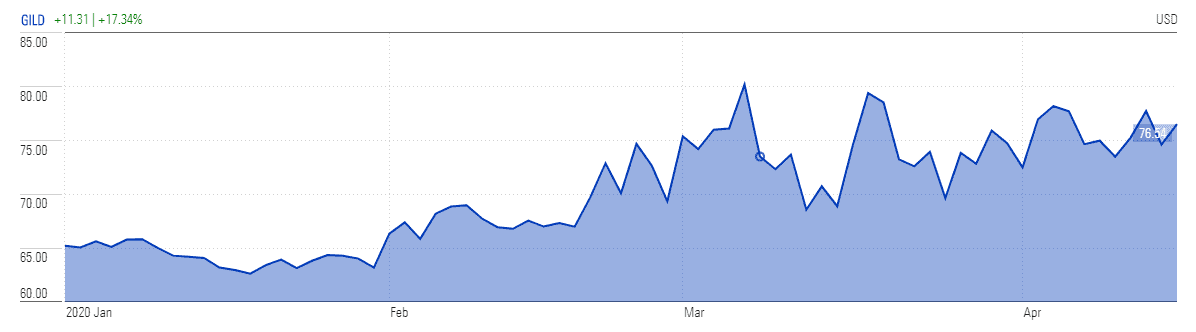

Gilead Sciences (NYSE: GILD) stock price bounced after the Chicago-based hospital treating severe coronavirus patients using Gilead Sciences’ antiviral medicine remdesivir said 123 out of 125 patients on the drug were discharged from hospital in less than a week. All these patients were treated with daily doses of Gilead’s remdesivir.

“The best news is that most of our patients have already been discharged, which is great. We’ve only had two patients perish,” said Kathleen Mullane, the University of Chicago infectious disease specialist.

Gilead Sciences jumped as high as 7% higher in Friday stock trading, extending the year to date rally to 26%. Day traders are making buy calls as Gilead’s stock price is likely to move significantly higher if further tests also go well.

President Donald Trump has previously applauded remdesivir’s potential to combat viral diseases. Trump said, “remdesivir seems to have a very good result.”

While Food and Drug Administration and other regulatory agencies have not yet approved any drug for the treatment of this virus, the world has been waiting for the full results of Gilead’s clinical trials.

Several other institutions are also testing remdesivir but no other data has been released as yet. “What we can say at this stage is that we look forward to data from ongoing studies becoming available,” Gilead said.

Gilead Sciences has started working with regulators to boost production of remdesivir as the current supply amounts to just 1.5 million doses, accounting for 140000 treatment courses. “As a result, we have reduced the end-to-end manufacturing timeline from approximately one year to around six months,” wrote chairman and chief executive officer Daniel O’Day wrote on the firm’s website.

Our featured stockbrokers offer an opportunity to buy Gilead Sciences to enjoy the potential share price gains ahead of remdesivir approval from FDA.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account