KwikCash Loan Review 2020 – READ THIS BEFORE Applying!

When you need a hand, financially speaking, loan service providers like KwikCash may sound alluring. While a short term loan from the platform may be a great way to weather the storm, you need to find out all you can before signing up.

When you need a hand, financially speaking, loan service providers like KwikCash may sound alluring. While a short term loan from the platform may be a great way to weather the storm, you need to find out all you can before signing up.

With that in mind, we have carried out a thorough review of the lender to help you get the information you need.

Read on to find out everything you need to know about KwikCash and decide whether it is the best loan provider for you.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

KwikCash is a direct lender specializing in installment loans and serving the state of California. The lender is flexible and transparent, and strives to make loans affordable by not charging any other fee besides the interest.

KwikCash is a direct lender specializing in installment loans and serving the state of California. The lender is flexible and transparent, and strives to make loans affordable by not charging any other fee besides the interest.What is KwikCash?

KwikCash is an installment loan service provider offering varying loan amounts to residents of California. They have been operating since 2008 have a head office in Irvine.

Loans are accessible to all types of borrowers even those with poor credit scores.

Pros and Cons of a KwikCash Loan

Pros

- Does not charge any fees on top of interests

- Offers flexible monthly repayments where you can choose your own due date

- Long loan terms

- There is no prepayment penalty

Cons

- Only limited to California

- The lender performs credit checks

- They automatically withdraw repayments from your bank account which may result in fines if the amount is insufficient

KwikCash vs online bad credit score lenders, how does it compare?

Kwikcash is an online based bad credit loans provider that’s specializes in installment loans. The lender is also well-known for its extended loan repayment periods and relatively high installment loan limits. The loan application on the platform is also quite straightforward and borrowers get to benefit from its relatively straightforward loan application process. We have compared it with other installment loan providers like LendUp, Opploans, and Rise Credit and summed up their key features in this table.

KwikCash

- Borrow installment loans of between $2,500 and $5,000

- No minimum credit score

- Loan APRSs change range from 165% to 220%

- Loan repayment periods of between 18 and 36 months

LendUp

- Loan amount of $100 – $1,000

- No credit score check

- An annual payment rate of 30% to 180%

- Loan repayment period of 1 to 12 months

Oppoloans

- Borrow loans of between $1,000 and $4,000

- Minimum credit score 350 FICO

- Loan APR averages between 99% and 199%

- Loan repayment period ranges from 9 to 36 months

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

How does a KwikCash loan work?

Regardless of your credit score, you can get an installment loan from KwikCash. The lender offers loans ranging from $2,500 all the way to $5,000. Loan terms vary and can range from 18 months to 36 months.

That offers you ample time to get the repayment plan in order so as to avoid missed and late payments, which may affect your credit score. But it also means you may have to pay a lot more over the long run than you would have paid with a shorter term due to interests.

The amount that you can access on the platform will depend on various factors. To qualify for a high loan amount for instance, you will need to have a relatively good credit score. You would also need to have a good history in terms of timely payments.

A major highlight of borrowing from this platform is that they will not charge you any fees other than interests. Therefore, there are no origination fees, application or monthly fees.

But installment loans are usually known for their high APRs and this one is no exception. It makes use of a fixed rate framework, and its rates cannot be said to be the highest in the market. And if you are in a position to, you can make early repayment without penalties so as to save on interests.

The lender allows some level of flexibility in that you can choose your monthly repayment due date, to coincide with your payday.

Like most lenders, they will carry out a credit check before approving your loan to confirm creditworthiness. This may impact your score slightly. In case they approve your application, they will withdraw repayments directly from your account on the due date.

It is important to ensure that you have the necessary funds so as to avoid incurring late payment fees and penalties from your bank. Note that poor repayment habits will also reflect on your credit history and make it hard to access cheaper forms of funding in future.

What loan products does KwikCash offer?

KwikCash offers installment loans.

What other store services does KwikCash offer?

The lender does not offer any other store services.

KwikCash Account Creation and Borrowing Process

KwikCash makes use of a simple and straightforward application process for borrowers in urgent need of funds.

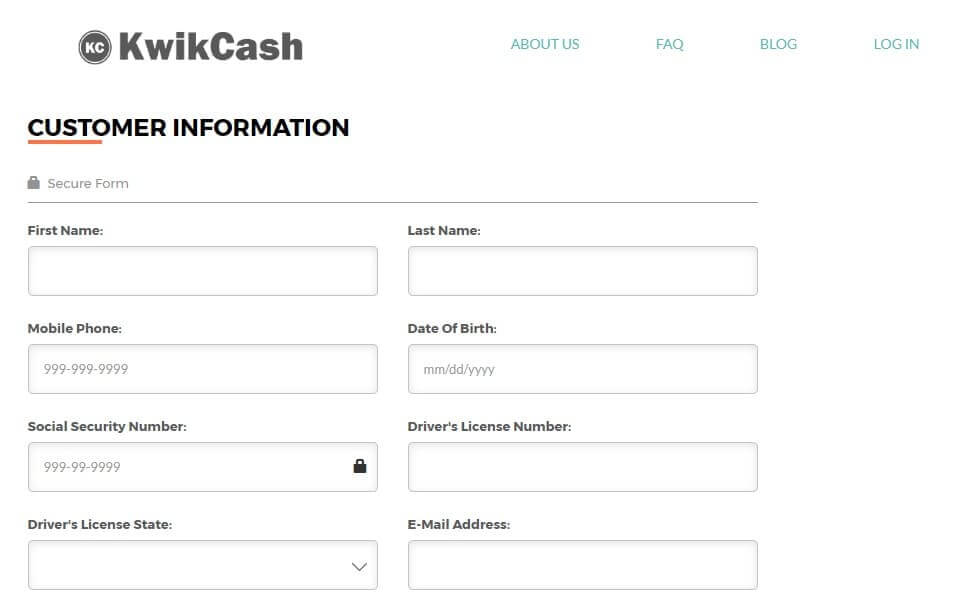

1. To start with, visit the website and click “Apply Now” then fill in a basic application form.

The form will require your personal details including address, social security number, employment details and income information.

2. You will also need to specify the purpose of the loan you want to take out and the amount you want.

3. In case they preapprove your application, someone from the KwikCash team will contact you. They will then guide you through subsequent steps.

You may have to submit some documents, which they will verify. And if they approve your application, the lender will transfer funds directly to your bank account. This may take as short as 1 business day.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for KwikCash Loan

Here are the qualifications you need to meet so as to qualify for a loan from this lender:

- Be at least 18 years of age

- Reside in California

- Have an open checking account

Information Borrowers Need to Provide to Get Loan

In the application process, you will need to submit the following information:

- Social security number

- A copy of your valid driver’s license

- Two recent paycheck stubs

- A copy of the most recent bank statement

- Bank account details

- Address details

- Income information

- Employment details

What states are accepted for KwikCash loans?

KwikCash only offers services in California.

What are KwikCash loan borrowing costs?

The lender is relatively transparent with borrowing costs. Here are some of the fees you may need to pay:

- APR – 165% to 220%

- Origination fee – nil

- Application fee – nil

- Prepayment fee – nil

- Late payment fee – 10%

KwikCash Customer Support

KwikCash has an A+ rating and accreditation from Better Business Bureau. However, there are no reviews whatsoever from its customers.

They have an equally high rating on Trustpilot, 9.2 out of 10, with at least 300 reviews. Most of these are positive, and they hail, among other things, excellent customer service.

Is it safe to borrow from KwikCash?

The lender makes use of a valid security license to protect the platform and the information you upload onto it. It has 256-bit SSL encryption and its staff members are not allowed to disclose borrower information, according to the privacy policy.

KwikCash Review Verdict

KwikCash is a highly reputable lender, offering great flexibility, excellent customer support and long loan terms. They offer a short application process and fast approval and funding.

As is the case with most installment lenders, their rates are on the high side, which is no surprise. The most unfortunate bit is that you can only access their services if you live in the state of California.

If you find yourself in a sticky situation financially and reside in this state, they are a good lender for you.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary Of Loaning

FAQ

Can I get funding from KwikCash if I live outside California?

No. You cannot access funding from the platform if you live in any other state.

Am I eligible for a KwikCash loan if I have recently filed bankruptcy?

Yes. The lender accepts applications from persons who have filed bankruptcy. But the terms may not be the most favorable.

Are there any penalties for late payment?

Yes. You will pay a $10 penalty for a late payment, but only after missing your due date by 10 days.

What is the procedure for making an early payment?

You would need to contact the customer service team and let them know you want to make an additional payment.

What will happen if I cannot make a payment on time?

To avoid damaging your credit score, you should contact the support team to get an adjustment on your payment schedule.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up