General Motors, the largest US-based automaker would release its first-quarter earnings on Wednesday before the markets open. What are analysts expecting from the Detroit automakers’ first-quarter performance?

Last week, Ford reported its first-quarter earnings. While the company shattered analysts’ estimates in the quarter the stock fell sharply after the earnings release as it lowered its 2021 guidance amid the worsening global chip shortage. America’s second-largest automaker expects to lose half of its second-quarter production due to chip shortage.

General Motors Q1 earnings estimates

Analysts polled by TIK expect General Motors’ first-quarter revenues to rise 0.7% year over year to $32.9 billion. The company’s EPS is expected to rise 60% over the period to $1.05. Notably, General Motors China operations were quite strong in the quarter and it along with the joint venture partners sold 780,000 vehicles during the period which was 69% higher than what it had sold in the corresponding quarter in 2020.

China sales soar

Meanwhile, the sharp year-over-year rise should be seen in the light of the base year effect, as China’s car sales had tumbled in the first quarter of 2020 due to the COVID-19 pandemic. However, while the deadly virus allegedly originated in the country and it was the worst affected country in the initial days, China has managed the health emergency much better than almost all the countries.

What to watch in General Motors’ first-quarter earnings release?

Global chip shortage has been among the key talking points in automakers’ first-quarter earnings call and General Motors would be no exception. Markets would watch out for comments from the management on how much production impact the company is witnessing from the chip shortage and what all it is doing to improve the situation.

Rival automaker Ford lowered its 2021 EBIT (earnings before interest and taxes) guidance to $5.5-$6.5 billion. The previous guidance was $8-$9 billion. The company now essentially expects the global chip shortage to wipe off almost $2.5 billion from its pre-tax profits in 2021.

Ford

Ford expects to lose almost half of its second-quarter production due to chip shortage after having lost 17% production in the first quarter. “There are more whitewater moments ahead for us that we have to navigate,” said CEO Jim Farley during the company’s first-quarter earnings call. He added, “The semiconductor shortage and the impact to production will get worse before it gets better.”

NIO also gave tepid guidance amid chip shortage

NIO expects to sell between 21,000-22,000 cars in the second quarter of 2021 as compared to 20,060 cars in the first quarter. Notably, NIO had to tone down its delivery guidance for the first quarter as it had to shut the plant for five days due to the chip shortage. The tepid second-quarter guidance was due to the chip shortage that has negatively impacted many industries.

Chip shortage is hurting automakers

According to consulting firm AlixPartners, the global automotive industry would lose $60.6 billion in revenues in 2021 due to the chip shortage. Apart from the automotive industry, while goods, gaming, and smartphone companies are also grappling with the chip shortage.

Meanwhile, the chip shortage has also been a boon for many chip companies. The Auto and power unit of STMicroelectronics NV reported a 280% increase in first-quarter profits.

The chip shortage is expected to persist at least for the new few quarters. “The second quarter is going to be worse for automakers than the first quarter,” said Song Sun-jae, an analyst at Hana Daetoo Securities Co. in Seoul. He added, “The chip-shortage problem could end up lasting longer, maybe into next year.”

General Motors electric vehicle plans

During their first-quarter earnings release, General Motors would also offer insights into its electric vehicle plans. The company plans to sell only zero-emission vehicles by 2035 and became the first major automaker to commit to a zero-emission future. Tesla’s success and the global pivot towards electric cars have led many carmakers to rethink their ICE (internal combustion engine) car portfolio and they are launching electric cars in a flurry to cover the lost ground.

Volkswagen

Volkswagen has also announced aggressive plans for electric cars and the German automaker wants to be the industry leader by 2025 in electric cars as well as autonomous driving. Volkswagen’s ID.3 has already dislodged Tesla from the leadership position in the European electric car market.

Will General Motors restore dividend

Meanwhile, General Motors might also take a call on its dividend which was suspended last year due to the COVID-19 pandemic. Ford had also suspended the dividend in 2020 as the COVID-19 pandemic took a toll on automakers’ earnings and cash flows. However, things have since improved and investors would fancy the chances of a dividend restoration.

General Motors and Ford are good electric vehicle plays

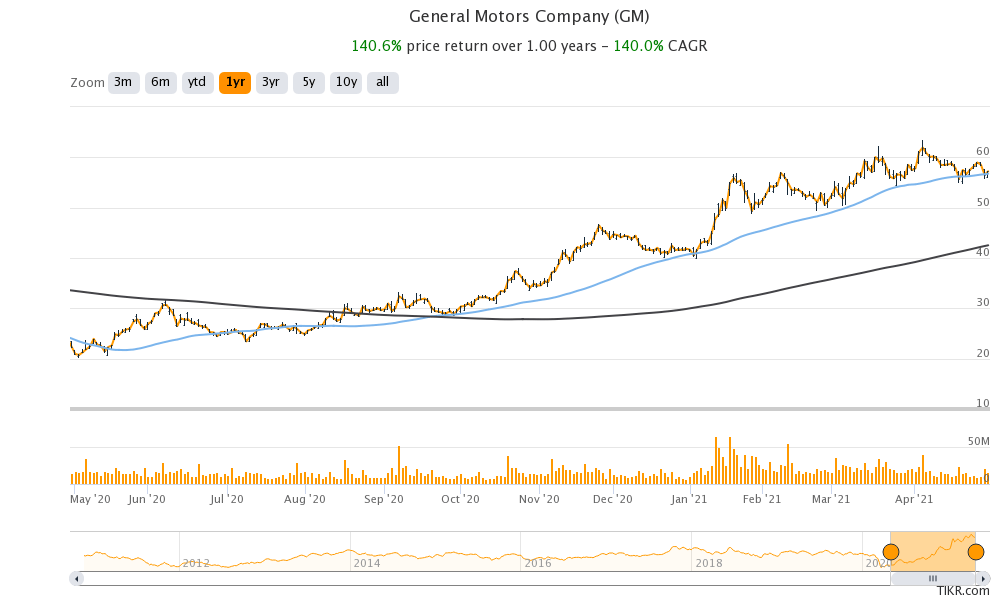

Notably, legacy automakers like Ford and General Motors have outperformed electric vehicle makers like Tesla and NIO in 2021. After years of underperformance, investors are now betting on legacy automakers expecting them to give a tough fight to pure-play electric car makers.

Both Ford and General Motors have seen some rerating in 2021 and might continue to do so as they reveal more details about their electric vehicle plans. Volkswagen took the lead and even held a “Power Day” on the lines of Tesla’s “Battery Day.”

Should you buy General Motors stock?

Volkswagen provided a lot of granular details on how it plans to become the market leader in the electric car industry and the stock soared after that. Markets would expect more granular details from General Motors also on its electric vehicle plans including how the newly launched models are faring.

You can buy General Motors stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account