BrightenLoans Loan Review 2020 – READ THIS BEFORE Applying!

Personal loans or short-term loans have always been helpful for people when they are facing an unexpected expense. With the arrival of online lending platforms, one can easily access the money with the quick application process.

BrightenLoans is among those platforms that are offering easy and quick access to cash. This platform plays a role of connecting borrowers with lenders with the help of online application form.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

BrightenLoans permits borrowers to receive loan proposals from various lenders with a single online application. This reduces the burden of finding and comparing rates of different lenders.What is BrightenLoans?

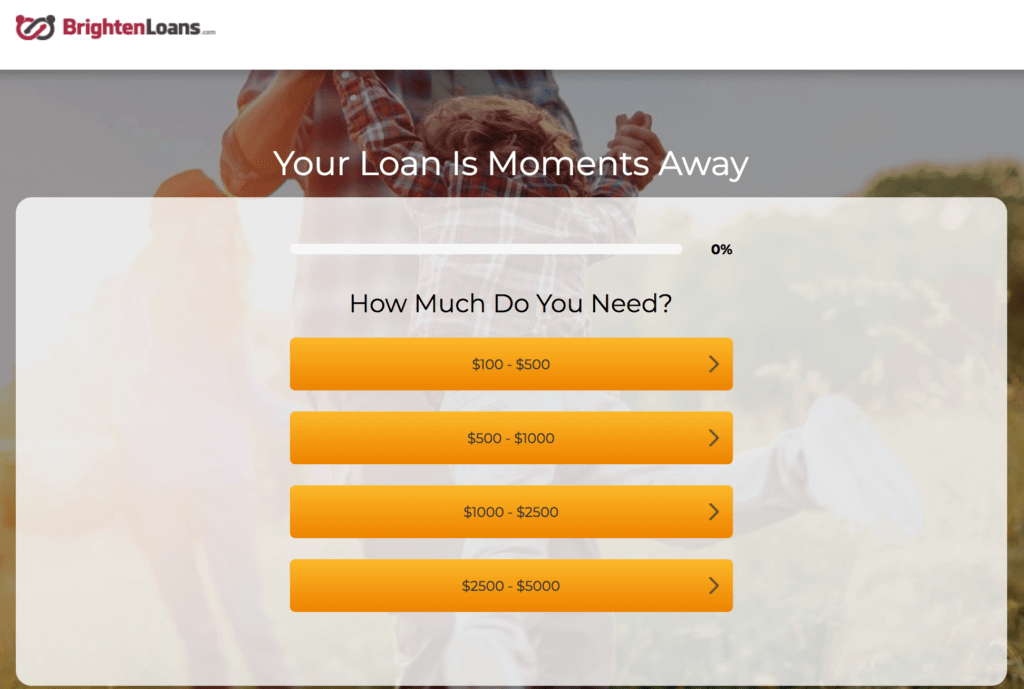

Founded in 2011, BrightenLoans is a marketplace for borrowers and lenders. The platform is working on the strategy of providing easy access to cash. They connect borrowers with an extensive number of reputable lenders for personal loans. The platform permits borrowers to get instant cash in the range of $100 to $5000. They have developed a simple online application process; the repayment options are also flexible. The client can use these personal loans for any purpose such as automobile maintenance, unexpected medical expenses, family vacation, home improvements, etc.

What are the Pros and Cons of BrightenLoans?

BrightenLoan Pros:

✅Fast funding

✅Simple application

✅Several Lenders

✅Flexible credit score requirements.

BrightenLoans Cons:

❌ Improvement required for customer support segment

❌ Lack of information about lenders

Brighten Loans Vs other Competitive Loan Lenders

Brighten is a personal loan provider founded in 2011. It essentially connects borrowers to reputable lenders through the convenience of a web application. This way users are assured of fast access to loans and ability to choose lenders with better terms and affordable rates. Let’s compare how the lender compares to other equally good personal loan providers such as Opploan, Check n Go, and Speedy Cash; based on their loan limit, credit score, interest rates, and repayment period.

Brighten Loans

- Loan amount from $100 to $5,000

- No credit score check

- Annual interest rates of 5.99% to 35.99%

- Repayment period of 12 to 30 months

OppLoans

- Borrow limit $500 to $5,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

Check n’ Go

- Borrow from $100 to $500

- Requires a credit score of 300 to 850 points

- Fee rate starts from $10 to $30( depending on the State)

- 3 to 18 months repayment period

Speedy Cash

- Loans from $100 to $5,000 ( collateral security may be required)

- Accepts bad credit score

- Payday loans should be paid within 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% but varies depending on state of residence

How Does BrightenLoans Work?

BrightenLoan does not offer loans. It is a marketplace for personal loans in the range of $100 to $5000. The platform connects borrowers with various types of lenders. They have developed an easy loan requesting procedure. The borrower only needs to fill out one easy online application form on the BrightenLoans website. The platform will instantly present your application to its large numbers of lenders. The borrower can expect loan offers from a lender in a few minutes. Below are the features of BrightenLoans:

- Cash Sent Directly To You: Once your loan application is approved, the lender will directly transfer cash in your account. The lender will not transfer money to BrightenLoans platform.

- Private And Secure: BrightenLoans use top-rated security and advanced encryption technology in order to protect the personal information of borrowers.

- Automated Repayment: The repayment process could also become hassle-free if you authorize the lender to make a debit transaction from your bank account on the due date. This process reduces mental stress along with the threat of late fee.

- Late Payments: Its necessary to understand the late payment policies. This is because late payment policies differ from state to state.

- Loan Extensions: You should also understand state laws regarding a lender’s ability to extend your loan. You are suggested to consult with your lender for a loan extension.

- Loan Default: The borrowers are suggested to pay their installments on time. For instance, if you can’t make your loan payments, late payments may apply. In addition, this situation could also adversely affect the credit score and makes it hard to get future loans.

The lenders that are supported on this platform offer interest rate in the range of 5.99% – 35.99%. You can get more than one loan through this platform. However, you are required to inform lenders about your previous loans. The repayment length stands around 12 to 30 months. The lender transfers funds in your account on the next business day once your request is approved. Below are the highlights related to BrightenLoan platforms:

- Extensive lenders network

- Fast preapproval

- Receive approval and funding in 24 to 48 hours

- Strong customer data security

- Great loan amounts

- Effective matching strategy

- Clear privacy policy

- Informative FAQ section.

What is the Application Process of BrightenLoans?

BrightenLoans is seeking to make the application process easy and quick. They like to provide access to cash instantly. You cannot get loans through a phone call. You are required to fill the online application form through BrightenLoans website. Once you reached the website, your loan application process starts with a credit score.

The borrower is required to provide information related to credit score and email address. You need to provide the following information during the application process:

- Name

- Email address

- Residence address

- Social Security Number

- Amount of loan

- Previous debts

- Monthly income.

Once you provided the information, the platform will make a soft credit check to verify your information and credit score. Once your information is verified, the BrightenLoans platform will send an encrypted copy to authorized lenders. The lenders will then come up with loan offers. These offers include the amount of loan, interest rate, repayment structure along with other costs and fee.

The borrowers are suggested to closely review the loan offer before accepting it. Once you accepted the loan offer, the lender could ask you to provide more documents and bank account details. The lender will make a hard credit check before transferring funds. If you pass the credit check, the lender will transfer the funds in your account as soon as the next business day. The borrower can use those funds for any purpose according to the financial requirements. The borrower is also liable to return the money according to the repayment schedule.

What types of Loans Borrower can Get Through BrightenLoans Platform?

The platform only offers short-term personal loans ranging from $100 to $5000. The duration of the loan stands around 12 to 36 months. The borrower can use the loan for the following purposes:

- Debt Consolidation: Debt consolidation is a common type of personal loans. The borrowers can use a personal loan for the payment of previous debts. Debt consolidation helps borrowers in replacing the high-interest rate debt with a new low-interest rate debt. This also helps in streamlining the debt repayments.

- Home Improvement: The borrower can use the loan for home improvement purpose. You can decorate your home or lawn with the help of a loan from lenders supported by BrightenLoans.

- Car Repair: Car repair is a common form of personal loans. You can get a loan for car repair if your card had an accident or other issues.

- Medical Expense: You can use the funds for medical-related expenses. Sometimes you have to bear unexpected medical expenses. Thus, getting money from lenders supported by BrightenLoans could help you get out of a worse situation.

- Utility and Family bills: Sometimes you don’t have money to pay your utility and other family-related bills. In this situation, you can get a loan from lenders supported by BrightenLoans.

- Credit Card Payments: Credit card debit always carries a higher fee and interest rate than traditional loans. Therefore, replacing a credit card debt with a new debt that carries a lower fee and interest rate is a good idea.

The borrower can use the money anywhere according to the financial requirements. The lender does not bind you to use the money for any specific purpose.

What Credit Score is Accepted on This Platform?

You don’t need to worry about the credit score when you are applying for the loan through BrightenLoans. They permit borrowers with good to bad credit score. If you have a better credit score, you can get loans on easy terms and conditions. The interest rate on loans also depends on credit score. The lenders could charge a high-interest rate to borrowers with a low credit score.

The platform says each lender or lending partner has its own underwriting policies. An alternative for those with bad credit may be to seek a short-term consumer loan. If we cannot find a lender or lending partner that can offer you a personal loan for the amount you requested, we will search our network of short term lenders or lending partners to see if we can find a short-term lender or lending partner for you.What is the Fee Structure of BrightenLoans?

BrightenLoans marketplace is free for borrowers. The platform does not charge any fee to borrowers even if they successfully get funds from lenders. They do not charge any loan origination fee. The platform also does not charge any management fee to borrowers. Their revenue generation is entirely dependent on commission from lenders that are supported on this platform. They get a commission once the borrower gets funds from its network of lenders.

The lender, however, could charge various types of a fee to borrowers. The actual cost of the loan varies by lender or lending partner. The lender will provide all the information related to the fee structure during the application process. You could expect origination fee, late payment fee, and other management fees from lenders supported on this platform.

Is BrightenLoans Platform Safe for Borrowers?

BrightenLoans is safe for borrowers. This is because the platform only offers a marketplace for borrowers and lenders. It does not originate the loan. It is not responsible for the transfer of funds into the borrower’s account. They do not charge any fee to borrowers. They only play the role of connection borrowers with lenders. They have been in this business since 2012. The customer’s feedback score also indicates that BrightenLoans is safe for borrowers. The customer feedback score on TrustPilot stands at 4.5 out of 5.

On the other hand, BrightenLoans has also been seriously working on privacy policy. The platform only collects information that is necessary for the loan purpose. They only share this information with lenders. They do not sell this information to marketing agencies. They only use your data for news alerts. The user can also unsubscribe newsletters if they don’t wish to receive them. Additionally, all data is stored on servers protected by industry-standard security measures that include both electronic and physical mechanisms.

What is the Eligibility Criteria for BrightenLoans?

BrightenLoans is strict regarding the eligibility criteria. They do not accept clients that are not complying with their lending policies. Below is the eligibility criterion that one needs to fulfill to get a loan:

- Must be employed in the current position for more than 90 days;

- You should be at least 18 years old,

- You must be a US citizen or a permanent resident

- You must have a valid Social Security Number

- Your income should stand around $1000 per month.

- Have a valid email address,

- work phone number

- home phone number

- Bank Account.

The platform only accepts clients from the United States. BrightenLoans is not available for foreign clients. They accept clients from all parts of the United States. Below are the few states that are acceptable on this platform:

[one_fourth]- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

Is BrightenLoans Customer Support Good?

BrightenLoans seeks to create strong customer support service. The platform has created several modes for its clients to reach the support team. The user can contact the support team through a phone call. On the other hand, the platform permit borrower to contact the support team via email. The support team responds to each query within three business day. They have developed extensive frequently asked question segment. This segment is helpful when you have general questions related to the loan and terms of the agreement.

BrightenLoans Review 2019 – Final Verdict

BrightenLoans is an emerging marketplace for borrowers and lenders. The platform has an extensive network of lenders that offer loans in the range of $100 to $5000. The interest rate on loans stands around 5% to 35%. They accept clients with below average to excellent credit score. The interest rate and repayment terms are always easy for borrowers with a strong credit score. The lenders could charge a higher rate to borrowers with a low credit score. The loan application process is simple and online. Once the borrower submits the loan application, the lenders will send loan proposals. On the whole, BrightenLoans could be a good place for people who need money on an emergency basis.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ:

How much you can borrow?

The platform permits borrowers to get a loan up to $5000. This totally depends on how a lender evaluates your loan application and financial history.When will borrower receive the loan money?

The application process is fast. You need to provide all the necessary details. Once your application is accepted, you can expect to receive the funds on the next business day.Does people with bankruptcy or bad credit are eligible to get a loan?

Yes, individuals with a bad credit score are eligible to apply for the loan. If they cannot find a lender or lending partner that can offer you a personal loan for the amount you requested, it will search its network of short term lenders or lending partners to see if we can find a short-term lender or lending partner for you.How long does the loan application process take?

The loan application process is online – which takes not more than a few minutes. The platform will immediately start sending loan proposals. Once the loan application is approved, the lender will transfer the funds on the next business day.What is the cost of a short term consumer loan?

BrightenLoans is free for borrowers. However, lenders can charge various types of fee to borrowers.Can a borrower get two loans?

Yes, the platform permits borrowers to get more than one loan. However, this also depends on your state laws and your financial position. You are required to let the lender know about your previous loans.When and how the borrower repay the loan?

You are required to return loan amount in monthly installments. The lender will give you a complete schedule related to repayment during the loan application process. The lender can make a debit transaction every month from your account. There are few other ways of making installment payments such as wire transfer and ACH payment option.What happens if the borrower misses the payment?

The borrower is required to repay the loan according to the terms of the agreement. Each lender or lending partner has its own late payment policy and fees.How is borrower private information protected?

The platform use industry-recognized security and advanced encryption technology in order to protect personal information.Is an extension possible on repaying the loan, and how many extensions can the borrower get?

The rules on extensions depend on lenders and state laws. In some states, rollovers are acceptable while in other rollovers are not acceptable. You need to contact the lender if you are seeking to get a loan extension.US Payday Loan Reviews – A-Z Directory

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

Scroll Up