Gene Munster, the co-founder of Loup Ventures, expects Tesla’s market capitalization to cross above $2 trillion over the next three years. So far, Apple is the only company that crossed the $2 trillion in market capitalization. Can Tesla achieve the feat?

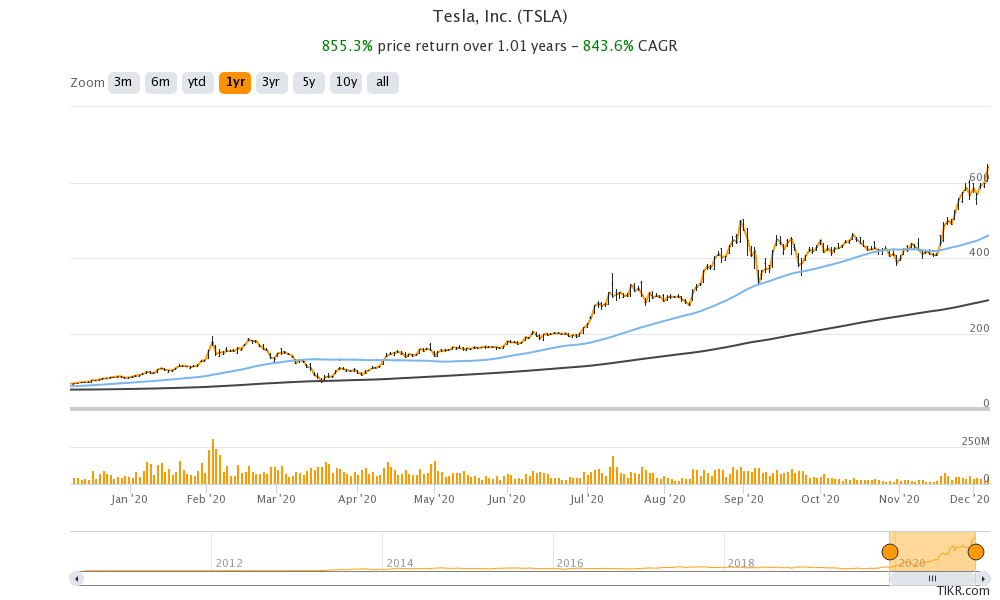

Tesla stock has been on a fire this year and has made over 30 record highs. It has gained 667% so far in 2020 and its market capitalization swelled above $600 billion yesterday for the first time ever. The rise in Tesla or for that matter other electric vehicle stocks has baffled many analysts.

Tesla stock’s rally

A large section of analysts doesn’t seem to digest Tesla’s soaring market capitalization. It’s the world’s most valuable automaker now. No other automaker in history has dad the market capitalization that it is enjoying. It has not only left the largest automakers like Toyota Motors and Volkswagen behind in terms of market capitalization, but its market cap is now above the combined market capitalizations of the top five automakers put together.

That said, Tesla is not exactly comparable to legacy automakers that mainly sell ICE (internal combustion cars). It is a pure-play electric vehicle maker. Its autonomous driving technology and energy operations are the other two value drivers. Last year, it also ventured into the insurance business even as the legendary value investor and Berkshire Hathaway’s chairman Warren Buffett doubted that the company would succeed in the insurance venture.

What would add value to Tesla in coming years

Currently, most of Tesla’s revenues come from the sales of electric vehicles. However, in the future other business segments could also start contributing handsomely to its earnings. For instance, Tesla’s CEO Elon Musk expects its Energy operations to eventually become as large as the automotive operations. Musk also expects the price of its FSD (full self-driving) option to rise to $100,000 in due course.

Gene Munster sees Tesla as evolving

Gene Muster expects Tesla stock to rise to $2,500 over the next three years. Based on the total number of shares outstanding that would mean its market capitalization surging above $2 trillion. The rise in Tesla’s stock price has already catapulted Elon Musk as the world’s second richest person dethroning Microsoft’s founder Bill Gates. If Tesla can rise to $2,500, Musk could become the world’s richest person bypassing Amazon’s CEO Jeff Bezos with whom he does not share the best of the chemistry.

Meanwhile, Muster sees Tesla on an evolutionary course and is betting on its insurance business. “Elon has recently said that 30% to 40% of the value of the car could be in insurance,” said Munster. He added, “What that means is that they can start offering their own insurance and improve margins. That’s high-margin revenue.” He however does not expect that Tesla would acquire another automotive company.

The biggest risk for Tesla

Muster sees a possible foray from Apple into electric vehicles as the biggest risk for Tesla. Apple is rumored to be building its electric vehicle capabilities through an internal project codenamed “Titan.” If Apple bets big on electric vehicles, it can be a tough competitor to incumbents. Apple has the financial strength and technical expertise to become a major competitor in the electric vehicle industry

Can Tesla stock continue to rally?

Betting against Tesla stock has cost short sellers billions of dollars this year. Long time Tesla bear Jim Chanos recently admitted that his short position on the stock has been “painful” over the last year and said that he has trimmed his short holdings. It is worth noting that short-sellers bet that the stock would fall. They however stand to lose when the stock rises as has been the case with Tesla.

Interestingly, while Chanos has cut his short positions on Tesla, Michael Burry, who rose to fame with his bet against the CDO (collateralized debt obligations) during 2008, has revealed that he is short on Tesla stock. Burry even mocked Musk to sell more shares of the company at these prices. Notably, Tesla has raised capital twice this year by selling cash. The cash would provide the company with the war chest to invest in its new factories in Berlin and Texas and possibly look at constructing more Gigafactories to meet the rising demand.

S&P 500 inclusion

On December 21, Tesla would join the S&P 500 in a single tranche. It is currently the sixth largest S&P 500 stock based on its market capitalization. After the formal inclusion into the S&P 500, index funds would have to invest billions of dollars of its stocks to mimic the index. This would add further impetus to the stock price that has been riding the deadly mix of liquidity and investor optimism.

In the near term there looks no trigger that could trigger a crash in Tesla stock. Short sellers are too bruised to take a new bet against the company From a fundamental perspective, a Joe Biden presidency would mean further impetus towards renewable energy and electric vehicles that would be positive for electric vehicle companies.

Green energy stocks could benefit from Biden’s presidency

Green energy stocks across the ecosystem have soared after Joe Biden was elected as the 46th US president. The rally could continue in the near term given the lack of negative catalysts. That, however, does not mean that Tesla is not overvalued at these prices. But then, valuations haven’t been a concern for investors this year who see Tesla as the future of everything from cars to autonomous driving and Robotaxi.

You can buy Tesla stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account