Over the weekend, Berkshire Hathaway, which’s led by the legendary Warren Buffett released its 2020 earnings and annual report that features Buffett’s annual letter. Here are the key takeaways.

More than the annual earnings, Berkshire Hathaway’s annual report is awaited for Buffett’s annual letter that over the years has offered valuable insights into his investment philosophy. While Buffett did share his pearls of wisdom this year also, the letter left the market asking for more.

Berkshire Hathaway’s earnings

Berkshire Hathaway generated an operating income of $5.02 billion in the fourth quarter as compared to $4.42 billion in the corresponding period in 2019. However, in the full year 2020, the conglomerate’s operating income fell 9% to $21.9 billion. The fall in the company’s earnings is not surprising and the S&P 500’s earnings also fell in 2020 even as the tech majors reported a rise in earnings.

Warren Buffett

While Buffett advises against using the GAAP (generally accepted accounting principles) earnings as they are distorted due to the inclusion of gains and losses on the stock portfolio, it is nonetheless worth a look. Berkshire Hathaway earned $42.5 billion in 2020 on a GAAP basis. This includes the operating income of $21.9 billion, $4.9 billion in realized capital gains, $26.7 billion in unrealized gains on the stock portfolio. These were somewhat offset by an $11 billion writedown.

Berkshire Hathaway wrote down Precision Castparts in 2020

Last year, Berkshire Hathaway wrote down the value of Precision Castparts, which produces components for aircraft, by almost $10 billion. In 2015, when the deal was announced, Buffett had called it expensive. He reiterated the same views in this year’s annual letter and called it a mistake.

“No one misled me in any way – I was simply too optimistic about PCC’s normalized profit potential. Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC’s most important source of customers,” said Buffett in his annual letter.

“PCC is far from my first error of that sort. But it’s a big one,” added Buffett. In the past, Buffett has admitted to overpaying in the Kraft-Heinz deal. He has also admitted that he missed out on companies like Amazon and Alphabet. While Berkshire has invested in Amazon, it is not Buffett but a different investment manager who took the position.

Ted Weschler and Todd Combs are the other two investment managers at Berkshire Hathaway but they manage a much smaller portfolio than Warren Buffett.

Buffett’s bet on Apple

Meanwhile, Buffett has somewhat made up for the “mistake” of not buying Amazon and Alphabet buy adding Apple shares to the portfolio. At the end of 2020, Berkshire Hathaway held a 5.4% stake in Apple. The company hasn’t added any Apple shares since the third quarter of 2018 and has been gradually selling shares.

As Buffett said during this year’s annual letter, Berkshire was holding a 5.4% stake in Apple in the third quarter of 2018 also. Despite the company booking an $11 billion profit by selling some Apple shares, it still holds the same stake which Buffett attributed to the buybacks made by Apple as well as Berkshire Hathaway.

Berkshire Hathaway scales up buybacks

In the past, Buffett has been frugal with the buybacks even as he talked about a hypothetical $100 billion buyback in 2019. Previously, the company had a quantitative buyback policy and brought back the shares when they were trading at less than 120% of the book value.

However, in 2018, the company changed its buyback policy to a qualitative one that gave Buffett and vice chairman Charlie Munger more leeway in making buybacks. The new policy came amid Berkshire’s soaring cash pile that was almost $150 billion at the peak.

Meanwhile, despite the new policy, Buffett and Munger were conservative with the buybacks. Things changed last year, and the company scaled up buybacks amid the apparent lack of investment opportunities. In the fourth quarter of 2020, Berkshire Hathaway repurchased $9 billion worth of its shares which was similar to the third quarter.

Berkshire Hathaway’s cash pile

In 2020, the company repurchased $24.7 billion of its shares which is a record for the company. To put that in perspective, it has repurchased only about $5 billion worth of its shares in 2019. However, despite the buybacks and the scaled-up stock purchases, Berkshire was holding $138 billion in cash at the end of 2020.

In his annual letter, Buffett, who has been critical of buybacks in the past, tried to justify the massive buybacks from Berkshire. “In no way do we think that Berkshire shares should be repurchased at simply any price,” said Buffett. He added, “I emphasize that point because American CEOs have an embarrassing record of devoting more company funds to repurchases when prices have risen than when they have tanked. Our approach is exactly the reverse.”

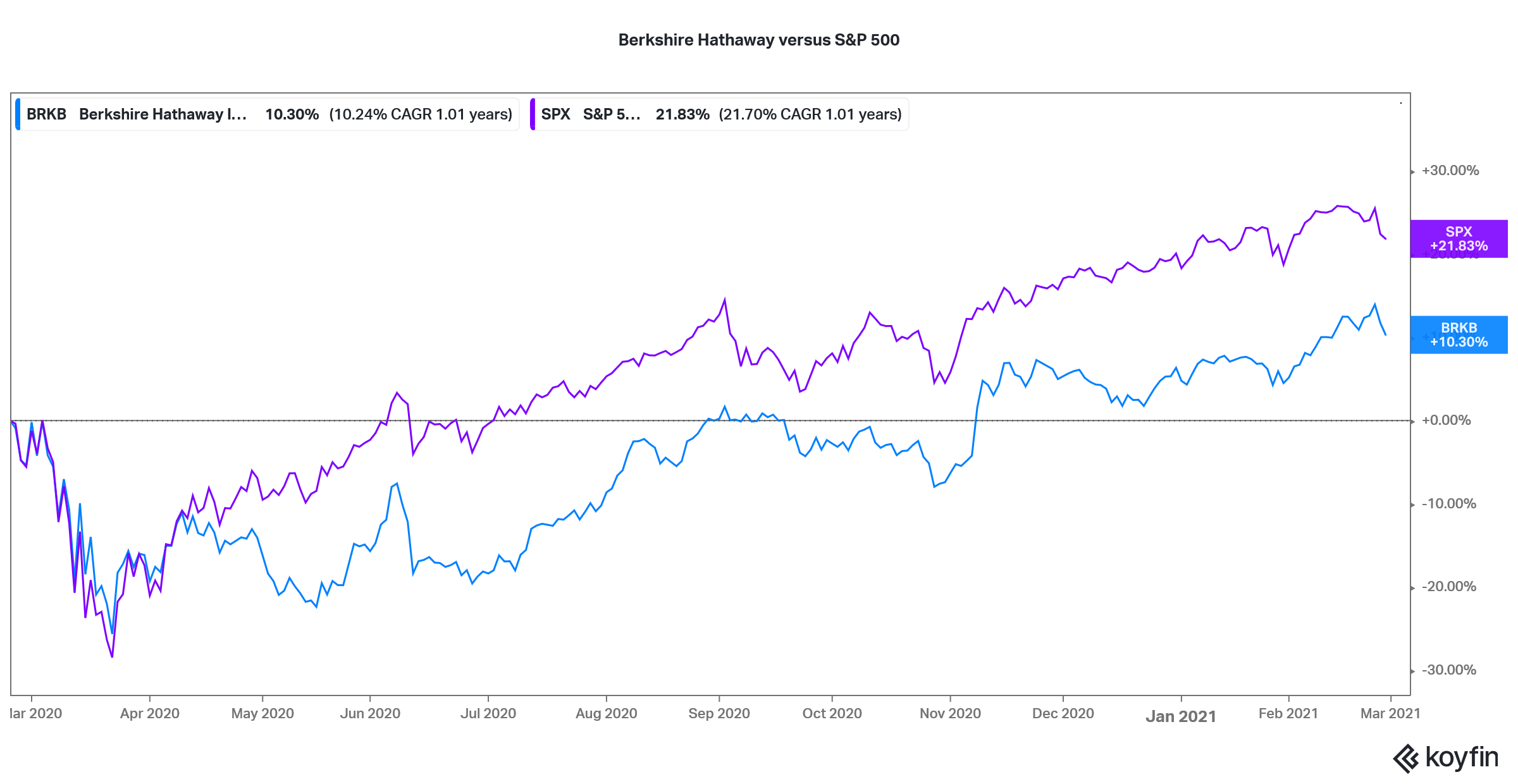

Berkshire Hathaway versus S&P 500

Over the last two years, Berkshire Hathaway stock has underperformed the S&P 500 by a big margin. It underperformed the index by 20.1% in 2019 and 16% in 2020. The returns for S&P 500 also include dividends. Berkshire does not pay a dividend even as the company collects billions of dollars in dividends every year.

Like in the past, Buffett spoke against investing in debt especially considering the negative interest rate scenario in countries like Japan and Germany. In the past, the Oracle of Omaha, as Buffett is known, has also advised against investing in gold. However, in 2020, the company took a small stake in gold mining company Barrick Gold that it eventually exited by the year-end.

What was missing in Buffett’s letter?

In his 2018 annual letter, Buffett sounded critical of President Trump and his trade war with China. In the past, he has addressed several issues including wealth inequality. However, his annual letter this year failed to impress observers.

Cathy Seifert, an analyst at CFRA Research called Buffett’s this year’s annual letter as “tone deaf” and “disappointing.” She said, “Here you have a company with such a revered leader who’s held in such high regard — whose opinion matters, who has businesses that were directly impacted by the pandemic, insurance companies that were influenced by global warming and social inflation — and there was not one word about the pandemic.”

Buffett’s annual letter also did not talk about his sale of all airline companies which Berkshire sold at a massive loss. He also did not touch upon last year’s presidential election as well as the Capitol Hill violence.

Market volatility

Buffett also did not talk about the market volatility including the rise from March 2020 lows. He did not comment on the wave of SPACs (special purpose acquisition companies) and the recent volatility and short squeeze in stocks like GameStop and AMC Theatres.

“There’s more found by what’s not in the letter,” said Cole Smead the firm’s president and portfolio manager at Smead Capital Management. He added, “I think just time and time again in this letter were sins of omission.” His company is among the investors of Berkshire Hathaway.

Incidentally, last week, Munger had touched upon the issue of short squeezes. “I think you should try and make your money in this world by selling other people things that are good for them, and if you’re selling them gambling services where you rake profits off the top like many of these new brokers who specialize in luring the gamblers in, I think it’s a dirty way to make money, and I think we’re crazy to allow it,” said Munger.

Should you buy Berkshire Hathaway stock

To sum it up, this year, Buffett seems to have played it safe and refrained from making any comments that could be criticized as political. But then, that’s what not we’re used to seeing from the legendary value investor.

Meanwhile, Warren Buffett’s massive repurchase of Berkshire Hathaway signals his faith in the company’s valuation. After the underperformance in 2019 and 2020, Berkshire Hathaway stock is outperforming the S&P 500 in 2021 and the trend might continue in the medium term.

You can buy Berkshire stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account