The FTSE 100 index has bounced from its early February lows, aided by yesterday’s strong uptick prompted by higher oil prices and optimism about the progressive easing of lockdowns in the United Kingdom.

The British stock index advanced 2.5% during yesterday’s stock trading session at 6,756, this being its highest closing price since 14 January, while it ended the day near the session’s high.

Meanwhile, the footsie is trading quietly this morning, advancing 0.1% so far in the day at 6,765 as bulls take a breather after pushing the price from the low 6,400s – producing a 6% gain in roughly 16 days.

Oil companies have been among the biggest winners within the FTSE 100 index, with Royal Dutch Shell and BP advancing 6% each yesterday amid a spike in oil prices caused by tensions in the Middle East and a potential supply disruption in the United States resulting from a strong ice storm in the state of Texas.

On the other hand, mining companies including Glencore (GLEN) are advancing strongly this morning as well, with the British miner posting a 3.3% gain after it announced the resumption of its dividend payments amid favorable conditions in the commodities market.

FTSE 100 companies could also benefit from the easing of lockdown measures in the United Kingdom from 22 February and forward, as Prime Minister Boris Johnson announced yesterday that he will be outlining his plan to progressively lift restrictions by then.

The head of the British government emphasized that the nation has made “huge progress” in rolling out vaccines, effectively administering a first shot to a total of 15 million people – roughly a quarter of the UK’s population.

However, Johnson remains cautious about lifting restrictions too fast as the number of hospitalizations remains high despite receding from the mid-January peak of 40,000 hospitalized patients.

What’s next for the FTSE 100 index?

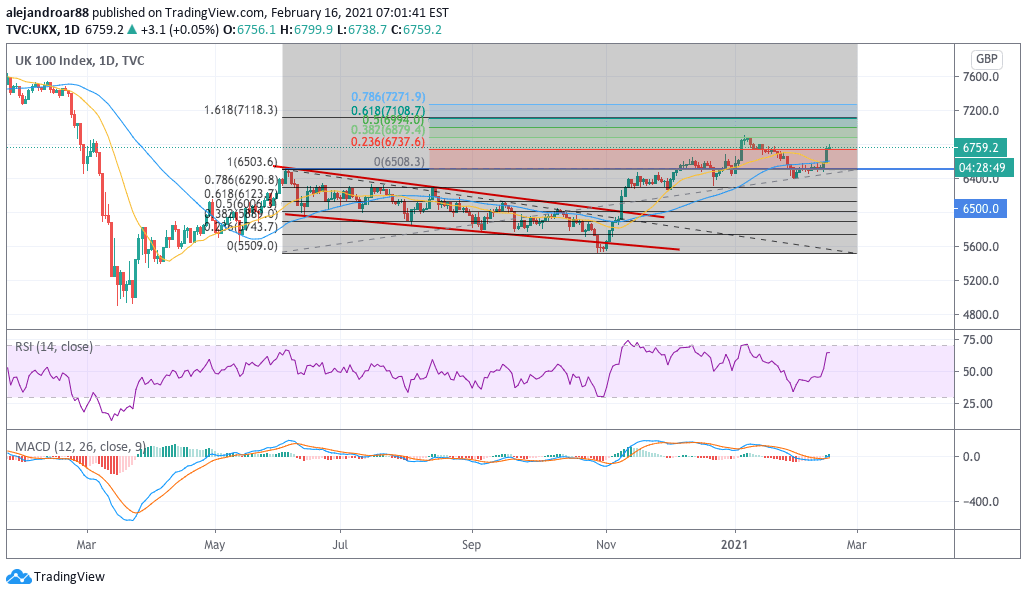

The chart above shows that the 6,400 lows seen by the FTSE 100 index in early February may have been the bottom of the downtrend that started in the early days of 2021 – a moment when the COVID situation worsened amid the discovery of a new strain of the virus.

This bounce may be an interesting one to ride as the country heads to ease lockdowns and given the fact that oil prices have kept advancing above the $60 level – a great price for oil producers and trading companies.

For now, a move above the 6,750 level could provide further confirmation that this is the beginning of a new bull run for the British index – a view that is reinforced by the MACD oscillator as it has already sent a buy signal while it emerges to positive territory.

Meanwhile, the RSI remains on an uptrend at 65, which means that the momentum is fairly positive for the British index.

However, there’s one particular troubling signal that traders should keep an eye on and that is a death cross in the short-term moving averages, with the 20-DMA crossing below the 50-DMA despite the fact that the price of the index is moving higher.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account