Lendyou Loan Review 2020 | Read This Before Applying

No matter your credit situation however, it would be best to take a moment and learn all you can about the service before signing up.

Our thorough analysis of the platform will answer all your questions and provide all the information you need to make a decision. So read on to find out whether it is the best platform for you.

-

- 1. Select the desired loan amount and enter the last four digits of your social security number.

- 2. Next, enter your email address, Zip Code and year of birth. Once you fill in these details, start the actual application process by clicking “Get Started.”

- 3. Follow the prompts on your screen to fill out the rest of the required details and submit the form.

- Eligibility Criteria for LendYou Loan

-

- 1. Select the desired loan amount and enter the last four digits of your social security number.

- 2. Next, enter your email address, Zip Code and year of birth. Once you fill in these details, start the actual application process by clicking “Get Started.”

- 3. Follow the prompts on your screen to fill out the rest of the required details and submit the form.

- Eligibility Criteria for LendYou Loan

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

LendYou is a connecting service that links borrowers to lenders in most US states. It offers a variety of loan options, with varying limits and durations. Lenders on the platform state their terms clearly before you sign up, and what you see is usually what you get.What is LendYou?

LendYou is not your everyday short term lender. Rather, they operate a loan connecting service, linking customers to third party lenders. They operate strictly online and offer services in a number of US states.

Pros and Cons of a LendYou Loan

Pros

- Offers a wide range of loan amounts with varying terms from different service providers

- Uses a simple application process

- Accepts bad and poor creditors

- Decisions are quick

Cons

- Not a direct lender

- There is no way of getting estimates before the application process

Comparing LendYou to other online short term loan providers

Lend You is yet another online lending company that specializes in bringing together different lenders and borrowers. It boats of a straightforward loan application and highly attractive loan limits. Lenders on the platform will also get access to such loan products as payday loans, installment loans and personal loans. But how does it compare to other online installment loan providers like LendUp, Ace Cash Express, and Speedy cash?

LendYou

- Borrow loans of between $100 and $35,000

- No minimum credit score required

- Loan APR for installment loans ranges from 6.63% to 225%

- Loan repayment period varies from one lender to another

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

LendUp

- Borrow payday loans of between $100 and $250

- No minimum credit score required

- Loan APR is set at between 237% and 1016.79%

- Payday loan repayment period of between 7 and 31 days

SpeedyCash

- Online payday loan limit is $100 – $1,500

- Accepts bad credit score

- Payday loans should be paid within 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% but varies depending on state of residence

How does a LendYou loan work?

LendYou offers an easy way for you to access a wide range of loan amounts from various providers regardless of your credit score. Loans on this platform range from $1,000 to $35,000 and there are few restrictions on how you can use the funds.

When you are looking for financial assistance, you simply need to submit an application on the online platform. After reviewing it, they will link you to third party lenders who can meet your needs.

In order to do this, they share your application details with a panel of lenders and in turn, the lenders may make you an offer. There is no obligation to accept any of the offers. But in case you do, the lender whose offer you accept will give you their terms and conditions.

These will cover everything, including the exact fees and charges associated with the loan. In case you find them satisfactory, you will need to sign a contract electronically and send it back to the lender.

Note that the terms will vary significantly from one lender to the next. Thus you need to take time to review these before accepting an offer and taking out a loan.

LendYou does not charge you any fees for its connecting services and registration is free. However, when they introduce you to a lender and you get into a loan agreement they receive a commission from the lending service.

Just like everything else about borrowing on this platform, the turnaround time for your funding will depend on the lender. You may get your funds as soon as the next business day or it could take longer.

A majority of the lenders will perform credit checks to verify your identity and check creditworthiness. Since that will leave a footprint on your score, it is advisable to apply for a single loan at a time.

What loan products does LendYou offer?

LendYou connects you to various lenders who offer a wide range of loan products. These include:

- Cash advances/ payday loans ($100 to $1,000)

- Short-term installment loans (up to $5,000)

- Personal loans (up to $35,000)

What other store services does LendYou offer?

LendYou does not offer any other store services.

LendYou Account Creation and Borrowing Process

Creating an account on the platform and borrowing your first loan is as simple as visiting the site.

Right on the homepage of the site (https://lendyou.com/), you will see a box where you can start the process.

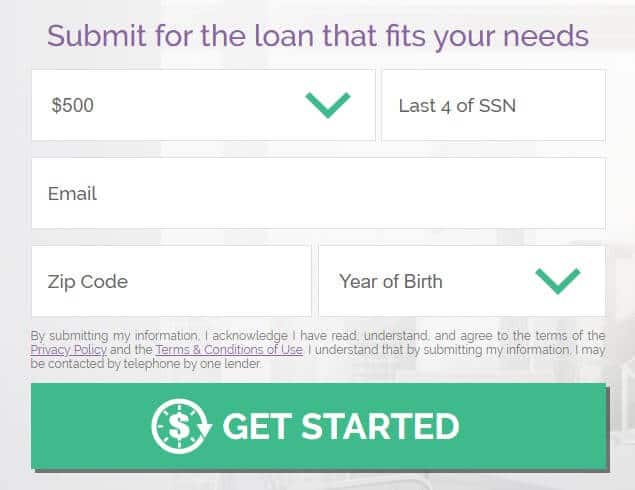

1. Select the desired loan amount and enter the last four digits of your social security number.

2. Next, enter your email address, Zip Code and year of birth. Once you fill in these details, start the actual application process by clicking “Get Started.”

3. Follow the prompts on your screen to fill out the rest of the required details and submit the form.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for LendYou Loan

Here are the criteria you need to meet so as to qualify for a loan on LendYou:

- Be at least 18 years or the statutory minimum

- Have a valid checking account with direct deposit

- Have a minimum regular income of $1,000

- Not be a regular or reserve member of the Army, Marine Corps, Navy, Air Force or Coast Guard or a dependent of one

Information Borrowers Need to Provide to Get LendYou Loan

In your application process, you will need to submit the following information:

- Banking information (account number and other details)

- Employment details (place of employment or other sources of regular income)

- Personal information (name, address, phone number)

- Driver’s license number

- Social security number

What states are accepted for LendYou loans?

As a connecting service, LendYou offers services in a majority of US states. The type of loan you can access on the platform will however depend on the legal framework governing your state.

But the site lists a number of states in which all short-term or small dollar loans are inaccessible. These include:

[one_third]- New York

- Arkansas

- West Virginia

- Vermont

What are LendYou loan borrowing costs?

Borrowing costs for the various types of loans on the platform vary according to the individual applicant, applicable state laws and the type of loan in question. Here are some of the estimate rates you can expect:

Payday loans:

- Minimum APR – 200%

- Maximum APR – 1,386%

Installment Loans:

- Minimum APR – 6.63%

- Maximum APR – 225%

Personal Loans:

- Minimum APR – 4.99%

- Maximum APR – 450%

LendYou Customer Support

The LendYou support team is above average. However, note that when you sign up for a loan on the platform, you will be dealing with your lender’s support team, and not LendYou’s.

Therefore, it is prudent to take time to find out their reputation before committing to their services.

Is it safe to borrow from LendYou?

LendYou makes use of multilayer, state of the art security measures to keep user data safe. All of the sensitive data that is transmitted between an applicant’s browser and the site is encrypted using 128-bit SSL encryption technology.

LendYou Review Verdict

When you are in urgent need of little dollar funding, LendYou offers a great choice of platform. You can get a wide range of loan types with the most convenient repayment terms since there are many lenders to choose from.

However, since they are not direct lenders, you can only tell what you are getting into after the application process.

All in all, it is best to consider the platform as a last resort option.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

What if I am not able to repay according to contract terms?

You may be subject to late fees, getting reported to a collection agency, lowering your credit score and possibly facing legal action.

Will the lender automatically renew my loan?

Well, that will depend on the state where you live and the lender’s policy.

How much will a lender on the platform offer me?

Loan offers will depend on your state of residence as well as creditworthiness and affordability.

Do I have to submit my social security number?

That will depend on the lender’s requirements. Some will require your SSN so as to carry out a credit check.

How soon can I apply for a second loan after repaying the first one?

That will depend on where you live and the state laws that apply.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up