The price of gold continues to be under pressure for a fourth consecutive day as Treasury yields continue to rise, making the precious metal less attractive for investors while bonds regain some of their lost appeal.

Gold’s downtrend started on 22 February and since then the price of the yellow metal has slipped 2.7%, currently trading at $1,758 per ounce while losing 0.7% in early commodity trading activity.

Today’s downtick seems to be in line with the gains seen by the US dollar – as reflected by Bloomberg’s US dollar index (DXY) – with the benchmark advancing 0.7% as well, trading at 90.76.

According to data from ETF Database, the two biggest gold exchange-traded funds (ETF), the SPDR Gold Trust (GLD) and the iShares Gold Trust (IAU) saw strong outflows in the past month, with roughly $3.88 billion in assets flying off GLD during the 30-day period ended on 24 February while IAU saw nearly $400 million in assets being withdrawn by investors as other areas of the market seem to be outshining gold.

Only yesterday, Goldman Sachs revised its 12-month forecast for gold, cutting its target to $2,000 for the next 12 months – down $300 from their previous forecast – as the bank acknowledged that investors have rotated to riskier assets and off gold lately.

That said, the bank continues to be bullish on the precious metal, with this recent target potentially producing a 13.7% gain if it were to be hit.

What’s next for gold?

According to a report released by the World Gold Council (WGO) nearly a month ago, gold should continue to perform positively this year, although its upside potential is lower compared to 2020 as most of the positive catalysts that pushed gold prices to all-time highs are now absent.

The base case scenario assumed by WGO is a steady economic global recovery in which lower interest rates will remain while consumer demand for the precious metal should improve compared to last year.

However, despite this seemingly positive outlook for gold provided by WGO, the precious metal has declined 7.3% since the year started and the latest price action indicates that the negative momentum could accelerate over the coming weeks as gold prices retest a key support.

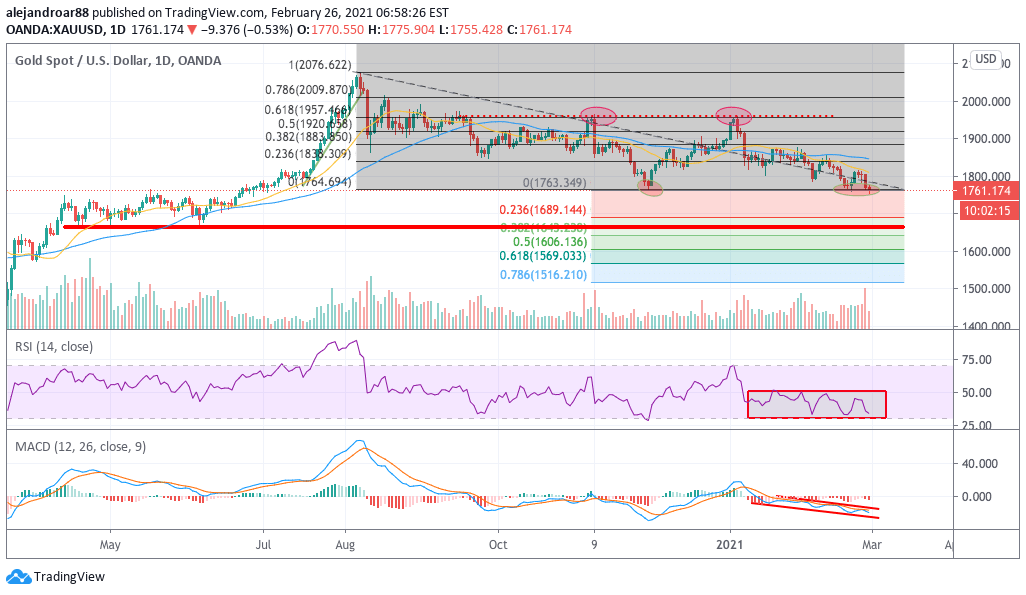

The chart above shows that today’s downtick has already pushed gold below the $1,760 support area, an important threshold for gold that is now being retested for a third time in roughly three months.

Each of these tags contributes to weakening the strength of the support while other indicators including the MACD and the RSI are also pointing to a pronounced negative momentum for gold prices.

If the price were to drop below this support, gold could be heading to a strong correction, possibly landing near the $1,670 level – the next area of support for the precious metal.

The most important factor at this point that could contribute to this acceleration of the downtrend would be the continuation of the current uptrend seen in long-term Treasury yields.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account