Gold-backed exchange-traded funds have taken a record-breaking amount of cash so far this year, as investors flock to gold during and after the coronavirus pandemic.

Nearly $33.7bn flowed into these ETFs investment vehicles that hold physical gold or gold futures, since the beginning of 2020, amounting to around 623 metric tons of the precious metal, up from a previous record of 591 metric tons recorded at the height of the financial crisis in 2009, according to data from the World Gold Council (WGC).

Meanwhile, gold ETFs holdings grew by 4.3% in May alone, pushing the volume to 3,510 metric tons held by these investment vehicles to date. Net capital inflows going to gold ETFs also spiked by a record high $195bn during the year.

Cash going into gold-backed ETFs have occurred before, during, and after the pandemic, as investors initially saw gold as a safe haven for the economic woes caused by the outbreak, but have been drawn to the precious metal even after the health emergency seems to be under control, potentially due to long-term economic uncertainties.

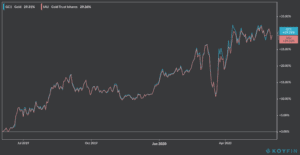

Gold prices have had a choppy week after posting a small 0.3% gain on Monday followed by two consecutive days of losses that sent the price below the 1,700 level, as investors moved on to riskier assets amid hopes of a swift economic recovery and an ongoing stock market rally.

Gold futures are up 1% in Friday’s early morning commodity trading activity, leveling at $1,712 amid a positive unemployment report from the US Bureau of labour, which revealed a joblessness rate of 13.3%, down from an expected rate of 19.5%.

Adam Perlaky, manager of investment research at the WGC, said: “Gold ETFs saw inflows on all but two trading days over the past two months, underscoring that investors are embracing gold in both risk-on and risk-off environments”.

He added: “As investors seek efficient and effective strategies to hedge ballooning budget deficits and high valuations for both stocks and bonds, collective holdings of gold ETFs exceed the official gold reserves of every country except for the U.S”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account