The International Energy Agency (IEA) said it expects to see a historic drop in global oil demand this year due to the coronavirus pandemic, but forecasts a swift recovery on 2021, citing three factors that will boost demand for crude.

In its closely-watched oil market report released on Tuesday, the agency headed by Fatih Birol (pictured) said it expects oil demand to plunge by around 8.1 million barrels per day for the rest of 2020, the largest fall in history, as global oil demand has been hit by lockdown measures and business shutdowns around the world.

This forecast is slightly better than the one provided a month ago, as the IEA raised its 2020 forecast by 500,ooo barrels per day, up from an 8.6 million barrels per day slump it expected in May.

Meanwhile, the Paris-based industry body also forecasts a swift comeback for oil in 2021, when it expects a surge in the demand for crude of around 5.7 million barrels per day, citing a higher intake from China, a high percentage of compliance of recent Opec+ cuts, and large voluntary production cuts from non-Opec G-20 countries, such as the US and Canada.

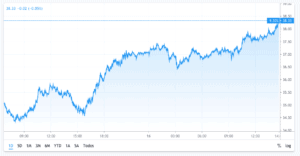

Oil prices have approached the $40 mark in June but have failed to sustain their gains over the past few days, as fears of a potential second wave of the coronavirus in the US and China have resurfaced.

Oil futures are now trading at $38 per barrel, up 2.4% from the previous session during early futures trading activity.

One of the elements holding back the price of crude is a weak outlook from the aviation industry, one of biggest users of oil, as the outbreak has forced airlines to cut flights and operations around the world to the bone, with no signs of a recovery yet on the horizon.

The IEA said that the oil market may be approaching the “close to the half time mark”, emphasizing that a continuation of these recent trends could provide a stable foothold for an increased pace in the industry’s recovery from what has been an unprecedented blow.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account