Gold prices are muted this morning after rallying four days out of the last five, with the yellow metal bouncing off a key support as market players weigh if the risk-on trade may have gone too far too fast.

The price of gold is hovering above the $1,860 per ounce level during today’s early commodity trading activity, virtually unchanged after yesterday’s strong 1.3% uptick, as the yellow metal seems to be regaining its shine despite some modest gains seen by the US dollar.

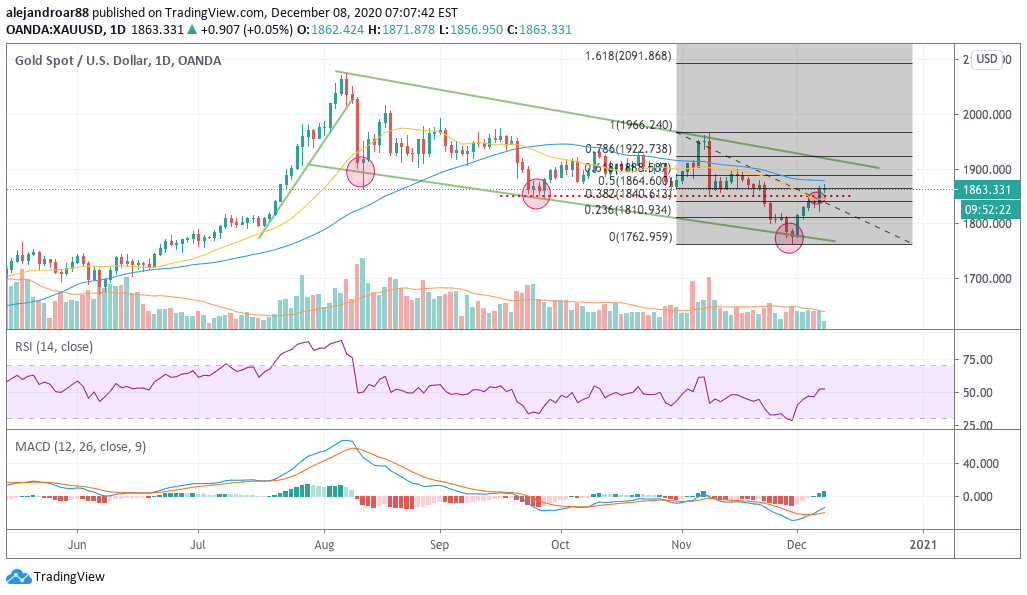

Gold prices have managed to reverse the course after dropping sharply in the past few weeks, as vaccine news prompted a broad risk-on move in the financial markets that pressured the yellow metal to lose 9% since 9 November, until the price bounced swiftly off a lower trend line that has now served as support three times in the past four months.

A possibly overheated rally in equities may be one of the catalysts driving gold prices higher recently, as reflected by the fact that the S&P 500 just hit its year-end target of 3,700 forecasted by Goldman Sachs, which would leave little upside for institutional traders while downside risks increase.

A survey from CNBC indicates that Goldman Sachs’ target is the highest among multiple Wall Street institutions, followed by JP Morgan Chase and BMO, which anticipated a year-end close at 3,600 and 3,650 respectively for the broad-market stock index.

With equities hovering near or above these levels, traders could be expecting a sharp pullback in the following days as investors take profits from the latest vaccine bull run – a view that is reinforced by gold’s latest uptick.

Meanwhile, the prospect of an upcoming stimulus bill from US Congress is threatening to put more pressure on the dollar, which would provide some extra fuel to gold prices on short notice.

Is gold staging a strong comeback?

Gold prices found support at the lower trend line of what still seems like a bull flag – a continuation pattern that could lead to another push towards the $2,000 level if the price action manages to move above $1,900 over the next few weeks.

Bears have been in control since gold’s August meltdown, as the price has failed to make a new high since those days, although this latest bounce is again giving gold bulls some hope that the precious metal might be staging a comeback.

For now, the bounce has only reinforced this particular trend line as a key support, while gold prices also managed to climb above a previously broken support found at the $1,850 level – a bullish signal that indicates a short-term reversal of the latest downtrend.

Meanwhile, the price action has stopped today at the 50% Fibonacci retracement level shown in the chart during the European session, with the US session possibly deciding the faith of gold prices today.

A move above this level could end up triggering a bull run as we would be entering the higher bracket of the Fibonacci setup. Meanwhile, the MACD has already sent a buy signal although it remains deep into negative territory, while the RSI has moved slightly above the 50 mark – reflecting the positive momentum that gold is seeing in the past few days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account