Home improvement retailer Home Depot will report its earnings next Tuesday and shoppers who sought to improve their homes during lockdown are expected to have lifted the firm’s revenues.

Sales for the second quarter are expected to come in at $33.31bn, up 8% from the $30.84bn the company reported a year ago, while earnings are expected to end the three-month period at $3.38 per share, up 6.6% from an EPS of $3.17 the company reported during the same period in 2019.

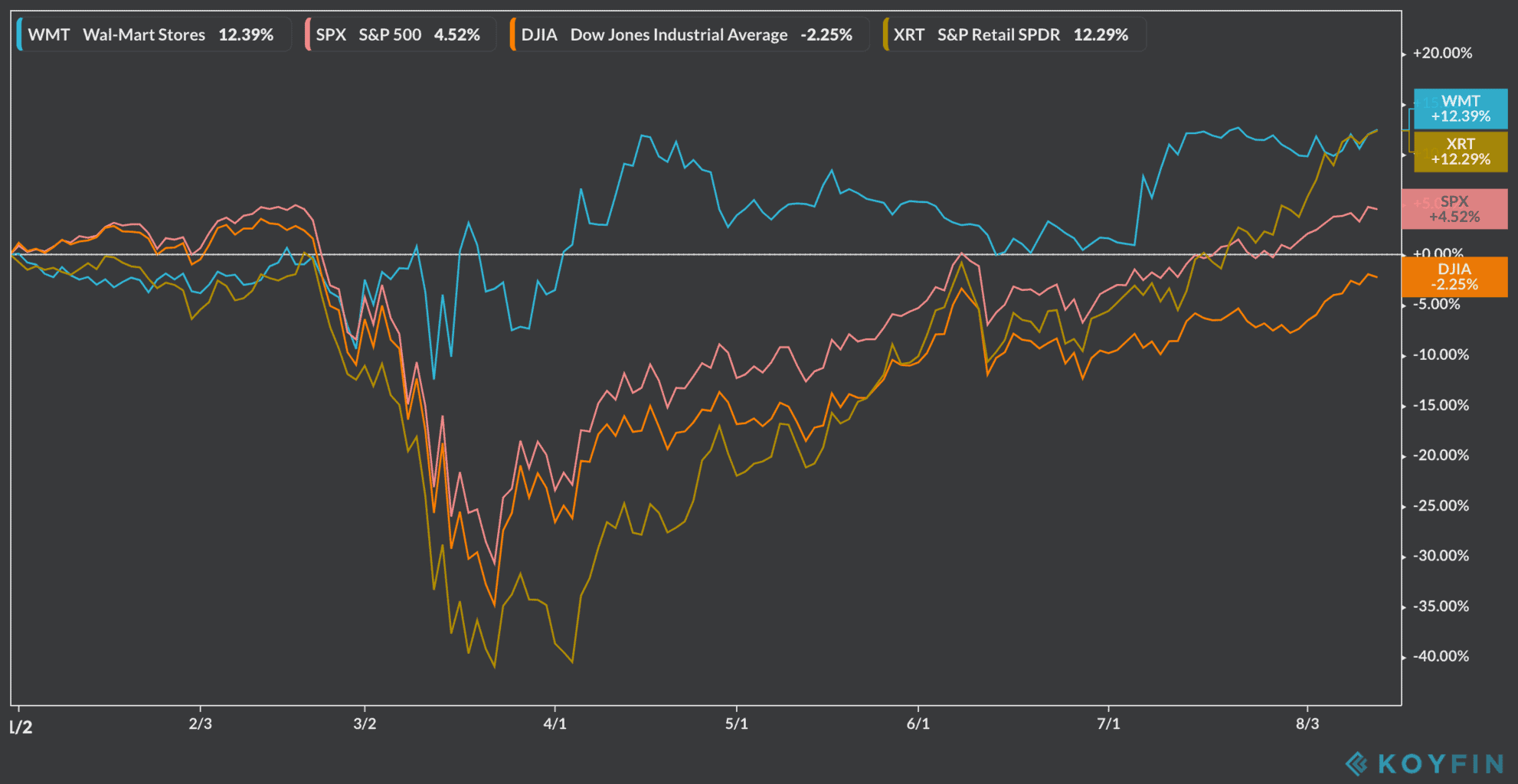

Home Depot shares have seen interesting gains since the pandemic struck the US, with shares of the home improvement giant soaring 30% – trading at $281.66 as of yesterday – higher than the 4.5% return the S&P 500 index delivered during that same period.

Also read: Home Depot Vs Lowe’s: Which firm will dominate lockdown home improvements?

Analysts estimates for Home Depot’s second-quarter earnings report

This Atlanta-based big-box retailer has benefitted from increased demand resulting from lockdowns, as customers took advantage of time on their hands to renovate their properties.

A persistent virus outbreak in the US provides a longer-than-expected tailwind for Home Depot, especially in the states where the virus has resurfaced strongly such as Texas and Florida.

Gardening products and do-it-yourself home improvement kits, have seen higher sales volumes during the pandemic, while the company has successfully adapted to social distancing restrictions, implementing curbside pickups and other delivery alternatives.

In the last four quarters, Home Depot has managed to beat Zacks.com earnings’ estimates by 0.8% on average.

What next for Home Depot stock?

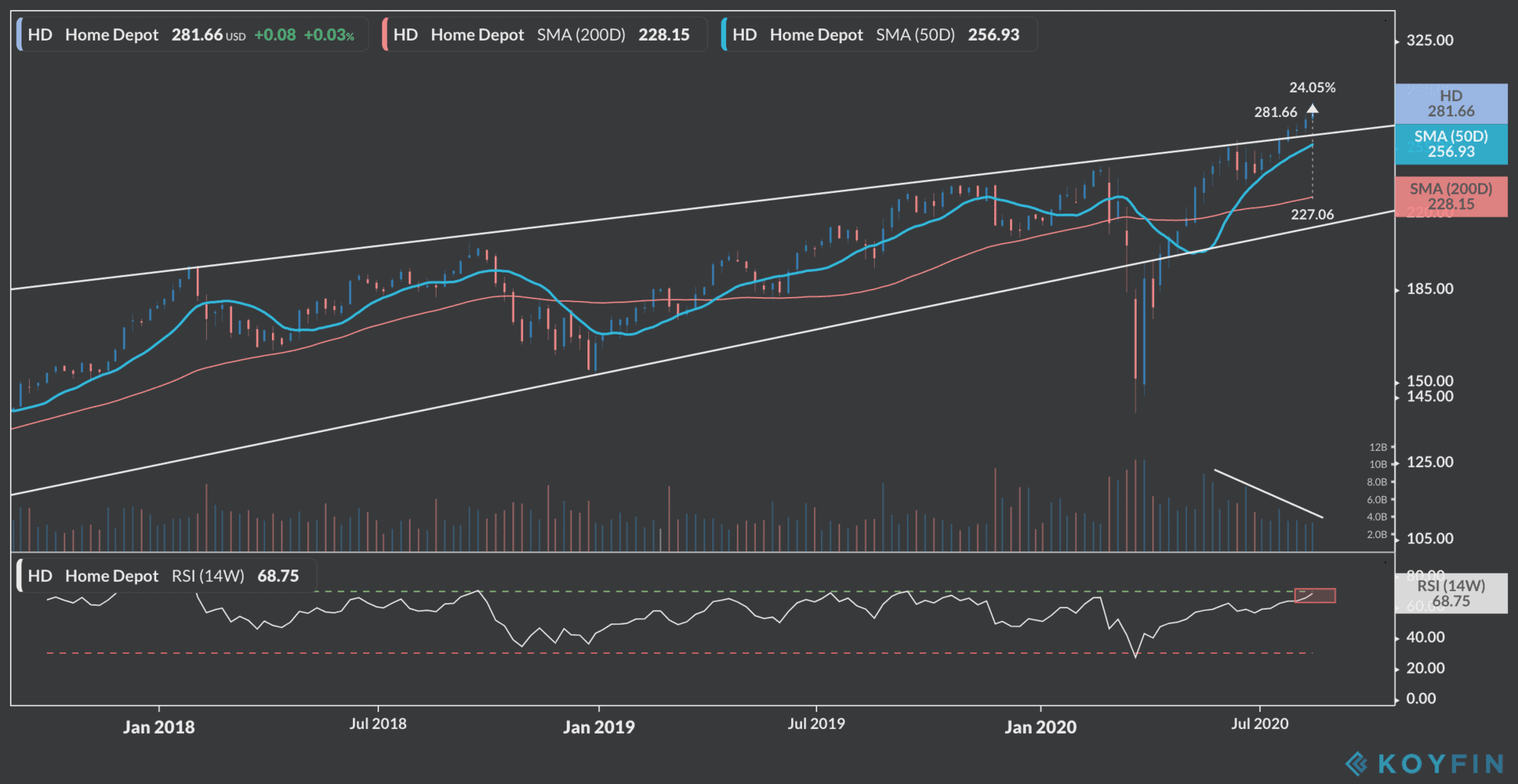

Home Depot shares have broadly risen since 2013, with the stock trading above its 200-day moving average for the most part of these last seven years, which points to the strength and resilience of its business model and financial performance.

In the last few months, the stock rose rapidly after quickly rebounding from their March lows, although they are now trading above this long-dated upper trend line (above), while also stretching 24% above their 200-day moving average.

This overextension is a factor to keep in mind, as it is the first time the stock trades at such a far-from-the-mean level since 2018 and these stretches have often been followed by sharp reversions to the mean once the momentum fades.

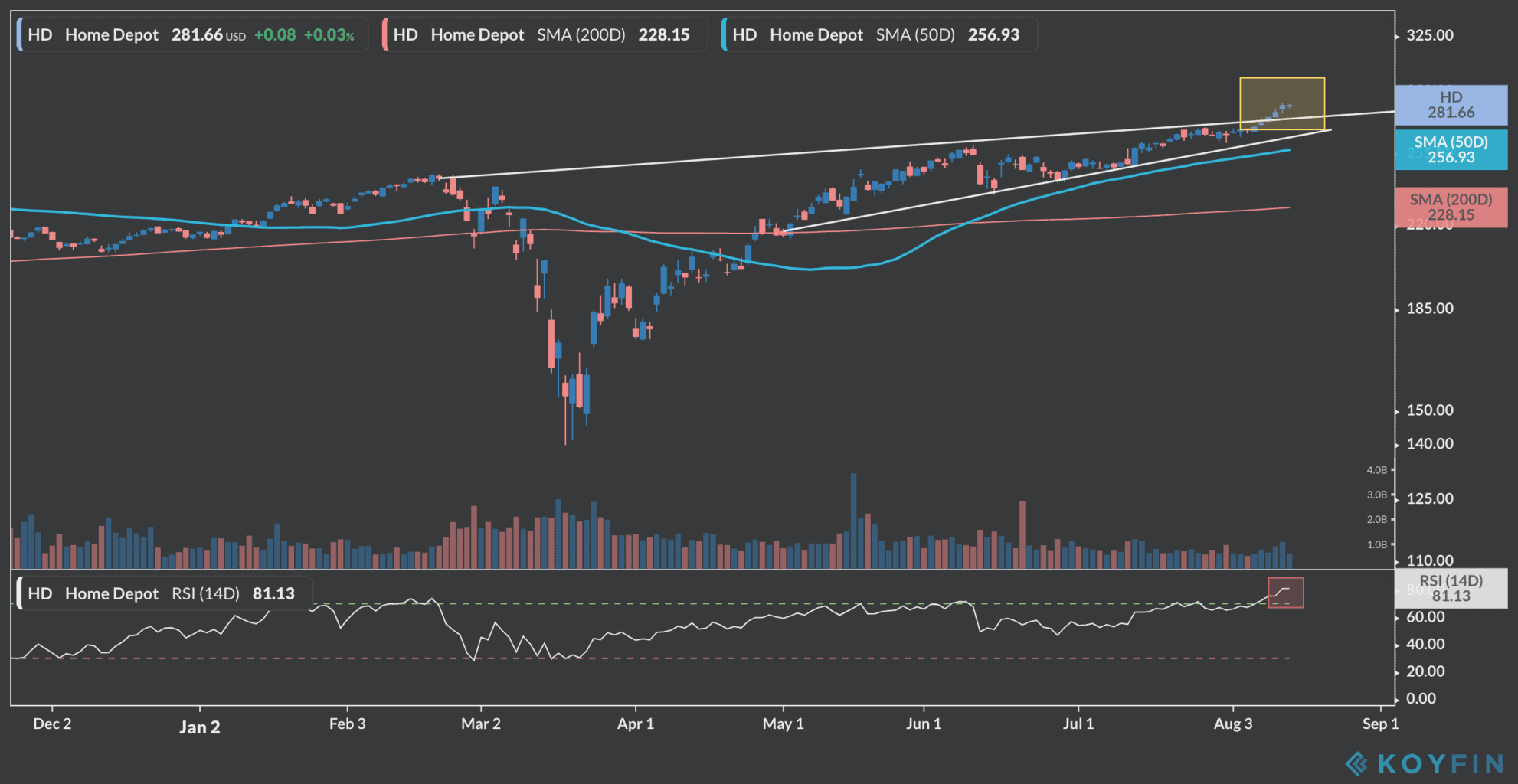

Meanwhile, the one-day relative strength index is signaling overbought at the moment and the price action since May has been compressing within a tighter range, forming a potential rising wedge, although the stock price has recently broken through it – at least temporarily.

Traders should be especially cautious ahead of this earnings report, as a disappointing outcome for Home Depot (HD) could trigger a sharp correction, possibly sending the stock down to its short-term moving averages.

That said, it is unlikely that the stock will see a downward momentum beyond those levels, as this home improvement retailer continues to be one of investors’ favorite coronavirus stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account