Life Loans Review 2020 – READ THIS BEFORE Applying!

If you’re currently in the look-out for financing, then you might want to consider a personal loan. Even if you’re in possession of a poor credit score, there is now a number of specialist lenders that might be able to help.

One such example of this is Life Loans. The online loan platform seeks to connect those looking for finance with suitable lenders. With loan sizes ranging from $100 up to a maximum of $40,000, Life Loans is able to service most requirements.

If you are thinking about using Life Loans to find a suitable lender, we would suggest reading our in-depth review. We’ve covered everything that we think you should know, such as how the platform works, APR fees, eligibility requirements, and more.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Life Loans?

Life Loans is an online platform that helps borrowers connect with lenders – as per your financial circumstances. Although the platform mainly focuses on personal loans, it also works with lenders that are involved in the short-term loans space.

The platform is suitable for a vast range of financial profiles, including those with poor to bad credit. It is important to note that Life Loans is not a direct lender. Instead, the platform is essentially a comparison website that seeks to find you the best deals currently in the market. Nevertheless, once you insert your loan requirements, Life Loans will assess your creditworthiness and thus – connect you with lenders that are able to offer you financing.

What are the Pros and Cons of Life Loans?

Life Loans Pros:

✅Online application

✅Fast approval process

✅No fees

✅Accepts bad credit score

✅Fast Processing

Life Loans Cons:

❌ Website needs improvement

❌ Poor customer support

❌ Lack of information about the lenders in its network

Life loan vs installment loan providers, how does it compare?

Life loans is an online loans platform that brings together lenders and borrowers from all over the country. On the platform are numerous lenders that cater to both good and bad credit borrowers. Its takes pride in providing attractive loan limits to borrowers at competitive interest rates. We compared it to equally reputable online bad credit lenders like LendUp, Opploans and Oportun and here is a summary of their key features

Life Loan

- Borrow loans of between $100 and $40,000

- No minimum credit score (some lenders may soft check)

- Loans APR range from 4.99% to 1386%

- Loan repayment period varies from one lender to another

Opploans

- Borrow limit $1,000 to $4,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

LendUp

- Borrow payday loans of between $100 and $250

- No minimum credit score required

- Loan APR is set at between 237% and 1016.79%

- Payday loan repayment period of between 7 and 31 days

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

How Does Life Loans Work?

Life Loans is an online-only marketplace that aims to find you the most competitively priced lenders. Although the platform needs a lot of improvement, it is simple and user-friendly.

In order to get started with a loan application, you’ll first need to head over to the Life Loans homepage. Next, you’ll then need to go through a 5-10 loan application process. This will require you to enter your loan requirements, as well as some personal information. Moreover, you’ll also need to enter information about your financial status – such as how much you earn, how frequently you get paid, and whether you own your home.

Once you’ve completed the required information, Life Loans will then display the lenders that are able to offer you a loan. As such, the lenders you are eligible with will list the APR rates that they can offer you, as well as details pertaining to your respective origination fee. If you are happy to proceed with the loan terms offered, you’ll then be re-directed to the lender’s website to sign a digital loan agreement.

- Marketplace and Lending Partners: The online platform is a marketplace for lenders and/or lending partners throughout the United States. These lenders are available and ready to fund eligible individuals.

- Fast Delivery: The application process rarely takes more than 5-10 minutes. Once you proceed with a loan offer and sign the digital agreement, the lending partner will then deposit the funds directly to your bank – typically within 1-2 business days.

- Safe & Secure: The platform complies with all respective consumer protection policies. They do not sell or share your information with any third parties – other than the lenders within its network. In addition, your information is 100% safe with Life Loans.

- All Credit Profiles Considered: Life Loans is suitable for all credit scores. While the platform does accept applicants with bad credit, this will be reflected in your APR rates.

- Upfront Disclosure: Although Life Loans strives to present you with accurate and up-to-date information, you are suggested to verify your loans terms via your loan agreement.

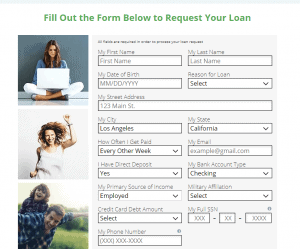

How Does the Life Loans Application Process Work?

Life Loans has developed a simple application process which rarely takes more than 5-10 minutes. However, it is important to remember that Life Loans is not a direct lender. On the contrary, they merely match you with suitable lenders. The platform is free for borrowers. They take a commission from lenders if you decide to proceed with a loan offer that they find you. The platform will only connects you with a lender that once you have gone through the online application process. Your respective rates will be determined by your history with credit, as well as other factors such as your income.

You will need to provide the Life Loans platform with the following information when going through the application process.

- Loan amount

- Zip Code

- Monthly income

- Credit score.

Once you have provided the above information, Life Loans will then take you to the next stage of the application.

- First Name

- Last Name

- Date of Birth

- Reason for Loan

- Address

- How Often You Get Paid

- Bank Account Type

- Source of Income

- Credit Card Debt Amount

- Military Affiliation

- Social Security Number

- Phone Number.

Below are the factors that the borrower needs to consider before signing the loan agreement:

- Fees

- APRs

- Repayment.

Am I Eligible With Life Loans?

Although the platform considers applications from credit profiles of all sizes, you still need to make some considerations regarding the platform’s minimum eligibility criteria. Lenders may also ask you to provide additional documents. You need to fulfill the following criteria for a loan application:

- Monthly income equal to or exceeding $1,000

- Home and work telephone numbers

- Verifiable income for at least 4 weeks

- Current bank account in the individual’s name

- Social security number

- Bank Account.

What is the Fee Structure of Life Loans?

Life Loans does charge any fees to use its search tool. Instead, the platform makes its money via the lenders it has partnered with.

In terms of the APR fees you are likely to pay, this will vary from lender-to-lender. If opting for a personal loan, you will also need to make some considerations regarding origination fees.

Lenders will also charge you a late fee if you miss a loan installment.

Life Loan Customer Support?

Life Loans is working on user-friendly policies. They permit users to contact the support team through email and phone calls. They respond to emails within three business days. The borrower can also directly contact the support team of lenders. Life Loans platform has created an extensive ‘Frequently Asked Question’ segment.

Is Life Loans Safe for Borrowers?

Yes, the platform is safe for borrowers. They only help borrowers in connecting with reputable lenders all over the United States. They do not transfer funds into borrower account. They are also not responsible for the collection of installments.

The lender directly transfers the amount into borrower’s bank account. The borrower is responsible for directly paying the installments into the borrowers account. Thus, the platform is safe for borrowers. In addition, Life Loans application process is safe. They only transfer your data to lenders. They do not sell your information for marketing purpose.

Life Loans Review 2019 – Verdict

Life Loans is an emerging platform that helps its users in connecting with several lenders with a single online application process. Once you submitted the application, lenders will directly contact you with the loan offers. You can expect to receive funds on the next business day once your loan application is approved. The platform also needs improvement. Information regarding the lenders is missing on the website. They also do not display the expected repayment structure. The cost of loan and interest rate policy is also not highlighted on the website.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQs

What is the cost structure of loan?

Life Loans platform is free for borrowers. They do not charge any hidden fee or commission to borrowers. The receive commission from lenders when you receive a loan. Despite all this, the cost of the loan depends on the factors listed below:

- Credit history

- Stable source of income,

- State law

- Lenders fee policy

- The terms of the loan agreement are clearly disclosed during the application process.

Does a lender perform credit checks?

Yes, lenders that offer loan always check your credit score and financial history. This credit check helps lenders in accessing how much loan is perfect for you. The rate of interest and repayment terms also depends on your credit score. If you have a strong credit score, lenders will offer a loan on easy terms and conditions. On the other hand, people with low credit score always experience difficulties in getting a loan. Lenders check credit score through national databases that track consumer lending transactions (such as Teletrack, DP Bureau, or DataX) or through the three major credit reporting bureaus (Experian, Equifax, and Trans Union).

How soon can a personal loan or cash advance be made available?

The platform has developed an easy application process. It takes close to two minutes to fill the loan application form. Once you accepted the loan offer, the lender will transfer funds as soon as the next day.

When does the personal loan or cash advance need to be repaid?

The lender will display the repayment terms during the application. You need to repay the loan in monthly installments according to the agreed schedule. The repayment terms include dates for repayment and any fees chargeable in the event of a rollover, etc.

What happens if a customer can't repay the loan on time?

If the customer fails to repay the loan, the lender has several options. The lender can charge you late fee along with other collection or legal fee.

What is the basic information you need to provide to the lender?

Below is the information that you need to provide to the lender:

- Monthly income equal to or exceeding $1000

- Current, valid home and work phone numbers

- Verifiable income for at least 4 weeks

- Current bank account in the individual's name

US Payday Loan Reviews - A-Z Directory

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up