Gold prices are rising 1.2% at $1,916 per ounce during today’s early commodity trading activity as investors keep piling on the yellow metal ahead of the US election amid expectations of increased market volatility.

The price of the precious metal has been trading range-bound since rebounding off the $1,860 lows of late September, as investors have once again turned bullish on the stock market following the tech sell-off seen during that same period.

However, gold prices seem to be trending higher again as the November US presidential election approaches, with market participants expecting a spike in volatility during those days, which increases the appeal of gold as safe haven if equities were to falter.

Today’s move in gold is partially explained by a depreciation of the greenback, as the US dollar index (DXY) is losing 0.3% during the European forex trading session at 93.30, its third consecutive day of losses while gold is making its third consecutive day of gains.

Analysts keep favoring gold amid a favorable backdrop

Commodity traders and analysts keep favoring gold as a hedge at a time when volatility is the name of the game.

Only a few days ago, Swiss bank UBS stated that they expected gold to hit the $2,000 mark by the end of the year as the current economic backdrop continues to favor a rise in the price of the precious metal given the uncertainty related to both the US election and the pandemic.

Meanwhile, inflation fears triggered by massive liquidity injections made by central banks around the world keep making a case for buying gold as investors will attempt to protect their wealth from losing its buying power if developed countries start to see a spike in inflation rates once the pandemic is over.

Is XAUUSD presenting a buying opportunity at these levels?

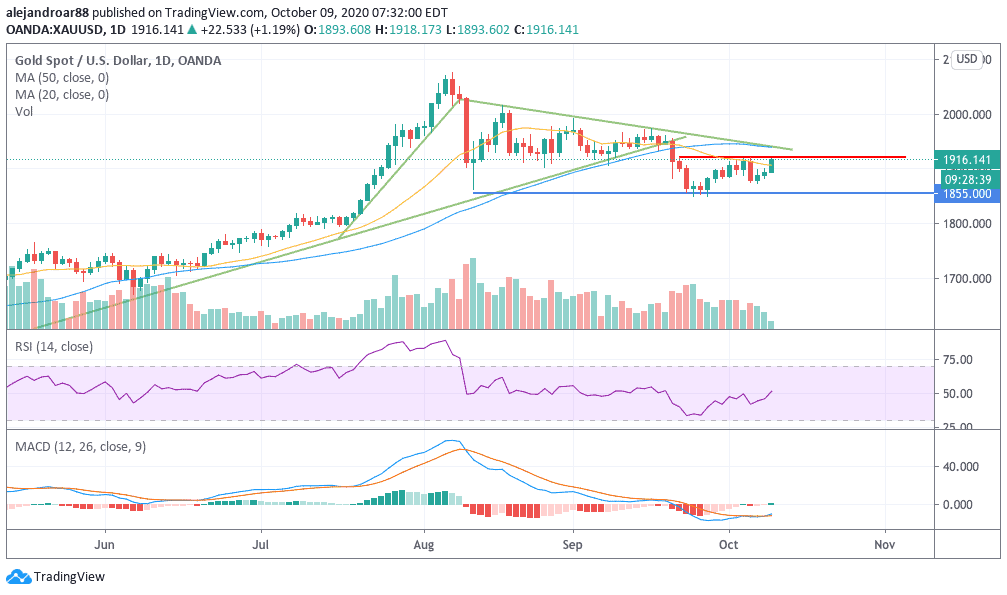

The price of gold has been trading range-bound for a few days but today it is retesting its intraday highs of $1,920 per ounce, a level that has served as resistance three times now.

A move above that level could mean that bulls are taking over the price action and, in consequence, a bigger push could be expected right after.

Overcoming both the $1,920 resistance and the upper trend line of the descending triangle shown in the chart would be, in my view, the most interesting move from a trading perspective, as that could lead to a bull run towards the $1,975 and then to the $2,000 if enough momentum builds up.

Given the positive backdrop that keeps supporting gold prices at the moment, both from a short-term and long-term perspective gold keeps being an attractive asset to own these days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account