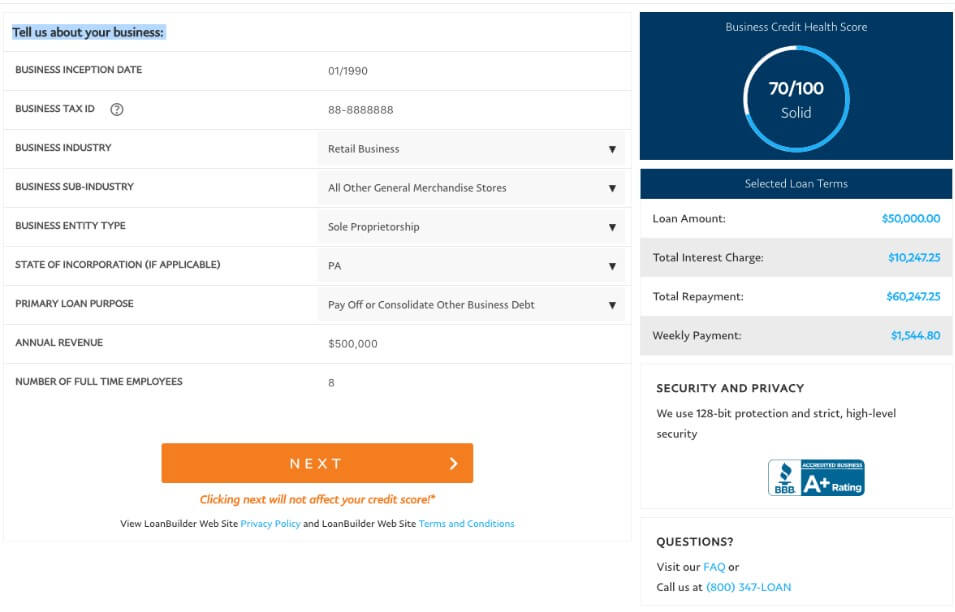

Before you apply for the loan, you can check your eligibility by filling out a short questionnaire online. If you qualify, you can see your estimated fees and terms, and adjust these to your liking using the Configurator. This is a tool that allows applicants to customize the loan offer so as to find terms that fit the financial situation of your business best.

Notably, exploring loan options using the tool will not affect your credit score. However, the figure you get from the tool is not guaranteed. You can only be certain of the cost of the loan after a hard credit check.

Calculating the cost of any loan is quite easy at this point as the platform shows it as a Total Interest Percentage. Therefore, all you have to do is multiply this figure by the borrowing amount. And this amount, being a one-time fee is different from an APR or interest rate. While interest accrues over the lifetime of a loan, this fee stays the same for the loan term.

After you submit a loan application, the lender will let you know whether or not it has approved your request. It will basically assess your financial history and general health and also take into consideration your credit rating.

Once you get pre-approval, you will get estimated fees and rates then you can customize the amount and term. After settling on the terms, you will complete a full application. Though this may vary from business to business, it will require various documents such as recent bank statements.

At this point, they will perform a hard credit check which might impact your credit score. If you get approval, you will sign an e-contract then receive funds on the next business day.

Once you get a loan through the platform, you will get access to a dedicated representative or your own go-to contact to handle your account. This makes it easy to handle challenges and queries.

The lender works with a weekly repayment policy, which might be challenging. Repayment is automated, each week the lender deducts the fixed figure from your business account using an ACH. Interestingly, most business lenders withdraw repayments daily, making this a slightly advantageous choice.

When you apply for the loan, you have to give a personal guarantee. What this means is that if your business is unable to repay the loan, then you hold personal responsibility. While this might seem disadvantageous, it is standard practice for business loans. It can also result in better, more cost-effective loan terms.

In case your loan gets declined, you will get immediate notification and an email after a few days outlining the details. You can reapply after 30 days taking these details into consideration.

What loan products does Swift Capital offer?

The lender specializes in offering business financing for small and medium-sized businesses. These come in the form of short-term business loans, which are a type of interest-free loan. Borrowers get to repay a fixed fee which is pre-determined, plus the borrowed amount.

What other store services does Swift Capital offer?

Swift Capital does not offer any other store services.

Swift Capital Account Creation and Borrowing Process

Creating an account on the platform and borrowing is quite easy.

1. First, you need to fill out the pre-qualification questionnaire to check eligibility.

You can opt to sign in using your account on PayPal. In that case, the lender will have access to some of your information from the get-go. But you can also sign in as a guest and fill in all details from scratch.

Start by filling in your contact information which includes your full name, email address and phone number

2. Next, fill in your personal information such as your home address and other required details.

Under business location, you need to enter your business phone numbers and business address.

The next item is business details, under which you will fill in information about your business type, annual revenue, state of incorporation, start date, number of employees, industry and sub-industry.

3. Finally, you will need to verify your identity by submitting details such as your social security number, date of birth, your federal tax identification and the percentage of the business that you own.

After you supply the information required, Swift Capital will perform a soft credit pull so as to get a sense of your credit score. Note that this will not have any impact on your credit score.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Swift Capital Loan

Here are some of the conditions you need to meet so as to qualify for a loan with this lender:

- Have a minimum annual business revenue of $42,000

- Have been in business for at least 9 months

- Have a personal credit score of at least 550

- Be a US citizen with a business based in the US

- Not have any active bankruptcy

- Work in eligible industry

As mentioned above, you have to work in an eligible industry so as to qualify for funding. Here are some of the industries the lender considers ineligible:

- Managing or representing athletes, artists, entertainers and all public figures

- Law

- Public administration

- Collection agencies

- Civic and social organizations

- Credit bureaus

- Environmental conservation and wildlife organizations

- Elementary and secondary schools and junior colleges

- Gambling and related businesses

- Financial services

- Gun stores

- Grant making foundations

- Management companies

- Holding companies

- Visual and performance art

- Human rights organizations

- Independent writing

- Manufactured home dealers

- Labor and political organizations

- Nonprofits

- New and used car, RV, ATV, motorcycle, watercraft and boat dealers

- Voluntary health organizations

- Religious organizations

Information Borrowers Need to Provide to Get Swift Capital Loan

When applying for the loan, here are some of the details you need to provide:

- Proof of income

- Proof of identity

- Contact information (full name, email address, phone number etc.)

- Personal information

- Business location

- Business details

What states are accepted for Swift Capital loans?

Swift Capital offers services in all 50 US states and Washington DC.

What are Swift Capital loan borrowing costs?

Borrowing from the lender comes with lots of merits but it is not the cheapest option out there. Here are the costs:

- One-time fee – 2.9% to 18.72% of the principal amount

- Origination fees – none

- Prepayment fees – none

- Application fees – none

- Stacking fees – none

- Returned payment fee – $20

Swift Capital Customer Support

Swift Capital has excellent customer support to say the least. Its support line has the recognition of J.D. Power Certified Contact Center Program. Additionally, it has the support of the online powerhouse PayPal.

Though it is still relatively new, its predecessor, Swift Capital, had accreditation from Better Business Bureau with an A+ rating. Similarly, it had an outstanding rating on TrustPilot, 9.6 out of 10 on the basis of 1,500 reviews of which 85% of customers gave it “Excellent” rating.

Is it safe to borrow from Swift Capital?

Yes. There are no safety issues associated with borrowing from Swift Capital. The site uses standard encryption practices to safeguard user data.

Swift Capital Review Verdict

Swift Capital is a highly reputable business financing platform associated with PayPal, a globally renowned name. It offers loans on reasonable terms, using a one-time fixed fee rather than an APR.

The reputation of the lender and its customer support team is excellent and the eligibility requirements are reasonable. It is a solid choice for a business in need of fast funding, on condition that you can afford to make weekly repayments.

If your sales are unpredictable and the repayment schedule seems daunting, you might however want to consider another option.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Is Swift Capital the same as PayPal Business Loan?

Yes. The two refer to one and the same product. In fact, during the application process, you might notice that the questionnaire refers to the service as a PayPal Business Loan.

Does applying for a loan with Swift Capital affect my credit?

Yes, it might. The early stages of the application will only require a soft credit pull and will not affect your score. However, if you get to the full application stage, the lender will have to perform a hard credit pull which could impact your score.

What kind of business can apply for the loan?

All types of businesses can apply, on condition they do not belong to the listed ineligible industries.

Can I pay for my loan before the due date?

Yes, you can. There are no fees for prepayment. But it will not have any benefits financially as there is no interest fee on the loan. You will therefore pay the same amount as you would have paid over the full term of the loan.

How can I reach customer support?

You can reach customer support using their email address or phone number, both of which are listed on the website.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up