Dave Loan App Loan Review 2021 – READ THIS BEFORE Applying!

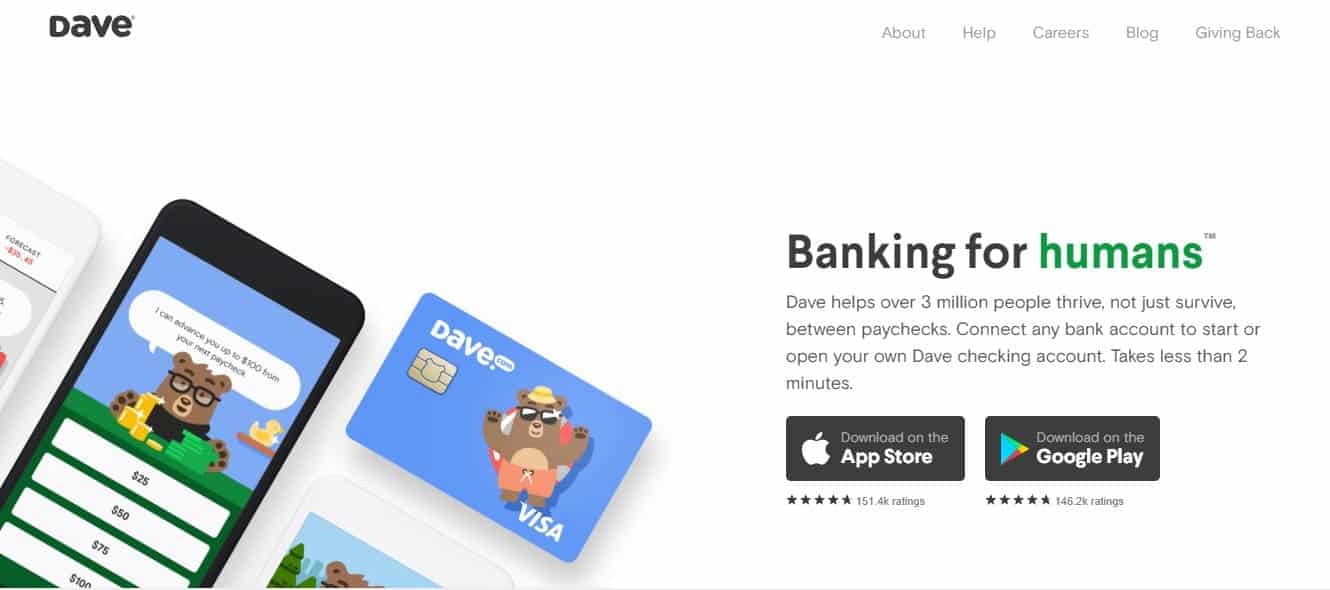

When living from paycheck to paycheck, you may find yourself surviving instead of thriving. The Dave Loan app is a platform that aims to help you change the status quo with a small financial boost.

When living from paycheck to paycheck, you may find yourself surviving instead of thriving. The Dave Loan app is a platform that aims to help you change the status quo with a small financial boost.

How does it work? Are there any concerns associated with using the app? Do the benefits outweigh the costs?

Find out all you need to know about this service by reading through our comprehensive review. At least then, you will be in a position to make an informed decision on whether or not to sign up.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Dave Loan app is an innovative AI-based lending approach that works directly with your bank account. It alerts you when funds are low and gives you boosts as many times as necessary. Though the loan amount is low, the terms are great and the app has an excellent reputation.

Dave Loan app is an innovative AI-based lending approach that works directly with your bank account. It alerts you when funds are low and gives you boosts as many times as necessary. Though the loan amount is low, the terms are great and the app has an excellent reputation.What is Dave Loan App?

Dave Loan app is a mobile platform that seeks to provide a shield between borrowers and traditional financial institutions.

It was born of a need to solve simple pain points such as hefty overdraft fees and budgeting problems.

Since its birth in 2016, it has gained over 3 million members. This comes as no surprise as it has the backing of finance industry giant Mark Cuban.

Founding Story

On its website, Dave offers a compelling founding story, comparing the app to the finance version of David vs. Goliath. It started out with three friends who were fed up with the traditional banking experience.

They often incurred $38 overdraft fees and had no insights into how much they had left before payday. In order to address these weaknesses, they decided to build their own bank, starting small.

It has grown significantly since then and still seeks to offer “approachable financial products.” For every tip users leave on the platform, a percentage goes to a sub-Saharan non-profit known as Trees for the Future. So far, it has planted over a million trees under the initiative.

Also, see how you can repair your credit score with one of these credit score repair loans

Pros and Cons of a Dave Loan App Loan

Pros

- Low monthly membership fee and optional tipping

- No fees or penalties

- You can use express delivery for same day funding

- Reputable lender with lots of positive user reviews

- Lots of compelling bonus features

- Automated system for preventing account overdrafts

- Easy access on a mobile platform

Cons

- Low loan limit

- Funding can take up to 3 days when using standard delivery

- Express delivery is costly

- Repayment periods are short, especially for small amounts

Dave Loan App vs other reputable online loan providers

Dave Loan app is not your everyday Payday loan provider. It is an online loan service provider that’s specially designed to help you avoid the hefty overdraft fees and interest rates charged by traditional banks or your payday loan provider to access overdraft facilities. For instance, instead of interest rates and loan fees, Dave loan app charges you a monthly subscription. We compared it with other payday loan service providers like Speedy cash, Ace cash Express and Rise Credit and here is what we found out:

Dave Loan App

- Borrow up to $100

- No minimum credit score (just proof of regular income)

- No fees and APRs just a $1 monthly subscription

- Loan repayment as soon as the next paycheck (less than 30 days)

Speedy Cash

- Borrowing from $100 – $500 (varies by state).

- Credit score requirements of NIL (does not check)

- Fee rate on $100 starts from $26 (State dependent)

- Term of Loan 14 to 30 days (for payday loans)

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

How does a Dave Loan App loan work?

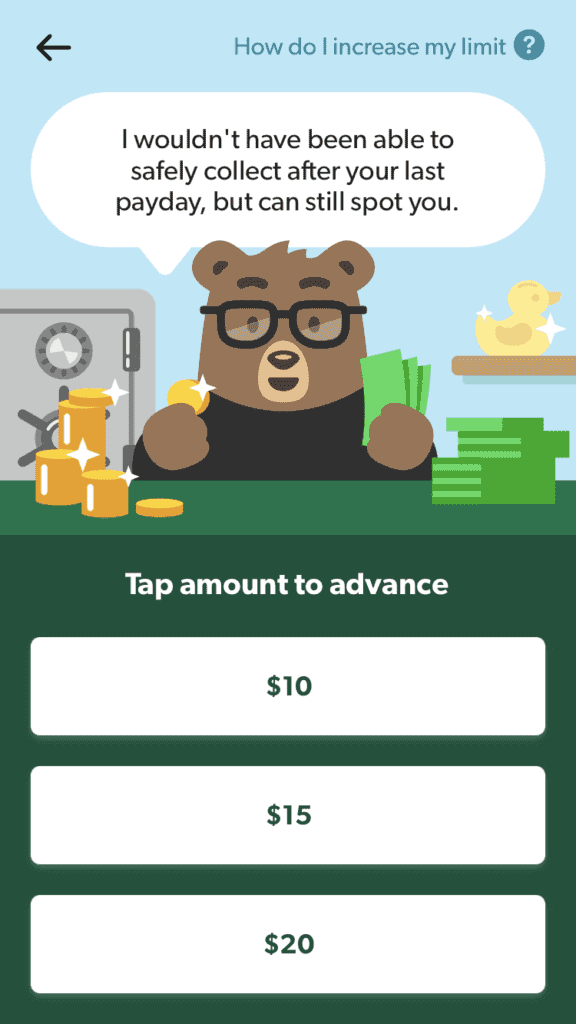

The Dave Loan app is an innovative provision that could help you access pay advances the when need arises. You can borrow up to $100 from the platform as often as you need it at no interest or fees.

Conditions for accessing funding on the app are minimal. One is that you can only borrow after you clear your last payment. It is also necessary to make sure that your account is not overdrawn by over $75. In place of hefty bank overdraft or cash advance loan fees, you only need to pay a $1 monthly subscription for the service.

Notably though, you can earn free months of membership by making purchases from the stores you already shop from.

Whenever you borrow from the platform, you can access your cash using two delivery methods. The fastest one is Express delivery, which will only take 8 hours, but it comes at a $4.99 fee. It goes straight to your debit card.

Standard delivery, which is the second option, will take up to 3 business days and is free of charge. In this case, the funds go to your checking account.

Dave will not check your credit score before giving you funds. But you will need to meet some income requirements to ensure you can pay back.

First, you need to show proof of consistent income. This should be in the form of a minimum of two direct deposit paychecks from your employer to your account. Second, you need to have some money leftover in your account after paying your bills.

When it comes to repayments, you need to pay Dave back on your payday. However, smaller advances are typically due on the Friday after you borrow. They make things easier for you by automating the withdrawal. So all you have to do is ensure that you have the necessary funds in your account.

Note that if you have money sooner, you could make an earlier payment as there are no penalties or fees for doing this.

The only time you will have to pay more than you borrowed is if you choose to leave a tip or opt for the express delivery option. But for as long as you sort out the monthly membership fee, you will never have to worry about late fees, early fees or prepayment penalties.

An interesting aspect of Dave app is that it can use advanced algorithms to monitor your transaction history. And any time your account seems like it may require an overdraft and have a negative balance, the app will make a prediction ahead of time. This way, you can easily avoid overdraft fees.

Here are the 8 best bad credit loans for your small business in 2026

What loan products does Dave Loan App offer?

Dave Loan app offers an alternative to the traditional cash advance at much friendlier terms.

What other services does Dave Loan App offer?

There are plenty of bonus features accessible to app users. Let us consider some of the most outstanding ones.

Bank with Dave

You can open a checking account with Dave and get access to your funds from more than 32,000 ATMs throughout the US for free. The account is a no-minimum, no-overdraft account with lots of great features.

For instance, if you ever lose the account debit card, you can freeze it on the app. The service provider will then mail you a new one. Alternatively, you can simply unfreeze it once you find it. You can also send checks for free to pay bills such as your rent.

Credit Building with Rent

Whether you have poor credit or no credit at all, Dave can give you an opportunity to build or repair your score. In partnership with CreditPop, the app lets you report your rent payments to the top credit bureaus.

For as long as you pay your rent consistently, this can give you a serious edge and help you access good financing options in the future. According to the site, your score can increase by 28 points in only 2 months, and 70 points in 2 years.

Automatic Budgeting

One of the issues Dave founders wanted to solve had to do with budgeting. Many times, people live from paycheck to paycheck as a result of poor budgeting.

Using this app, you can get an automatic budget in mere seconds to help you plan for upcoming expenses. The app outlines the wages you expect and your payday. It then lays out all expenses and their due dates, helping you avoid late payments and plan better.

Job Hunting

In order to help you address financial problems sustainably, Dave can also help you get a side hustle. Through its network of partners, you can discover and apply for jobs right from your mobile device app.

Dave Loan App Account Creation and Borrowing Process

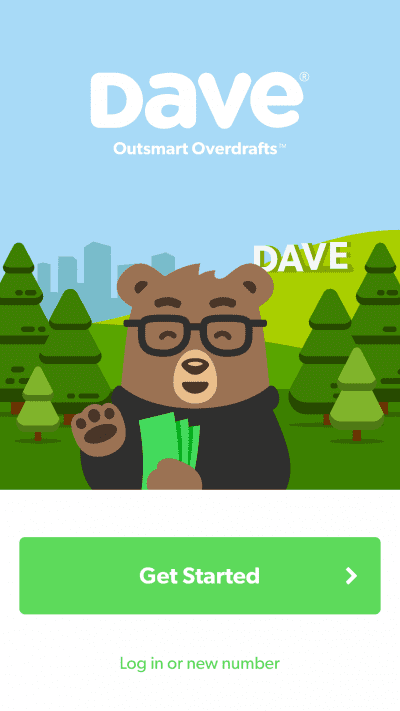

Using the app to sign up and start accessing pay advances is quite easy. Go to the Google Play Store or Apple App Store and find Dave Loan App.

1. Download the app and follow the prompts to install on your device. Next, open the app and select ‘Get Started.’

Dave will explain how everything works at this point, before you actually sign up.

2. If you are comfortable with the model, enter your mobile number and create your Dave account.

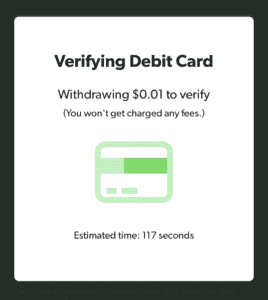

3. You will get a 4-digit code on that number for confirmation. Enter the code into the app and then connect your debit card and bank account.

As soon as Dave creates your account and verifies identity information, the app will start tracking your transactions.

4. You will have the opportunity to borrow up to $100 when you need it and get alerts when you risk overdrawing your account.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Dave Loan App Loan

In order to qualify to access funding from the platform, you need to meet some minimal qualifications. These include:

- Earn a consistent income

- Provide proof of two recent direct deposit paychecks

- Have a checking account

- Have a debit card

- Have money left in your account after paying bills

Information Borrowers Need to Provide to Get Dave Loan App Loan

Here is list of the information you need to provide so as to use the loan app:

- Your social security number

- Bank account information

- Driver’s license

- Debit card information

- Recent pay stubs

- Other personal information

What are Dave Loan App loan borrowing costs?

Dave does not charge borrowers any fees or penalties. You only need to pay a monthly membership fee:

- Monthly membership fee – $1

Dave Loan App Customer Support

Dave Loan gets great reviews from tens of thousands of users. On the App Store, it has a rating of 4.7 out of 5 stars based on over 80,000 reviews. And on Play Store, it has 4.6 stars out of 5 from over 60,000 users. Among the reasons for the excellent reviews is its customer service which users hail.

On Better Business Bureau, it is accredited and has an A+ rating. There are a total of 66 complaints, and each of these is answered. Notably, none of these has to do with customer support.

Is it safe to borrow from Dave Loan App?

According to the Dave Loan site, they make use of 2048-bit SSL encryption to secure the transmission of your sensitive data. Additionally, they do not store any bank login information. You only need this information to connect your account as well as to verify that you own that account.

The information they store is encrypted so as to prevent unauthorized users from accessing your personal data and sensitive financial information.

Another safety measure is that they hire external security teams to assess the platform, identify and fix flaws that could result in data theft.

And finally, they use traditional security measures on the grounds of their data centers round the clock to prevent physical attacks.

Dave Loan App Review Verdict

Overdrafts will almost always make a bad situation worse, and Dave app seeks to right this wrong. The app automatically alerts you when your account balance seems set to go into negative to help avoid overdraft fees.

And it charges a minimal fee for small loans to keep you going until the next paycheck so as to avoid expensive borrowing. Its AI-based approach is ingenious and helpful and you can also open a Dave account which has no overdraft and no account minimum.

Almost everything about this loan app is a win, apart from the fact that you can only access $100 at most. It might therefore not be suitable for bigger expenses.

But overall, it is a great choice of financing with limited downsides.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary Of Loaning Terms

FAQ

Does borrowing from Dave affect my credit score?

No. Dave will not perform a credit check, not even a soft credit pull. Credit bureaus do not require reporting of pay advances. Therefore, it will have no impact on your score. But you can use it to improve your score by signing up for the credit-building feature.

Can I sign up for the service using a joint account?

No. At present, Dave only accepts singular ownership bank accounts for its members.

How can I cancel membership?

You will need to deactivate your profile by going to the app and selecting Account ‘Dave Membership’ Cancel Dave Membership then select a reason and tap ‘Delete.’ If you choose to reactivate the account, it will take two months before you can request for a cash advance again.

Can I add expenses manually?

Yes. Simply go to the app and select ‘Add New’ next to ‘Expenses’ then ‘Add Your Own.’ Name the expense, indicate how often you pay it and ‘Save.’

How can I reach the customer support team?

You can do so by going to the site, and under ‘Help,’ select ‘Contact Us.’ You will need to enter your email address, mobile number and a description of the problem. Upload screenshots if necessary and then click ‘Send Message.’

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up