Delta Air Lines (DAL) will report its second-quarter earnings on Thursday, a widely anticipated move by the market that will shed light on the size of the hole the US aviation industry is in.

Although the Atlanta-based carrier is expected to deliver some of the worst quarterly results in its history – with revenues plunging by around 89% to $1.39bn, down from $12.54bn the year before – analysts are waiting to see if recent estimates are actually downplaying or overestimating the impact of the health crisis in the airline industry.

The company is expected to report big losses, with the consensus estimate being $4.24 in losses per share for the quarter, compared to the $2.20 in earnings per share it reported a year ago.

The airline’s cash position will also be in the spotlight, as air carriers continue to struggle to survive the pandemic after seeing a 90%-plus plunge in air traffic volume as a result of severe restrictions on international travel due to the pandemic.

Analysts have pointed that Delta may be overstating the actual graveness of its situation not to get investors hopes up, as a second wave of the virus in the US could further delay its recovery.

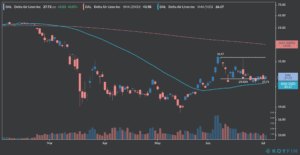

Delta (DAL) shares seem to have taken foothold at the stock’s 50-day moving average of $27 per share – a short-term indicator of its price trend – after going down 25% from their 8 June post-pandemic peak of $37 per share.

The stock may continue to trade at those levels until the company’s quarterly earnings are released and may be pushed in either direction depending on the outcome and how results fared against estimates.

Meanwhile, the virus situation continues to be a short-term threat for Delta shares. For now, investors have been content with the fact that the spike in cases seen recently has not led to a higher number of deaths, but that could change at any point in the next couple of weeks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account