Power Finance Texas Loan Review 2020: READ THIS BEFORE Applying!

To help you determine whether they are the best service providers for you, we have undertaken a thorough review of the platform.

Read on to find out the highlights, downsides and everything else that you need to know about them.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Power Finance Texas offers services both online and in-store, at multiple locations in Texas. It offers short-term installment loans to less than ideal borrowers. And you can get a good referral bonus for introducing new users.What is Power Finance Texas?

Power Finance Texas is a licensed Credit Access Business (CAB) operating in Texas USA. This means that they do not offer direct credit. Rather, they connect borrowers with third party lenders.

They offer installment loans at both physical stores and an online platform. The lender accepts all types of creditors, the even have loans for borrowers with bad credit. But in addition to paying the rates and fees applicable for your loan, you will need to pay a CAB fee when you use the service.

Pros and Cons of a Power Finance Texas Loan

Pros

- Has both an online platform and physical stores

- You do not have to set up direct deposit if you apply in-store

- Applicants can earn $50 bonus for every referral that takes out a loan

- No penalties for prepayment

Cons

- Borrowers have to pay CAB fees in addition to interest and other borrowing costs

- Not a direct lender

- Only operates in Texas

- Online rates and those in physical stores differ

- Rates and terms in different physical stores differ

- Acting as a CAB, the lender can charge as much in fees as it deems fit without any legal limit and is thus a very expensive service provider

- Sets a minimum monthly income for applicants

Comparing Power Finance Texas with popular online personal loans service providers

Power Finance Texas is not a direct lender but a Credit Access Business managing a loans platform that connects borrowers to third party lenders. Some of its key features include maintaining large database of lenders and the fact that it doesn’t pay too much emphasis on credit scores. We compared the lender with other online sort term loan providers like Ace Cash Express, Cash Net USA and LendUp and summed up their key attributes in the table below:

Power Finance Texas

- Borrow loans of between $100 and $1250

- No minimum credit limit (bad credit lenders available)

- Loan APR ranges from 5.99% to 793.97% (varies from lender to lender)

- Loan repayment of up to 6 months

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

Cash Net USA

- Borrow limit extends from $100 to $3,000 depending on the type of loan and the borrower’s state of residence

- Requires a credit score of at least 300

- Annual interest rates starts from 89% to 1,140% on payday loans

- 2 weeks to 6 months payback period

LendUp

- Borrow payday loans of between $100 and $250

- No minimum credit score required

- Loan APR is set at between 237% and 1016.79%

- Payday loan repayment period of between 7 and 31 days

How does a Power Finance Texas loan work?

On Power Finance Texas, you can borrow amounts ranging from $100 to $1,250 for terms of up to 6 months. The lender has 10 physical stores in various locations across Texas. There is one in Arlington and one in Dallas, and two each in El Paso, Houston and San Antonio.

If you visit one of the physical stores to make your application, you may get a loan on the same day. Otherwise, for online applicants, you will normally receive funds in your account on the next business day.

There are varying Texas law and city ordinances. And therefore, you may get varying terms depending on the location you choose to visit. Interestingly, the income requirements for online and in-store applicants differ too.

A key highlight of the lender is that they do not require borrowers to set up direct deposit for repayment, as is the case with most others. Rather, they also make provisions to accept borrowers who usually receive their pay via printed check. But this only applies if you make your application in person.

Another benefit for existing customers is that you can qualify for a $50 bonus every time you refer a new client and they take out a loan on the site.

However, it also has some major downsides. Based on the regulations for short-term lending under Texas law, the lender does not fit the description of a direct lender. Rather, they fall under CABs, and thus charge CAB fees on top of the interest rates.

And unfortunately, the fees they charge do not fall under regulatory oversight. They thus have the freedom to charge as high as they wish. For this reason, borrowers often repay up to three times the amount they originally borrowed.

When it comes to repayments, the lender calculates rates on a daily interest model. You get to make repayments in equal installments during the 180-day period. But you can also make prepayments without any fees or penalties.

Also, see how you can repair your credit rating with credit repair loans

What loan products does Power Finance Texas offer?

Power Finance Texas specializes in offering short-term installment loans.

What other store services does Power Finance Texas offer?

The lender does not offer any other store services.

Power Finance Texas Account Creation and Borrowing Process

1. To create an account on the platform and borrow your first loan, visit the site and start the process right on the homepage.

2. Begin by filling in your name, phone number and email address on the box on your right side and once you are done, click “Apply Now.”

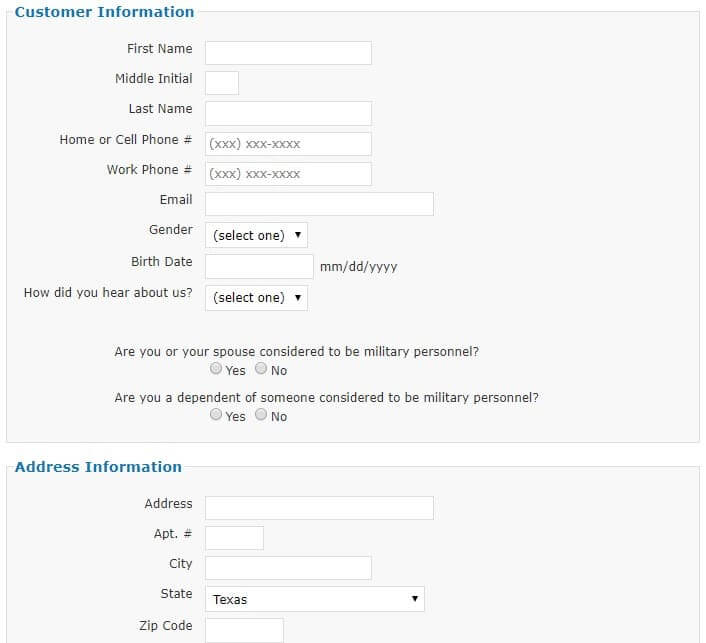

Complete the online form that appears. Some of the details required here include gender, birth date, military status, address details, income information and bank information. Next, select your two next pay dates.

3. After filling in all the details, click “Apply Now” at the bottom of the screen and wait for a response.

The lender reviews applications in as few as 60 seconds and you can get cash in 1 business day.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Power Finance Texas Loan

Take a look at the requirements you need to meet to qualify for a loan from the platform:

- Online applicants need a minimum monthly income of $1,000 while in-person applicants need to earn at least $800

- Be employed for a minimum of 3 months or get social security benefits

- Have a checking account open for a minimum of 30 days

- Online applicants need to have a bank account and set up direct deposit

- Have a valid phone number

Information Borrowers Need to Provide to Get Power Finance Texas Loan

Here are some of the details you need to provide when applying for a loan on the site:

- Name

- Email address

- Phone number

- Date of birth

- Gender

- Address

- Months at residence

- Residence status

- Monthly income

- Pay frequency

- Payment type

- Social security number

- Driver’s license number

- Bankruptcy status

- Bank details

- Pay dates

What states are accepted for Power Finance Texas loans?

Power Finance Texas only provides services in Texas.

What are Power Finance Texas loan borrowing costs?

The exact cost of your loan will depend on creditworthiness and affordability as well as other individual factors. But here are some estimates to give you a rough idea:

- Maximum APR – 765.89%

Representative Example:

- Loan amount – $300

- Repayment period – 15 days

- Interest rate – 10% ($1.23)

- CAB fees – $90

- Repayment total – $391.23

- APR – 739.97%

Power Finance Texas Customer Support

The Power Finance Texas gets mixed reviews online. Some customers claim that they are friendly and helpful while others accuse them of harassing phone calls.

It is noteworthy that the service is not accredited or rated by the Better Business Bureau in spite of having multiple complaints.

Is it safe to borrow from Power Finance Texas?

The platform uses advanced encryption for all personal details. But though it outlines its data collection and sharing terms on the privacy policy, there are no provisions to limit sharing.

Power Finance Texas Review Verdict

Power Finance Texas offers the benefits of fast loan applications and approval, and accepts borrowers who are not paid by direct deposit. But their fees are very high since they charge both interests and CAB fees.

They also have a poor online reputation and their privacy policy is wanting. Overall, the negatives seem to outweigh the positives of using this service.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary of Loaning Terms

FAQ

Can I apply for a loan if I get paid monthly?

Yes. You can qualify no matter you pay frequency as long as you meet all the requirements.

Can I apply for a loan over the phone?

Yes, you can. You will need to provide the necessary application details and wait on the line for approval.

How long does it take to access funds?

Typically, it takes 1 business day, but in-store applicants can get funds on the same day.

Can I get a loan if I am self-employed?

No. self-employed applicants and persons who work contract labor do not qualify.

Can I use my social security allowance as income?

Yes, as long as it is at least $800 or higher.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up