Finova Financial Loan Review 2020 – READ THIS BEFORE Applying!

To help you understand the service better and decide if it is suitable for you, we have carried out a thorough review of the platform.

Our review covers the important features of the service as well as its highlights and downsides. Read on to find out if it is the right one for you.

-

- 1. To start with, visit the lender’s website and fill out your personal details on the homepage. These include your name, phone number, email address and car model.

- 2. Next, fill in the details of your car on the form that appears, including the year of manufacture, model, style and mileage. Click “Continue.”

- 3. Verify your account using a code to log in or have a representative from the company call you so as to complete the process.

-

- 1. To start with, visit the lender’s website and fill out your personal details on the homepage. These include your name, phone number, email address and car model.

- 2. Next, fill in the details of your car on the form that appears, including the year of manufacture, model, style and mileage. Click “Continue.”

- 3. Verify your account using a code to log in or have a representative from the company call you so as to complete the process.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Finova offers car equity loans with a high loan limit and long repayment terms. They do not require bank accounts and fund poor and bad creditors. And their application process is fast and easy.What is Finova Financial?

Founded in 2015, Finova Financial is a company that operates under a team consisting of financial technology, payment and services. It makes use of digital financial technologies to try and offer inclusivity for the people outside the traditional financial system.

The company has the backing of top Silicon Valley venture capital firms as well as private equity investors from Wall Street.

Pros and Cons of a Finova Financial Loan

Pros

- A bank account is not mandatory

- Long loan terms of up to 2 years

- Lower APR than most short-term loans

Cons

- Requires your car as collateral

- You must have comprehensive and collision insurance or use a costly debt cancelation addendum

- There are a number of extra fees not included in the rate

- Services only available in a few states

- If you repay through MoneyGram, you might have to pay a monthly fee

Comparing Finova Financial with other Installment loan services provider

Finova Financial is an established online loan services provider offering multiple types of loans, from payday to personal and installment loans. It is nonetheless best known for its auto equity loan referred to as consumer loan on car. Some of Finova’s unique features include lower APR on loans, straightforward online loan application process and fast disbursement of funds. In the table below, we compared Finova to Opploans, Cash Net USA, and Check n Go installment loan service providers and this is how it faired:

Finova Financial

- Borrow auto equity loan of between $750 and $5,000

- Minimum credit score – Fair

- Loan APR starts from – capped at 30%

- Loan repayment period set at between 12 and 24 months

CashNet USA

- Loan limit starts from $255 to $3,400

- Requires a Credit Score above 300

- Interests rates range from 86.9% to 1140% ( depending on the type of loan)

- The loan is paid back within a week or 1 year depending on the type of loan. ( 5% – 15% penalty fee on every missed payments)

Opploans

- Borrow limit $500 to $5,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

Check N Go

- Borrow from $100 to $500

- Requires a credit score of 300 to 850 points

- Fee rate starts from $10 to $30( depending on the State)

- 3 to 18 months repayment period

How does a Finova Financial loan work?

Finova Financial provides what it refers to as a Consumer Loan on Car (CLOC) for customers who require funding urgently. The service is accessible online, where you fill out an application with details about your car as well as the amount you want to borrow.

Offering amounts ranging from $750 to $5,000, the lender sets a considerably long repayment period. You can repay the loan in a span of between 12 and 24 months. Services are accessible in select states, and the exact loan amount and terms will depend on your state of residence.

Though the loans have a low APR cap, they come with a number of significant additional fees. The multiple fees can add up to make the loan expensive, so it is important to weigh everything before settling on a loan.

What the platform offers is known as an auto equity loan, which has some similarities and differences with the traditional auto title loans. Both types of loan will make use of your car title as collateral and both are expensive forms of credit.

However, in addition to offering a longer repayment term, the auto equity loan gives the lender the option to take ownership of your automobile in case you fail to repay.

This type of loan does not require a bank account as is the case with most traditional loans. Rather, they encourage making repayments through MoneyGram. As such, you can pay back using hard cash at one of the 32,000 MoneyGram outlets.

The lender also offers a fast turnaround. After submitting the online application, you will get a call from a company representative to complete the process. in case they approve the application, it may take only a few hours to get funding.

And like many online lenders, they accept all types of borrowers, even bad creditors. They consider your affordability, which is the ability to repay, more than the credit score.

To qualify for this loan however, you will need comprehensive and collision insurance on your car. Additionally, Finova should be a payee on the policy you take out in case an accident happens during the life of your loan. The policy must include a minimum of $500 as a prepaid deductible and coverage for the length of the loan.

In case your existing policy does not have comprehensive and collision insurance, you can take advantage of their debt cancellation addendum. But this comes at a fee. Basically, the debt cancelation addendum is an insurance policy that you take out through the lender. And unfortunately, it can add thousands of dollars to the cost of your loan.

What loan products does Finova Financial offer?

Finova Financial offers an auto equity loan known as the Consumer Loan on Car (CLOC).

What other store services does Finova Financial offer?

Finova offers a prepaid card which you can use at any place where MasterCard works.

Finova Financial Account Creation and Borrowing Process

Creating an account and borrowing from Finova Financial is quite simple and seamless.

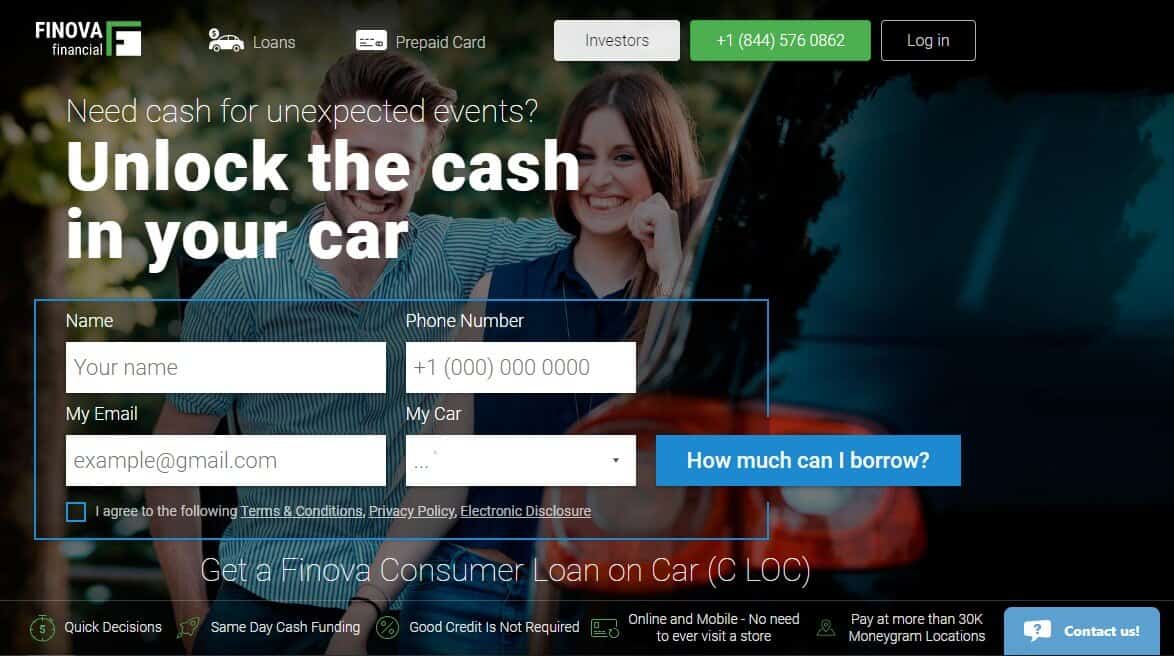

1. To start with, visit the lender’s website and fill out your personal details on the homepage. These include your name, phone number, email address and car model.

Once you are done filling in the details, click “How much can I borrow?”

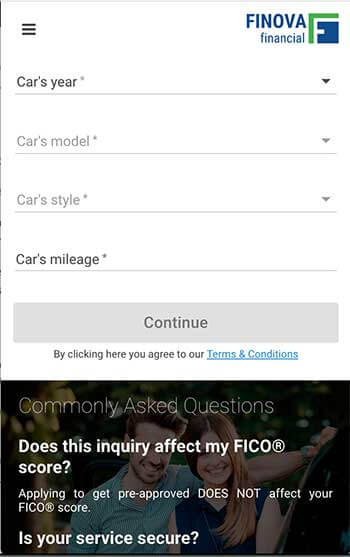

2. Next, fill in the details of your car on the form that appears, including the year of manufacture, model, style and mileage. Click “Continue.”

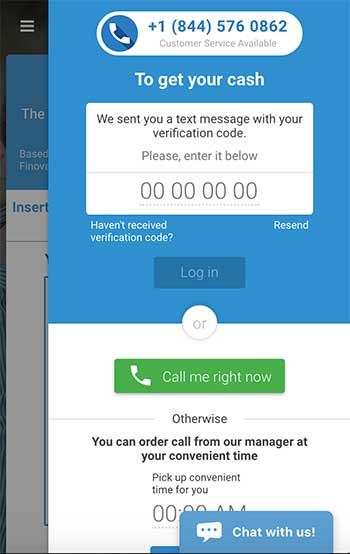

3. Verify your account using a code to log in or have a representative from the company call you so as to complete the process.

In case they approve your loan, they will transfer funds to your MoneyGram account or send it to you by check. Make sure you read the contract thoroughly to understand the terms before signing up.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Finova Financial Loan

Here are the requirements you need to meet so as to qualify for a loan from this lender:

- Be at least 18 years of age

- Live in a state where they offer services

- Own your car outright

- Have valid insurance on the car

- Be a permanent resident or citizen of the US

Information Borrowers Need to Provide to Get Finova Financial Loan

Some of the information you will need to provide includes:

- Your car’s details

- Name

- Phone number

- Email address

What states are accepted for Finova Financial loans?

Finova offers services in the following states:

[one_third]- Arizona

- California

- New Mexico

- South Carolina

- Florida

- Tennessee

- Oregon

What are Finova Financial loan borrowing costs?

Here are some of the costs you can expect to incur when you borrow from Finova:

- APR – capped at 30%

- Filing fee – up to $75 to cover your car’s lien

- Credit investigation fee – $25 on your first loan repayment

- Origination fee -$25 or $30

- Debt consolidation addendum – vary

- Prepayment fees – nil

Finova Financial Customer Support

Though the lender is not on TrustPilot and does not have BBB accreditation, there are lots of positive reviews about the platform online. Users hail the customer support team for its helpfulness and fast response times.

Is it safe to borrow from Finova Financial?

Finova makes use of SSL encryption to protect user data on its site. However, it has the right to distribute your personal financial information unless you call them and opt out.

Finova Financial Review Verdict

Finova Financial offers a much higher loan ceiling at a friendly APR for borrowers requiring urgent funding. The application process is short and approval and funding process is fast and easy. Repayment is also convenient as you can do it at any of MoneyGram’s 32,000 outlets.

But on the downside, it charges high extra fees which may make borrowing a lot costlier than it seems.

Overall though, it is a good platform for times when you have no other way out of a financial fix.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

How much can I borrow?

You can borrow any amount between $750 and $5,000, depending on the value of your car, your affordability and state laws.

Will they check my credit?

Yes. They will start with a soft credit pull and once you confirm your application, they undertake a hard check from a major agency.

When will I get funds?

In most cases, it only takes a few hours when you use MoneyGram. But you can also get the payment via check within a maximum of 2 days.

Do they charge late payment fees?

Yes, they charge late payment fees.

Can I repay early?

Yes, there are no penalties for early repayment.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up