Gold prices are taking a strong hit this morning in early commodity trading activity as investors remain in risk-on mode amid positive news on the vaccine front including the potential approval of Pfizer’s vaccine in the United Kingdom in a matter of days.

Today’s downtick comes after last week’s meltdown, with the price of the yellow metal plunging 1.3% on Friday at $1,786 per ounce while it is down 0.9% today at $1,711, slipping below a key support line and shattering virtually all of its short-term thresholds as bears seem to be taking over the price action.

Meanwhile, the effect of a weaker dollar today is going unnoticed by gold traders, which highlights the overly bearish stand that the market is taking towards the precious metal, as the value of the North American currency – as reflected by Bloomberg’s US Dollar Index (DXY) is dropping 0.25% at 91.557.

News on the vaccine front could be contributing to this morning’s slide, as the United Kingdom is reportedly moving to approve Pfizer’s vaccine in a matter of days, which would make the country the first Western nation to approve a vaccine for the COVID-19 virus.

According to sources cited by the Financial Times, the United Kingdom could start giving its citizens the first dose as early as 7 December, while the second shot would be administered 30 days after in line with the treatment’s recommended dosage.

Meanwhile, from a long-term perspective, the fundamentals supporting higher gold prices over the next few years have weakened, as although the Federal Reserve’s monetary policy remains highly accommodative, the US Congress is now less prompted to pass any further large economic stimulus since the vaccine could help the economy in rebounding swiftly during the first two quarters of 2021.

What’s next for gold?

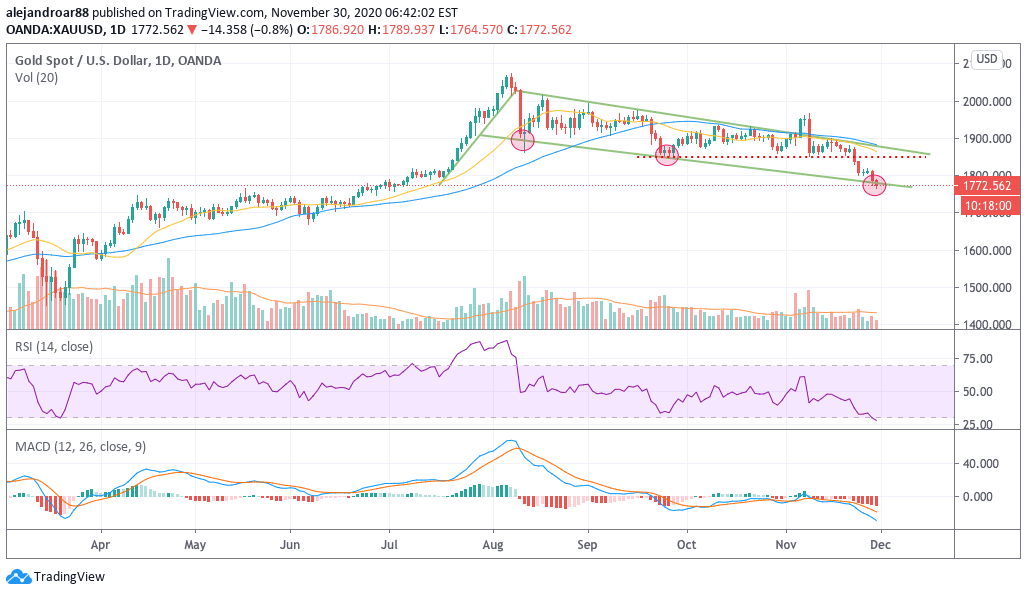

The spot price of gold is trading below a key support today although bulls managed to keep the precious metal above that threshold during Friday’s session.

The chart above shows how this lower trend line has served as support for the precious metal multiple times in the past four months, which means that bears appear to be taking over as bulls capitulate.

The combination of a break below the $1,850 support – highlighted in the chart – along with today’s downtick could result in a severe short-term plunge for gold with the high 1,600s now in sight as a plausible target for short-sellers.

News on the approval of Pfizer’s vaccine in the United States could further accelerate this downtrend in the following days, although traders should keep an eye on how market volatility behaves since the market is currently submerged in a phase of extreme greed, a situation that could lead to a short-term pullback that would give gold a temporary breather.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account