MyFlexCash Loan Review 2020 – READ THIS BEFORE Applying!

When you are in a rut financially and have bad credit, you might seriously consider getting a short-term loan. At such times, flexibility on the part of your provider could go a long way, and as its name implies, MyFlexCash promises precisely that.

When you are in a rut financially and have bad credit, you might seriously consider getting a short-term loan. At such times, flexibility on the part of your provider could go a long way, and as its name implies, MyFlexCash promises precisely that.

But does this lender live up to its name? Before you commit to taking out a loan from the platform, there are lots of considerations you need to make.

To help you along, our comprehensive guide provides an in-depth look into everything you need to know about the lender. Read on to find out whether or not this is the lender for you.

-

- 1. Visit the official website and under the “Online Loan Application” tab, enter your full name, email address and the loan amount you want to apply for. Click “Apply”

- 2. On the page that appears, provide the required information about yourself.

- 3. Next, enter your employment information.

- 4. Enter your banking information.

-

- 1. Visit the official website and under the “Online Loan Application” tab, enter your full name, email address and the loan amount you want to apply for. Click “Apply”

- 2. On the page that appears, provide the required information about yourself.

- 3. Next, enter your employment information.

- 4. Enter your banking information.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

MyFlexCash is an online tribal lender that offers payday loan services in all 50 states. Though the lender accepts bad and poor creditors, borrowers have to be employed. The rates are extremely high, running into the thousands as it does not adhere to state laws and limits.

MyFlexCash is an online tribal lender that offers payday loan services in all 50 states. Though the lender accepts bad and poor creditors, borrowers have to be employed. The rates are extremely high, running into the thousands as it does not adhere to state laws and limits.What is MyFlexCash?

MyFlexCash is a tribal lender that offers services in all 50 US states and has its headquarters on tribal land in California. The lender operates under Red Hawk Financial, which runs under the Mechoopda Indian Tribe of Chico Rancheria. It is a federally recognized sovereign nation which means it operates strictly on a tribal basis.

Its area of specialty is in payday loans and its APRs could at times run into the thousands. But in view of the fact that it is not limited by state regulations, that comes as no surprise.

As is the case with all tribal lending platforms, it is subject to Tribe Law, which does not stipulate interest rate and fees caps for short-term loans. Different from state-regulated companies, it is a sovereign entity which can charge any amount.

Pros and Cons of a MyFlexCash Loan

Pros

- Operates in all US states

- Allows borrowers to get additional funds before they pay out the outstanding amount

- It operates as a direct lender and therefore does not have the typical disadvantages associated with connecting platforms

- Lender does not charge prepayment fees

- Since it operates under tribal law, the lender can offer its payday loans even in states where these are illegal

Cons

- Low loan ceilings

- High APRs and fees as the lender is not subject to state regulations

- Does not adhere to state laws which increases the chances of lending practices that are illegal under the state

- You cannot sue the lender for malpractices

- The platform has strict eligibility requirements

- Site collects and shares user information under a sketchy privacy policy

- The site offers only one loan option, payday loans

MyFlexCash Loan

MyFlexCash loan is an online based tribal lender specializing in payday loan services. Some of its unique features include the fact that its services are available in 50 states across the country and that it does not discriminate borrowers based on credit scores. We have compared it with such other payday loan service providers as Ace Cash Express, LendUp, and Check N Go and highlighted their key features below.

MyFlexCash Loan

- Borrow payday loans of between $200 and$1,000

- No minimum credit score required

- Payday loan interest rate may be as high as $30 for every $100 advanced

- Loan repayment during the next payday

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

LendUp

- Borrow payday loans of between $100 and $250

- No minimum credit score required

- Loan APR is set at between 237% and 1016.79%

- Payday loan repayment period of between 7 and 31 days

Check N Go

- Borrow from $100 to $500

- Minimum credit score of 300 FICO

- Fee rate starts from $10 to $30( depending on the State)

- Payday loan repayment period of between 2 and 4 weeks

How does a MyFlexCash loan work?

MyFlexCash offers loans that range between $200 and $1,000. These are typically payday loans, which are its area of specialty. As such, they have relatively short repayment periods and extremely high interest rates.

Typically, a loan from the lender attracts an interest of $30 per $100, which is an outrageous fee by most standards. On the bright side, it approves applications almost instantaneously and you can have the funds as soon as the next business day.

They also do not pay as much attention to your credit score or such things as bankruptcy before approval as would most traditional lenders.

Note that payday loans are typically due for payment on your next payday. But if you would like to get an extension, you can get one by making the minimum payment amount which is due. However, this will lead to extremely high interest rates which could double or triple the initial amount.

MyFlexCash is a direct lender meaning that it deals directly with all its borrowers. Therefore, it does not sell user information to any other businesses as it would need to if it were an intermediary.

Additionally, its approval process is easy and straightforward and will not require you to fax any documentation. However, you have to be employed so as to access the service and you will need to provide your employer’s contact details.

So as not to impact your credit negatively, the lender makes use of alternative credit checks. This simply means that they do not perform a hard credit pull using any one of the three main credit bureaus.

Rather, they perform a soft pull, which gives them access to the required information on your creditworthiness. Using this information, they calculate an individual rate for your loan. Hence, even though you can qualify in spite of your credit status, the worse your credit, the higher the rate.

If you are in urgent need of funds, you need to submit your application before 3:00 PM ET on weekdays. Only then can you receive the funds the next business day. In case you submit after this time, processing will take two business days. Similarly, applications submitted on Saturdays and Sundays will take two business days to process.

Therefore, if you make your application on Saturday, you might actually have to wait four days to access your funds.

Note that following your application submission, you might get a phone call from customer support to verify your details.

As soon as you get approved, check your loan agreements for all the details. Read through them thoroughly to ensure you agree with the terms. Sign the loan and start planning for repayment immediately.

The lender does not charge an early repayment penalty like most others. Therefore, the sooner you can afford to pay back, the better for everyone, as you will pay lower interests and fees. But it does charge a fee for late payments and insufficient funds.

MyFlexCash will typically debit funds from the account you provide in your application. Therefore, always have the required funds in your account by the due date. Try to make payments on time and if for some reason it is not possible, reach out to customer support at least two days before the due date.

Payments for payday loans are usually due on the next payday. The only exception is if your next payday falls on a weekend or a holiday. In that case, payment will be due on the next business day after the holiday or weekend.

What loan products does MyFlexCash offer?

The platform specializes in payday loans which also go under the name cash advance.

What other store services does MyFlexCash offer?

There are no other store services in MyFlexCash.

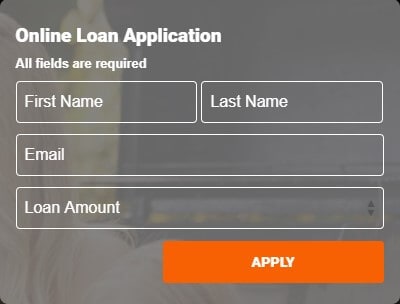

MyFlexCash Account Creation and Borrowing Process

Creating an account and borrowing your first loan from the platform is a simple process. In fact, it could only take a matter of minutes if you have all the information required:

Here are the steps you need to follow:

1. Visit the official website and under the “Online Loan Application” tab, enter your full name, email address and the loan amount you want to apply for. Click “Apply”

2. On the page that appears, provide the required information about yourself.

Some of the details you need to provide include your home address, date of birth, phone number and social security number.

3. Next, enter your employment information.

The purpose of this is for the lender to confirm that you actually have the required income amount and that you actually receive paychecks on a regular basis.

4. Enter your banking information.

Note that the lender will deposit your funds in this account if your application gets approved.

That is all you need to do, then wait for a response. Typically, this should take moments then you will get an email showing the details of your approval status.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for MyFlexCash Loan

Here are some of the requirements you need to meet so as to qualify for a loan on the site:

- 18 years or older

- Be a US citizen or permanent resident

- Proof of employment

- Income verification

- Have an open and active checking account in good standing

- Monthly income minimum of $1,000

- Active phone number

- Active email address

Information Borrowers Need to Provide to Get MyFlexCash Loan

Other than meeting the above eligibility criteria, you need to provide a number of details when applying for a loan:

- Full name

- Email address

- Social security number

- Date of birth

- Home address

- Bank account information

- Employment status

- Details of income

- Driver’s license or state ID number

- Employer’s contact information

What states are accepted for MyFlexCash loans?

MyFlexCash operates in all 50 states.

What are MyFlexCash loan borrowing costs?

A majority of short-term lenders including MyFlexCash are not exactly transparent about their fees and rates. But here are some of the fees you can expect to pay when using the platform:

- APR – 608.33% to 1,564.29%

MyFlexCash Customer Support

There is very little information on the internet about the customer support team.

On Better Business Bureau, it has a C+ rating but does not have any customer reviews. There are six complaints filed against the platform, and these have to do with high rates and repayment mishandling.

You can get in touch with a representative via email or phone call during working hours.

Is it safe to borrow from MyFlexCash?

As is the case with a majority of reputable online platforms, MyFlexCash encrypts all of the information that you submit or upload to the site.

However, there are a few glaring concerns with regards to safety. First, its privacy policy leaves a lot of loopholes open to exploitation. For instance, it states that it collects user information but does not explain what kind of information it will collect.

Furthermore, it has a few lines that imply the site will share your information. But it does not get into details on how a user can limit potential information collection or sharing.

Moreover, it is unclear why a direct lender that does not use third-party providers needs to share user information.

You might therefore want to carry out some research, probably contacting customer support to get insights on these concerns.

MyFlexCash Review Verdict

MyFlexCash can come in quite handy when you need cash urgently and happen to live in a state where payday loans are illegal. Poor credit scores are not a hindrance for applicants as the platform accepts all types of borrowers in the condition they are employed.

It has widespread coverage, operating in all 50 states under tribal law. Therefore, it does not come under state regulations and has unfettered freedom in more ways than one.

However, in this major highlight lie its biggest disadvantages. The lender charges interest rates in the thousands as there are no limits applicable. It is, in fact, one of the most expensive short-term lenders out there.

It also collects and shares user information and its privacy policy is not clear or detailed enough to outline whether there is a way to opt out.

So all in all, the lender does have some level of flexibility. But its negatives seem to far outweigh the positives. It might be advisable to use it only when you find yourself in a tough situation and cannot find any cost-effective way out.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

What is the difference between a tribal lender and other short-term lenders?

Tribal lenders function under Tribe Laws that specifically apply to the Native American tribe that owns them. They do not follow state regulations as other short-term lenders do. Therefore, they can operate in more states and charge more.

How do I know if MyFlexCash has approved my loan?

The lender approves (or rejects) loans almost instantaneously. Soon after you submit your application, you will receive a confirmation via email. You will also get a call from the underwriting team.

How does the payday loan process work?

Borrowers simply need to submit their applications online according to the outlined requirements. If you qualify for the loan, you will get funds in your account on the next business day.

What is a short-term loan?

Short-term loans are direct deposit loans that you apply for when in an emergency situation. MyFlexCash offers payday loans that require repayment on the next business day. But they are not meant to be a long-term solution.

What is MyFlexCash loan increase?

It is an arrangement under which you can borrow funds before you clear the outstanding balance. But you need to meet some outlined requirements.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up