US stock futures are heading down this morning as US Treasury bond yields have kept climbing amid growing optimism among market players in regards to the country’s economic recovery and ongoing fears about a potential spike in inflation rates.

So far today, the tech-heavy Nasdaq 100 index is leading the downtick, dropping 1.2% at 13,413 in early futures trading action, followed by the S&P 500 index which is down 0.7% at 3,875 while futures of the Dow Jones Industrial Average are also retreating 0.5% at 31,271.

10-year Treasury yields, a widely-used benchmark to assess the interest rate situation in America, are heading higher today as well, moving from 1.340% on Friday to 1.365% this morning as bond traders seem to be dumping their holdings ahead of this week’s economic data releases.

The resumption of delayed vaccine deliveries in the US could also be prompting today’s uptick in Treasury yields, as the Biden administration stated yesterday that it plans to complete the shipping of around 4 million delayed vaccines that faced logistical disruptions across the country amid a strong winter storm.

After touching all-time lows at 0.52% in July last year, 10-year Treasury yields have started to progressively climb on the prospect of an upcoming treatment for the virus, which would help the US economy in bouncing from the crisis.

Meanwhile, the inflation ‘bogeyman’ has kept instilling fears among investors, as a spike in economic activity and a strong recovery in consumption levels could result in upward pressures for the price of goods and services within the country which would, in turn, affect the performance of bonds in short notice as traders demand higher yields to compensate for the impact of the erosion in the dollar’s purchasing power.

“Despite a firm Fed commitment that monetary policy will remain supportive and additional fiscal spending from the Biden administration, US stocks are ripe for a pullback if yields continue to go up”, said Edward Moya, senior market analyst at Oanda last week.

What’s next for US stock futures?

At this point, the Federal Reserve could move to purchase a significant amount of bonds in an effort to maintain Treasury yields below the 1% level, although that would take a significant expansion of its balance sheet.

On the other hand, if that does not happen and treasury yields keep climbing – possibly heading to 1.5% – a pullback in stocks remains a highly likely scenario as investors would ramp up their cost of capital – which would effectively reduce valuations from a fundamental perspective.

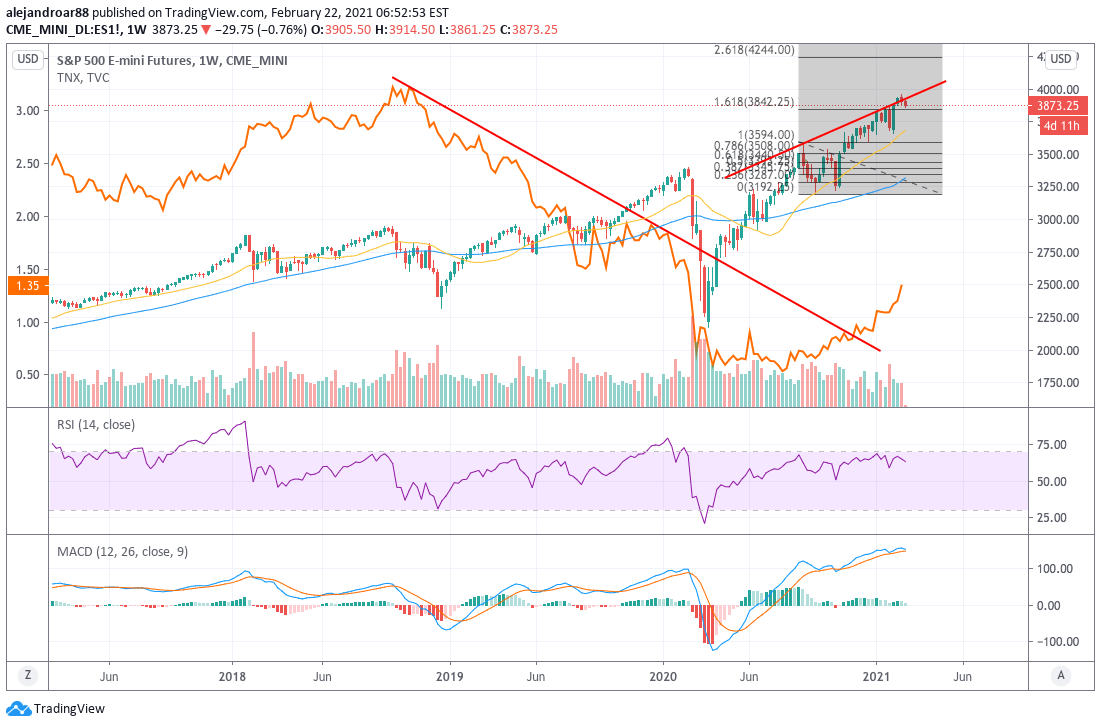

The chart above shows how futures of the S&P 500 have struggled to move above the 4,000 level amid this U-turn in 10-year Treasury yields, with the benchmark already breaking a long-dated downtrend as it heads for the 1.4% level.

Meanwhile, if the current uptrend faces a setback amid a spike in bond buying from the Federal Reserve, chances are that futures of the S&P 500 could finally manage to climb above that psychological resistance as bulls would finally clear this looming obstacle.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account