In what would represent the largest tech deal ever pulled off, privately held Dell Inc. said Monday morning it would buy diversified computing concern EMC Corporation in a cash and stock transaction worth better than $65 billion. While EMC’s roots are mostly related to storage hardware, today it is probably better known for its cloud services.

Dell, a one time growth stock darling during the late 90s, went private several years ago amidst a slowdown in the PC space. Competition from Apple, Hewlett Packard, and several smaller outfits hit Dell’s margins hard, as it struggled to differentiate its consumer direct model and win new enterprise business.

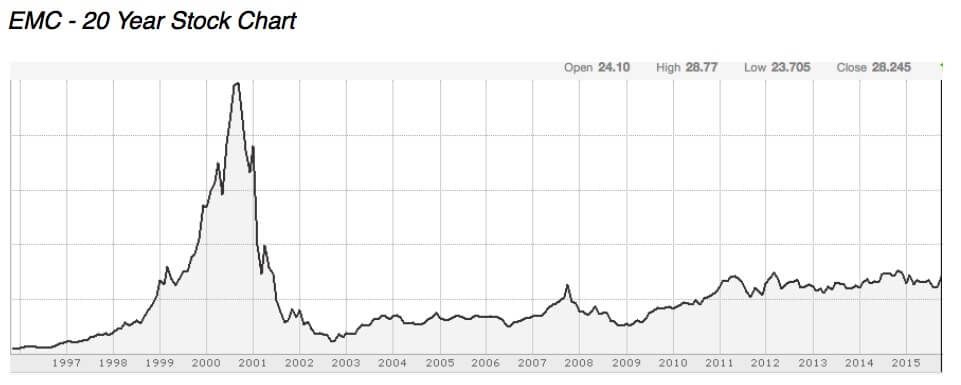

EMC, similar to Dell, has had difficulty maintaining growth traction since also gaining notoriety during the tech/Internet bubble of the late 90s. Like many peers, EMC’s stock price ramped quickly, then cratered as investors equally realized their over-exhuberance. A few Wall Street analysts at the time predicted that EMC would become the world’s first trillion dollar company. Today, Apple would seem the odd’s on favorite to earn that distinction. EMC, with a market cap a bit above $50 billion, is valued less than 1/10th of Apple.

Taken directly from the joint press release, here are the terms of the deal:

…..EMC shareholders will receive $24.05 per share in cash in addition to tracking stock linked to a portion of EMC’s economic interest in the VMware business. Based on the estimated number of EMC shares outstanding at the close of the transaction, EMC shareholders are expected to receive approximately 0.111 shares of new tracking stock for each EMC share. Assuming, for illustrative purposes, a valuation for each share of tracking stock of $81.78, the intraday volume-weighted average price for VMware on Wednesday, October 7, 2015, EMC shareholders would receive a total combined consideration of $33.15 per EMC share and the total transaction would be valued at approximately $67 billion. The value of the tracking stock may vary from the market price of VMware given the different characteristics and rights of the two stocks.

What Is VMware?

VMWare is a publicly traded entity, ticker VMW, roughly 78% owned by EMC. The company specializes in cloud and virtualization software and possess a diverse product line. With a current market cap of around $9 billion, EMC’s stake in VMW is worth around $7 billion. As the press release notes, EMC will be issuing a new tracking stock in conjunction with the deal’s closing. For every 9 EMC share owned, investors will receive about one share of the tracking stock.

EMC / Dell Deal Rationale

The companies seem to be highlighting on the marquee board the combination of EMC Corporation and Dell Inc. as an “end to end” IT customer solution. On a fundamental basis Dell and EMC possess both similarity and difference. Similarity from the respect that they have overlapping enterprise end customers, difference in that they have varying product solutions. At first glance there would seem to be a pleasant complement. As they noted in the PR:

The transaction combines two of the world’s greatest technology franchises – with leadership positions in Servers, Storage, Virtualization and PCs – and brings together strong capabilities in the fastest growing areas of our industry, including Digital Transformation, Software Defined Data Center, Hybrid Cloud, Converged Infrastructure, Mobile and Security.

As we know, G&A cost cutting is a usual by product of M&A activity. The potential to eliminate overlap by slimming down headcount and achieve fiscal savings is a large part of the strategic rationale.

Regulatory Concerns?

The background motivation of a merger is generally that bigger is better in corporate America. The aforementioned cost synergy being one of the key components. Regulatory scrutiny is always a hurdle in a large merger, especially when the companies sit on a horizontal plane of business. In this case there wouldn’t appear to be a high level of problematic overlap, as there is a lot of verticality to the product lines.

Will Tech M&A Accelerate?

There certainly hasn’t been an absence of large deals this year. Intel is buying PLD chipmaker Altera and Avago acquired fabless chip designer Broadcom. 2015 is actually panning out to be the busiest M&A year since the tech bubble.

I would argue that M&A may accelerate in the current environment.

But why? Beyond the obvious cost savings that can be achieved, a company that is diversified and well capitalized can be viewed as an entity that can survive in any kind of weather. The shaky recovery we seem to be holding on to can quickly do a one-eighty. One-trick, highly levered ponies can find themselves in a hole quicker than you can say recession.

Building scale, while usually not beneficial to consumers, can be a boon to enterprise. Further, the speed at which technology seems to be evolving today can leave a company, a la Dell, in the dust if they miss just a small turn along the way.

For that reason, it may behoove technology companies on the margins to team up and for larger players like Dell/EMC to create technology conglomerates which customers can view as a one-stop shop.

Adam Aloisi was long shares of EMC at time of writing, but positions can change at any time.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account