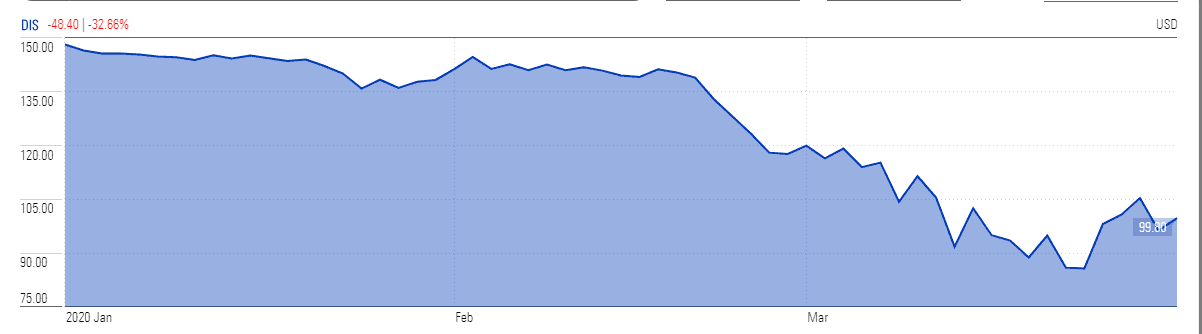

The Walt Disney Company (NYSE: DIS) stock price is off more than 30% from 52-week high of $150 due to the widespread disruption across its domestic parks, hotels, and cruise lines as well as the halts in production at its film business. ESPN is expected to lose $481m in NBA-related ads.

However, Disney Plus, which screens Star Wars: The Clone Wars and The World According to Jeff Goldblum (pictured), is benefitting people’s staying at home due to lockdown measures imposed by governments across the world.

While the rating agencies and market analysts are trimming Disney’s revenue and earnings forecast for 2020 and 2021, they still provide a buy rating due to its long-term fundamentals. Also, its strong balance sheet along with a revolving credit facility of $12.5bn reduces any threat of running out of cash to meet business expenses. It recently filed to raise $6bn in a new debt to boost its cash position. The company ended fiscal 2019 with $6.8bn of cash and cash equivalents. Disney edged up 2.6% at $102.63 in afternoon trading on Monday.

Credit Suisse gives a price target of $140 for The Walt Disney stock despite cutting its financial outlook. The firm expects Disney’s 2020 revenue to stand around $71.7bn and earnings to slump to around $4.3bn, compared to the earlier estimate of $8.1bn.

“There remains virtually no visibility as to when sports and Hollywood content production will resume and reopenings for Theme Parks [the US now closed indefinitely] and theatres [China just reclosed] will take place – we assume the beginning of June,” he writes. “As for the media business, the depth of ad declines is also uncertain.”

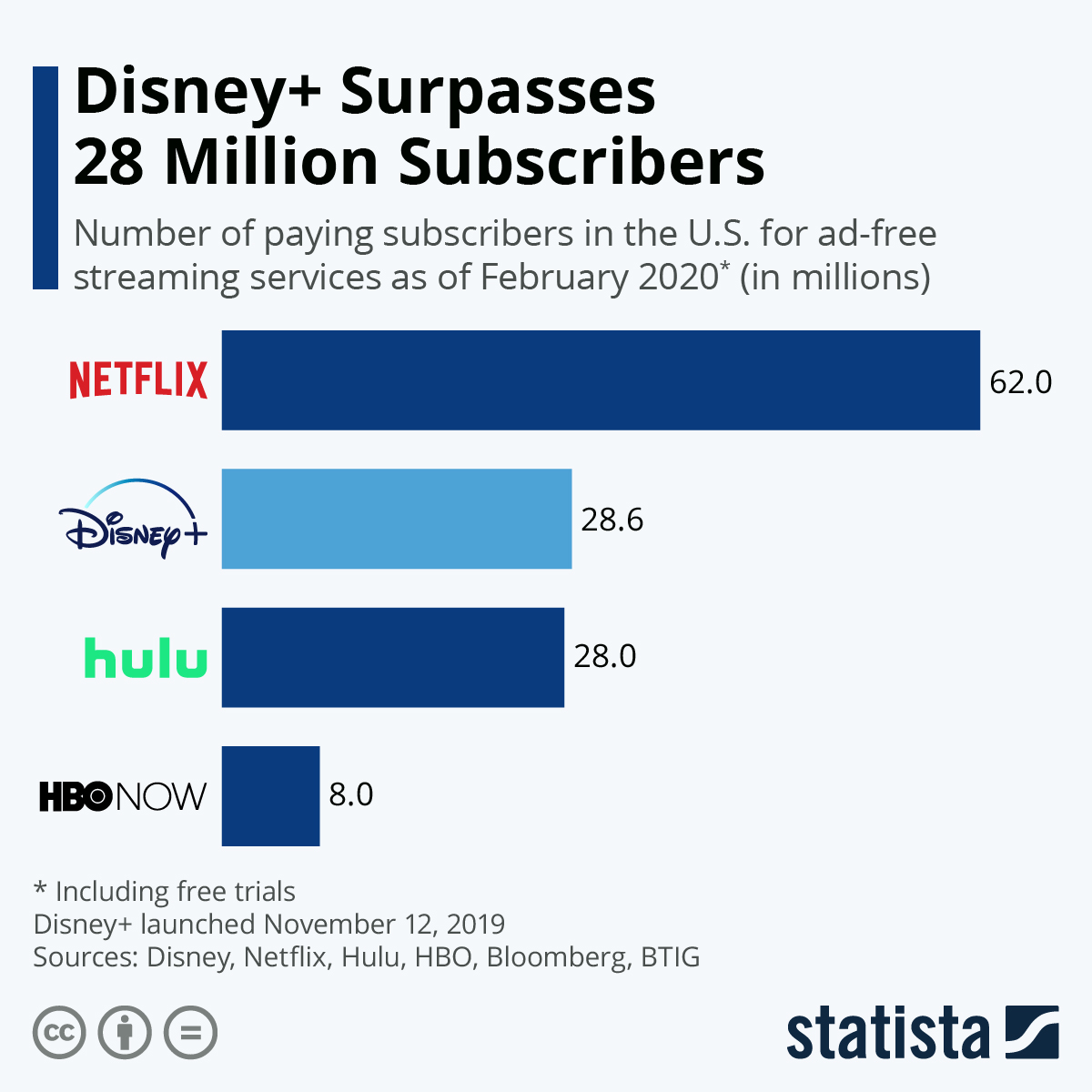

Despite the worse impact of the virus on parks, cruise ships, and live-action film, some market analysts believe the investors are underestimating Disney’s streaming business, launched last December, which is expected to benefit from lockdown conditions. Disney recently launched its streaming service and acquired two-thirds ownership of Hulu with its acquisition of Fox last year. The company also plans to launch the streaming platform Disney Plus Hotstar in India this week. On the whole, the streaming service would help it in offsetting the negative impact of low revenue from domestic parks, hotels, and cruise lines business.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account