The price of gold has kept dropping recently after investors withdrew approximately $2.7 billion from the largest exchange-traded funds (ETF) offering exposure to the precious metal while 10-year US Treasury yields remain near the 1.5% threshold ahead of Jerome Powell’s speech.

According to data from ETF Database, the two largest ETFs tracking the price of gold – the iShares Gold Trust (IAU) and the SPDR Gold Trust (GLD) – bled $380 million and $2.32 billion respectively from 22 February to 2 March, as investors seem to be rushing to get their money off the precious metal now that the bond market is offering much more interesting yields.

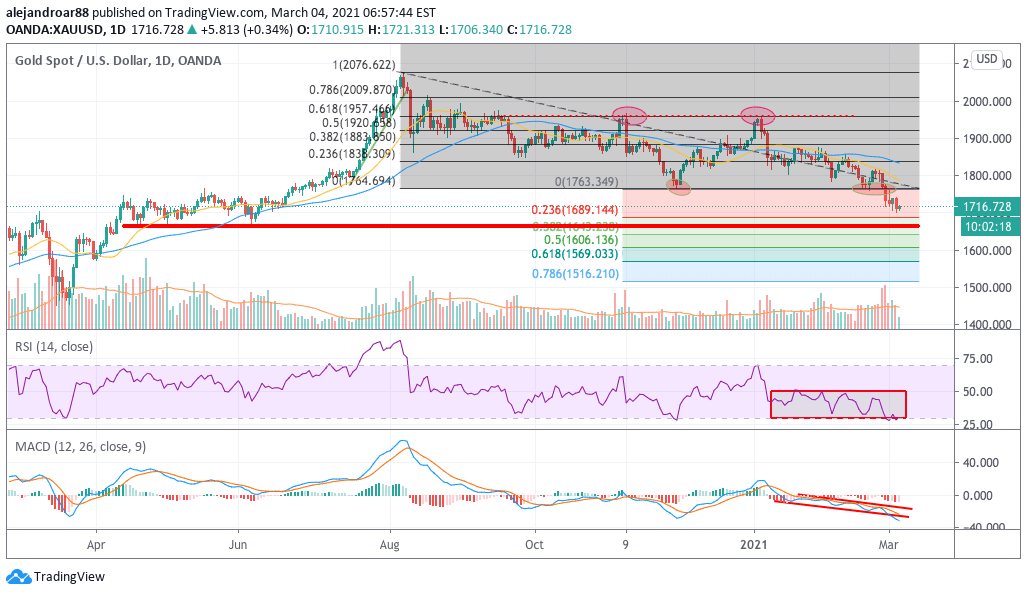

As a result, gold prices have effectively broken below an important support area highlighted in a recent article, while they have kept moving downwards – now approaching a psychological threshold at $1,700 per ounce.

Up until today, the price of the yellow metal has declined in six out of the past eight sessions, although it is taking a breather this morning as it is advancing 0.26% at $1,715 per ounce in early commodity trading action.

“Rising 10-year yields, along with the U.S. dollar moving higher, and we had a resurgence in risk appetite. All that was a very bad recipe for gold” commented Bart Melek, head of commodity strategies for TD Securities.

Market participants are eagerly expecting today’s speech from the head of the US Federal Reserve, Jerome Powell, who is scheduled to address the public during a virtual Wall Street Journal Jobs Summit at 12:05 pm EST.

Chairman Powell is expected to make important announcements in regards to the supplementary leverage ratio (SLR), an indicator that determines the percentage of deposits that banks have to maintain with the Fed, as financial institutions were given a break until 31 March to reduce the percentage held with the institution during the pandemic as an additional measure to further boost the liquidity of the financial system during the chaotic months that followed the health crisis.

If the Fed does not extend such relief, banks might be forced to liquidate a portion of their Treasury holdings – along with other positions – which could result in a spike in market volatility while possibly causing another uptick in Treasury yields as the sell-off would accelerate (bond prices move inversely to yields).

Finally, the case for a potential reversal in gold’s current downtrend is weak amid the advance of vaccinations in most developed countries, which diminishes the demand for safe-haven assets as the world remains on track to head out of the COVID crisis.

What’s next for gold?

Gold’s negative momentum has accelerated in the past few days, with the MACD heading to its lowest level since the pandemic started while dipping below an already pronounced downtrend while the RSI is also posting its lowest reading in roughly 12 months.

The strength of this downtrend is signaling that the market’s sentiment for gold has shifted as the backdrop is net negative – meaning that there are more negative catalysts than positive ones at the moment.

That said, gold prices could be heading to a strong short-term rebound, as technical indicators show that the downtrend has gone too far for now.

If a bounce were to take place, gold’s former support of $1,763 could now become resistance, while a resumption of the dip could result in a drop to the $1,650 area of support highlighted in the chart.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account