Cash Factory USA Loan Review 2020 – READ THIS BEFORE Applying!

At times, getting over the period between paydays is challenging, and a payday loan could offer a way to survive. Cash Factory USA is a payday loan provider in the US, but is it your best choice of platform?

At times, getting over the period between paydays is challenging, and a payday loan could offer a way to survive. Cash Factory USA is a payday loan provider in the US, but is it your best choice of platform?

In this comprehensive review of the platform, we will take a look at its services, key features, merits and demerits.

By the end of the review, you will be in a position to tell whether it is the right one for you. Read on to make an informed decision.

-

- 1. Visit the website and on the box labeled “Welcome Back,” click on the “New Customer” button at the bottom.

- 2. Start the application process by selecting your state, choosing a loan amount and then clicking “Get Started.”

- 3. Fill in the basic information which includes your email address and loan amount.

- 4. Next, fill in the required personal information including your full name, date of birth and social security number.

- 5. Provide your contact information starting with home address and city, then the zip code and primary phone.

- 6. Once you have done that, enter your employment information including income source, monthly income, pay frequency, payroll type, employer, work phone and upcoming pay dates.

- 7. Finally, provide your bank account information including the bank name, routing number and account number.

-

- 1. Visit the website and on the box labeled “Welcome Back,” click on the “New Customer” button at the bottom.

- 2. Start the application process by selecting your state, choosing a loan amount and then clicking “Get Started.”

- 3. Fill in the basic information which includes your email address and loan amount.

- 4. Next, fill in the required personal information including your full name, date of birth and social security number.

- 5. Provide your contact information starting with home address and city, then the zip code and primary phone.

- 6. Once you have done that, enter your employment information including income source, monthly income, pay frequency, payroll type, employer, work phone and upcoming pay dates.

- 7. Finally, provide your bank account information including the bank name, routing number and account number.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

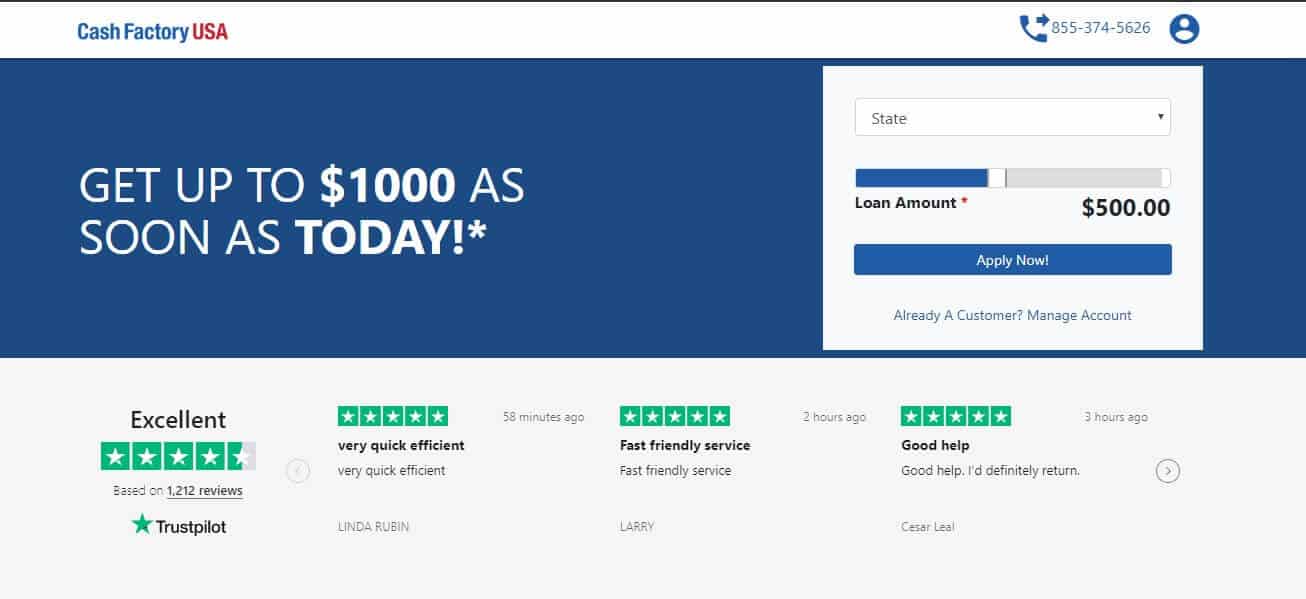

Cash Factory USA is a short term lender offering payday and installment loans. Services are available in only 9 states. The lender strives to be transparent, showing the cost of borrowing upfront.

Cash Factory USA is a short term lender offering payday and installment loans. Services are available in only 9 states. The lender strives to be transparent, showing the cost of borrowing upfront.What is Cash Factory USA?

Cash Factory USA is a direct lender offering access to funding in 9 US states. It offers two main short term financing options and strive to be transparent in their dealings. Its corporate headquarters are in Las Vegas, Nevada.

Pros and Cons of a Cash Factory USA Loan

Pros

- Transparent fee framework

- You can cancel the loan without paying any fees

- Lender has a mobile app

- Fast loan approval and funding

Cons

- Extremely high interest rates

- The company provides little information about itself

- Services are only available in 9 states

- Low loan limits

Cash Factory USA vs other competitive loan providers

Cash Factory is a payday loan lender known for its transparency and lenient payments terms. The loan application process is done online where borrowers are able to see the cost breakdown of their loans including other associated fees. But its direct competitors such as Advance America, Opploans, and Rise Credit are also a force to reckon with in this field. Let’s see how they all compare in terms of loan limit, credit score requirement, interest rates, and repayment period.

Cash Factory USA

- Offers a loan limit of $100 to $1,000

- No minimum credit score required

- Interests rates range between 207.7% to as high as 547.36% depending on the state of residence

- Repayment period from 2 weeks up to 6 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- weekly and monthly payback installments

Oppoloans

- Borrow limit $500 to $5,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payback period of 9 to 36 months

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- The repayment term ranges from 7 to 26 months, depending on state of residence

How does a Cash Factory USA loan work?

Cash Factory USA offers services in just a handful of states, in the form of payday and short term installment loans. These vary in amounts, ranging from $100 to $1,000.

The amount you can access from the lender will mostly depend on your state of residence and individual circumstances. Loan terms can last from two weeks up to 6 months for these loans.

Among its top highlights is the fact that the website lays bare all the details you need in relation to the borrowing costs. This is unlike a majority of short term lenders. Who only let you see the rates once you complete the application process.

Adding to the transparency is the fact that they provide multiple examples of loans and potential costs in the different states where they offer services.

Another highlight is the fact that after borrowing from the platform and receiving funds, you have the option of returning the funds. If you get in touch with the team within a span of 1 to 3 days after getting the case, you can return it without paying any fees.

Loan cancellation terms however vary from one state to the next. If you are a resident of California or Nevada, you must cancel before 5:00 PM PT on the business day after you finalize the loan agreement.

In Wisconsin, you have to cancel within one business day after signing the loan agreement. And in Missouri you must cancel before 5:00 PM PT on the day after agreement finalization. Texas residents have the most time as they need to cancel before 12:00 AM CT on the third day after finalizing the loan agreement.

What loan products does Cash Factory USA offer?

Cash Factory USA offers two main loan products:

- Payday loans (which the site refers to as short-term loans)

- Installment loans

What other store services does Cash Factory USA offer?

The lender does not offer any other store services.

Cash Factory USA Account Creation and Borrowing Process

Creating an account on Cash Factory USA is quite simple.

1. Visit the website and on the box labeled “Welcome Back,” click on the “New Customer” button at the bottom.

2. Start the application process by selecting your state, choosing a loan amount and then clicking “Get Started.”

Here, you will get a countdown timer showing the time you may have to wait till the next batch of funding.

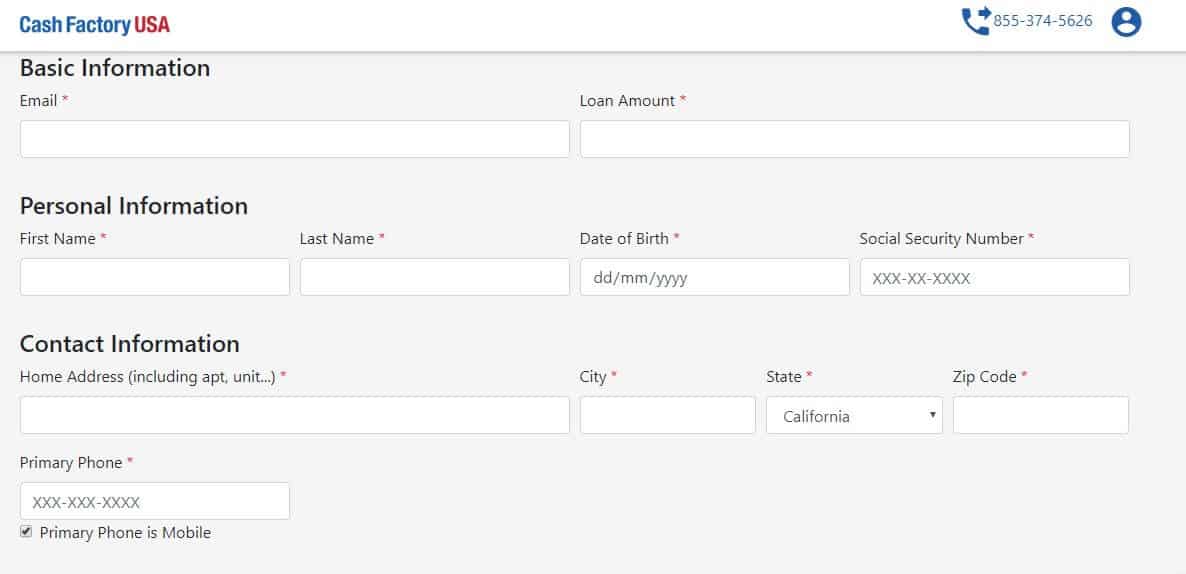

3. Fill in the basic information which includes your email address and loan amount.

4. Next, fill in the required personal information including your full name, date of birth and social security number.

5. Provide your contact information starting with home address and city, then the zip code and primary phone.

6. Once you have done that, enter your employment information including income source, monthly income, pay frequency, payroll type, employer, work phone and upcoming pay dates.

7. Finally, provide your bank account information including the bank name, routing number and account number.

Then tick the boxes concerning military status and click “Submit” to complete the process.

It might take as few as 60 seconds to get a response on your loan application, and up to 1 business day to get funds.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Cash Factory USA Loan

In order to qualify for a loan from this lender, there are a number of qualifications you need to meet:

- Be at least 18 years or older

- Have a government-issued ID

- Be a US citizen or a permanent resident

- Have a bank account

- Provide proof of income

Information Borrowers Need to Provide to Get Cash Factory USA Loan

When applying for a loan from this platform, you will need to provide the following information:

- Name

- Date of birth

- Social security number

- Monthly income

- Pay frequency

- Bank details

- Proof of residence

- Proof of income

- Copy of state ID or driver’s license

What states are accepted for Cash Factory USA loans?

The lender offers services in a number of US states including:

[one_third]- California

- Delaware

- Idaho

- Missouri

- Nevada

- Ohio

- Texas

- Utah

- Wisconsin

What are Cash Factory USA loan borrowing costs?

As a short term lender, Cash Factory USA is a high cost source of funding. Take a look at the costs you may have to deal with when borrowing from the platform:

- Lowest Starting APR – 207.7% (California)

- Highest Starting APR – 547.36% (Wisconsin)

- Maximum APR – 3,647.08%

Cash Factory USA Customer Support

Based on online reviews, Cash Factory USA support team has an excellent reputation. The platform is not accredited with Better Business Bureau and does not have an official rating.

But on Trustpilot, it gets 4.7 out of 5 stars, with 81% of 1,199 customers rating services as ‘Excellent.’

Is it safe to borrow from Cash Factory USA?

The lender strives to keep user data safe by encrypting all the data users submit through the online application. It is licensed in all of the states where it operates and goes the extra mile by having a page for helping customers to stay safe on the internet.

Cash Factory USA Review Verdict

As a short term lender, Cash Factory is certainly an expensive source of funding. But on the plus side, it has a great reputation online and offers fast loan processing and funding. You also get to cancel your loan without penalties if you get buyers’ remorse after accessing funding.

Overall, it is a great choice of platform if you live in a state where services are accessible and have no other way out.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Can I extend my loan?

If it is an installment loan, you cannot extend it. But for payday loans, it will depend on your state of residence.

Can I pay off my loan early?

Yes, you can make an early repayment without any fee or penalty.

What if I do not pay my loan or pay late?

Non-payments and late payments may attract additional fees, collection activity or both.

How can I change my bank information?

Log in to site and then click the icon adjacent to your name and select “Payment Methods.” Add a bank account and verify the information then contact the support team to update the information.

When is the lender’s business hours?

The lender works from Monday to Friday, 6:00 AM to 7:00 PM PST and on weekends from 6:00 AM to 6:00 PM PST.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up