Billionaire Elon Musk has rebranded Twitter as X and replaced the iconic blue bird with an X logo. The social media platform meanwhile continues to grapple with multiple troubles even as Musk seems to be pivoting it to become an everything app like WeChat in China.

Last year, Musk reportedly told Twitter employees that “You basically live on WeChat in China. If we can recreate that with Twitter, we’ll be a great success.” Musk’s obsession with China is not new and he has praised the company’s manufacturing prowess and work ethics of Chinese employees in the past.

On Sunday, Musk tweeted that the idea behind changing the logo to X is “To embody the imperfections in us all that make us unique.”

Linda Yaccarino whom Musk handpicked to become the Twitter CEO said, “It’s an exceptionally rare thing – in life or in business – that you get a second chance to make another big impression. Twitter made one massive impression and changed the way we communicate. Now, X will go further, transforming the global town square.”

Musk changes the Twitter logo from blue bird to X

Musk called upon his nearly 150 million Twitter followers to come up with ideas for the logos and multiple users responded with different logos. Initially, Twitter has gone ahead with a simple-looking X sign but Musk has said that the logo “probably changes later, certainly will be refined.”

Meanwhile, the name change might not do much to help bail out Twitter from its woes.

Last week only, Musk said that the company is still losing cash. Responding to a tweet about recapitalization, Musk said, “We’re still negative cash flow, due to (about a) 50% drop in advertising revenue plus heavy debt load.”

The billionaire added, “Need to reach positive cash flow before we have the luxury of anything else.”

His comments come barely two months after he claimed to have performed a “major open-heart surgery” on the social media company to make it viable.

Musk said he performed open-heart surgery on Twitter

Notably, previously Musk said that Twitter is on track to hit $3 billion in revenues in 2023 which is way below the $5.1 billion that the company reported in 2021 – the last full financial year before Musk took it private in October 2022.

Musk has taken several cost-cut actions since he acquired Twitter – including lowering the headcount by almost 80%. Many of the former employees have sued Twitter, including over unpaid legal bills.

The company is also facing lawsuits from landlords, vendors, and consultants over unpaid bills.

Musk has been on a cost-cutting spree and has taken aggressive actions to lower the company’s cost base including shutting down some offices. The billionaire joked that he performed an “open heart surgery” on Twitter.

Musk previously said that because of these actions, Twitter’s non-interest expenses in 2023 would be around $1.5 billion – $3 billion lower than what they would have been otherwise.

Separately, Twitter has a debt load of $13 billion which Musk took to finance the $44 billion acquisition.

Musk’s pivot to paid subscriptions failed

Musk has made several changes at Twitter including the pivot to paid verifications. However, he now seems to have changed his thoughts on advertising. It became apparent when he hired NBC Universal advertising executive Linda Yaccarino to lead Twitter.

Recently, Twitter has started sharing revenues with some content creators on the platform.

Multiple technical snags have marred Twitter since Musk’s acquisition including during a Twitter Spaces interaction between Musk and Ron DeSantis where the latter officially launched his 2024 presidential campaign.

Twitter’s valuation has slumped

Earlier this month slashed the company’s valuation by over half to $20 billion. He said the company’s valuation could eventually rise to $250 billion.

Other Twitter investors have also marked down the social media company’s valuation and last month Fidelity lowered the valuation for the third time to a mere $15 billion.

Even Twitter’s co-founder Jack Dorsey, who backed Musk’s acquisition and continued to remain an investor in the company, has criticized Musk’s handling of Twitter and said that he’s not the right leader to lead the company.

Dorsey has incidentally launched his own social media platform Bluesky. However, while there are several other platforms trying to compete with Twitter, Instagram’s Threads could be the biggest threat to the Elon Musk-owned company.

Could Threads be a threat to Twitter?

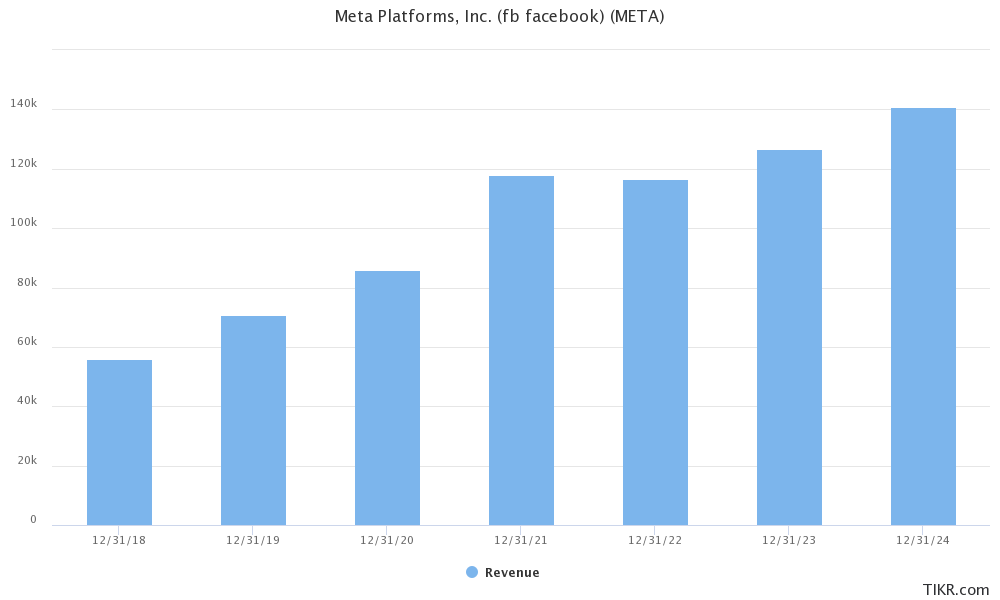

While Threads started with a bank and hit almost 150 million users within days of launch, its active user count has since tanked over 70% from the peak. The engagement numbers on the platform have also come down but analysts predict that it could billions of dollars to its revenues with Evercore ISI forecasting revenues of $8 billion in 2025.

While that’s a fraction of Meta Platforms’ current revenues, it is almost thrice what Twitter is expected to post in 2023.

As for Twitter, the platform has primarily been run as per Musk’s whims and fancies and there have been frequent changes.

Overall, it has been less than eight months since Musk acquired Twitter and far from the turnaround that Musk is targeting, the platform continues to face newer issues.

The rebranding of Twitter from the iconic blue bird which has been so closely associated with the brand to X might not help solve the multiple troubles that Twitter faces.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account