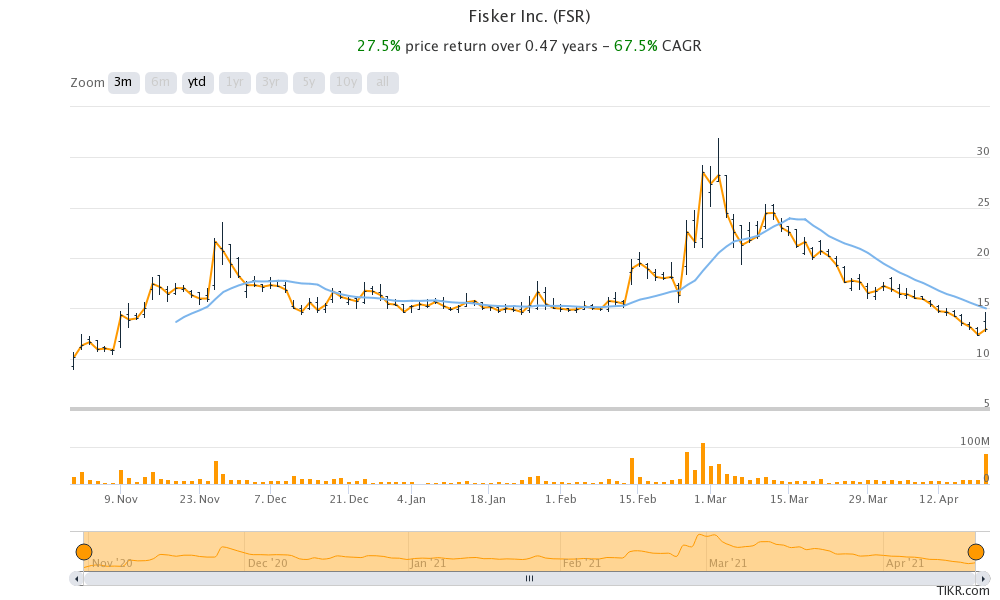

Fisker stock surged 4.5% yesterday and is up sharply in US premarket trading today after Bank of America issued a bullish note on the company forecasting massive upside for the electric vehicle startup company.

Bank of America initiated coverage on Fisker stock yesterday with a buy rating and a $31 price target. The target price implies a potential upside of 140% over Fisker’s yesterday’s closing prices.

Bank of America issues bullish note on Fisker

The brokerage based its price forecast on the expected boom in electric vehicle sales and Fisker’s 2025 revenue and earnings numbers. Here it is worth noting that Fisker is currently a pre-revenue company and it is expected to start producing cars only in 2022.

Bank of America analysts valued Fisker based on early trading multiples of Tesla. However, Tesla has its own manufacturing plant and is more vertically integrated than many of the mainstream automotive companies. Fisker on the other hand has partnered with Magna to produce its cars.

Fisker would focus on the leasing market

Also, Fisker would focus on the leasing market which Bank of America analysts see as a dampener. “We remain a bit cautious on [Fisker’s] go-to-market strategy, namely its flexible leasing program, which we believe may overcomplicate the business model,” said Bank of America analysts led by John Murphy, CFA, in their note.

However, they sounded optimistic about the electric vehicle start-up company despite rising competition and said that Fisker stands “out even with plenty of fish in the ocean of new EV (electric vehicle) automakers.”

They also added that “Our Buy rating on Fisker is predicated on our view that the company is a beneficiary of, although still one of many participants within, the automotive industry evolution towards electrification.”

Fisker would offer Ocean SUV

Fisker’s first model would be an SUV named Ocean and would start at $37,499. The lease cost is expected to be around $379 per month. The model is expected to have a range between 250-250 miles which is below what companies like Tesla and NIO offer. That said, the price point for Ocean is also below Tesla’s Model X and Model Y. The Model X is among Tesla’s older models and its sales have been stagnant. However, the Model Y is among the recent models whose sales have been strong.

Tesla

In the first quarter of 2021, Tesla started delivering China-made Model Y to customers. It began the deliveries of China-made Model 3 towards the end of 2019 and ramped up the deliveries last year. “We are encouraged by the strong reception of the Model Y in China and are quickly progressing to full production capacity,” said the company in its release.

As for Model S/X, the company is revamping the models. “The new Model S and Model X have also been exceptionally well received, with the new equipment installed and tested in Q1 and we are in the early stages of ramping production,” it said in the release.

Competition is heating up in the electric vehicle industry

Meanwhile, competition is heating up in the electric vehicle industry. Over the next two years, we’ll have models from several start-up electric vehicle companies like Lucid Motors, Fisker, Canoo, Lordstown Motors, and Nikola. Also, pure-play electric car companies like Tesla and NIO are also ramping up capacity. After the China Gigafactory, Tesla is setting up two new facilities in Berlin and Texas that would increase its production capacities.

Volkswagen is working to become the leader in the electric vehicle market

Volkswagen has outlined plans to become the global leader in the electric vehicle industry by 2025. UBS is also bullish on Volkswagen and expects the automotive industry to be a two-horse race led by Tesla and Volkswagen. The company expects both Tesla and Volkswagen to deliver 1.2 million electric cars each in 2022.

“The analysis of the ID.3 shows that Volkswagen has developed a pure electric platform which is cutting-edge. This enables the group to offer attractive electric vehicles (BEVs) across the entire product range, and to achieve positive earnings (EBIT),” said UBS in its note as it raised Volkswagen’s target price.”

Volkswagen has already dethroned Tesla as the market leader in the European electric car market even as it was late to the party. It has also launched the ID.4 which would compete with Tesla models.

The massive impetus that legacy automakers are putting towards vehicle electrification is a risk for start-up electric car companies like Fisker which are yet to deliver their first car.

US automakers are also doubling down on electric vehicles

Ford and General Motors are also doubling down on their electric vehicle plans. General Motors became the first Detroit automaker to publicly admit that it would sell only zero-emission cars by 2035 and called upon peers to step up their zero-emission vehicle plans.

“General Motors is joining governments and companies around the globe working to establish a safer, greener and better world,” said General Motors CEO Mary Barra. She added, “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Ford would sell only zero-emission cars in Europe by the end of this decade. The company started delivering all-electric Mustang Mach-E to US customers late last year which is believed to be snatching market share from Tesla.

Mercedes has also thrown its hat into the wring with its EQS electric car. The car has good specifications and would be a tough competitor in the premium electric car market.

Fisker stock is down sharply from the peaks

Meanwhile, Fisker stock is down almost 60% from its 52-week highs of $31.96. There has been a bloodbath in all electric vehicle stocks especially those that are in the pre-production stage. Markets are now getting apprehensive over these companies given the execution risk.

Even Churchill Capital IV (CCIV), the SPAC (special purpose acquisition company), that’s taking Lucid Motors public, has fallen sharply from its peaks. However, the crash could be an opportunity to buy some of the fundamentally strong electric vehicle stocks now.

You can trade in electric vehicle stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account