Gold is rebounding today during the European commodity trading session, moving slightly above the $1,900 per ounce level following yesterday’s plunge as the International Monetary Fund (IMF) warned that financial markets could face “sharp adjustments” if the pace of the global economic recovery stalls.

Gold prices went down 1.64% yesterday as a result of a stronger US dollar, although some profit-taking may have also played a role in the move, as traders remain cautious about pushing gold above a bull flag pattern that has been forming since the August lows.

Yesterday’s comments from the International Monetary Fund (IMF) seem to be helping the price of gold in finding support, as the institution issued a warning on the disconnect between asset prices in the financial markets and the real economy and cautioned investors about potential “bouts of volatility” that could lead to sharp adjustments in equity prices.

Meanwhile, investors remain expectant about how the US Presidential election will unfold in the following weeks, with current levels of volatility still well-above those seen before the pandemic as the US economy struggles to emerge from the coronavirus crisis.

Gold buyers are also keeping an eye on how stimulus talks continue to advance within the US administration, as Congress has failed to compromise multiple times, although the markets still expect to see the approval of a bill before the day of the election.

What’s next for gold?

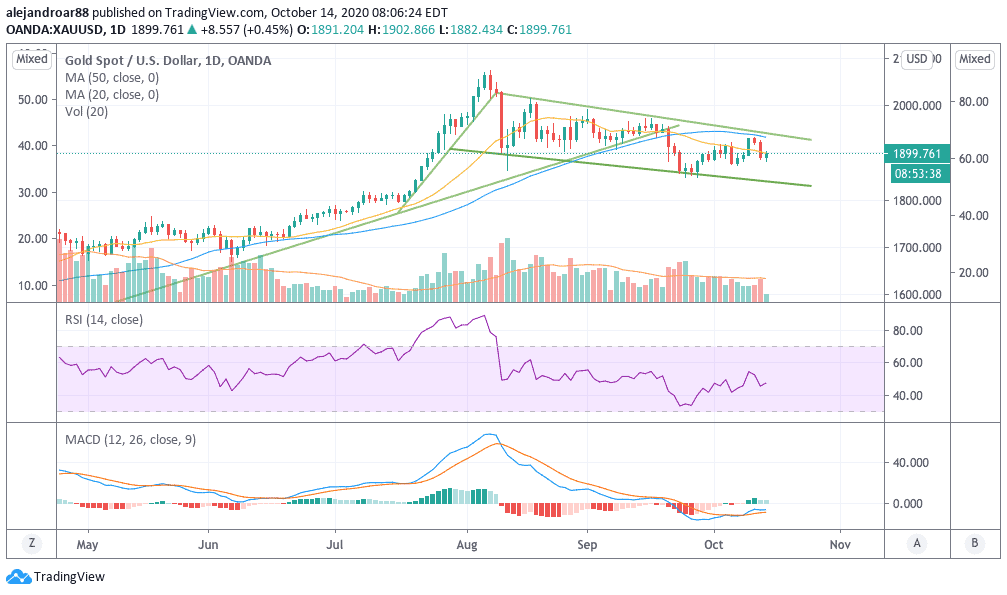

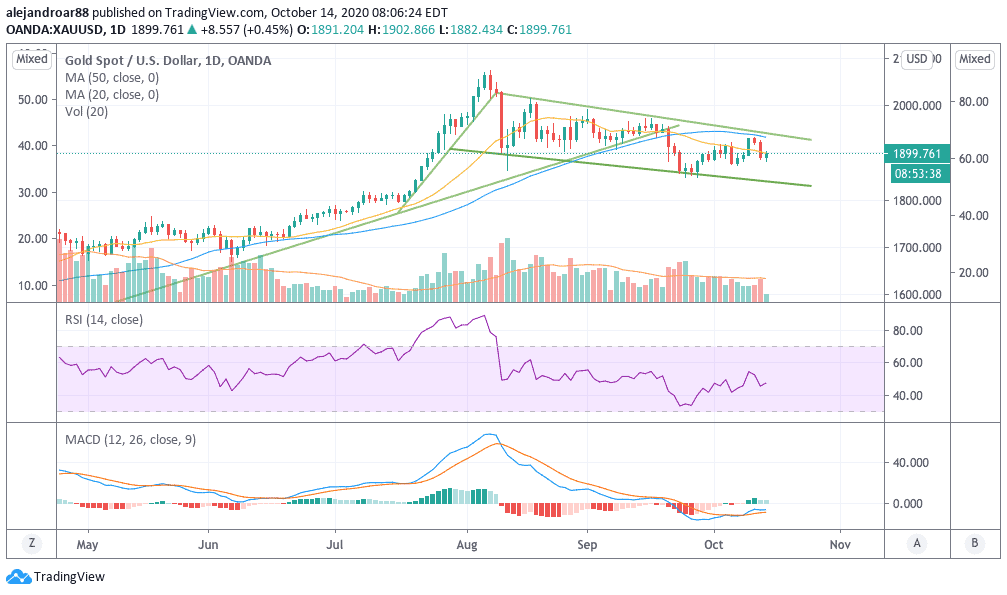

Gold prices failed to maintain the higher levels seen the day before yesterday when the price action managed to climb above the yellow metal’s intraday high of $1,920 although the price remains on top of the lower trend line shown in the hourly chart above.

Today’s uptick is partially explained by a technical rebound off oversold territory in the hourly RSI, which is not necessarily an indication that the price is resuming its upward trend or that positive momentum has come back.

That said, the price of the precious metal continues to trade within a bull flag pattern that has formed since the August sell-off. This pattern is typically bullish as it indicates the continuation of a previous trend – in this case, the uptrend seen in July.

The price action has consistently failed to break the upper trend line of that formation but given gold’s current positive backdrop it appears to be just a matter of time before we see that move taking place. Therefore, patience is the name of the game at this point for gold buyers.

At the moment, the MACD is sending a buy signal although the indicator remains in negative territory, which indicates that although some positive momentum exists, it is still not that strong.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account