Traders point to consumer staple stocks as likely winners during the pandemic, as consumers don’t have many places to spend their money aside from the grocery store.

During an interview with CNBC’s Trading Nation, top analysts from Blue Line Capital and Tocqueville Asset Management said that they favored the sector amid a potential second wave of the virus in the US, as it is well positioned to take advantage of a shift in consumer trends.

John Petrides, portfolio manager at Tocqueville Asset Management, said that investors should “pick and choose” their stocks within the sector, citing a “perfect storm for consumer staples to rally”, as the coronavirus prompts buyers to stockpile essential goods.

Petrides added that these stocks were also attractive due to their “inherently low-beta, less volatile, and in a low-interest-rate environment, they throw off good dividends”.

Meanwhile, Bill Baruch (pictured), president and founder of Blue Line Capital, agreed with Petrides’ view of the sector, but also cautioned investors about the long-term performance of consumer staple companies, adding that “their margins are growing because they don’t have the coupon”.

“They don’t have to take any discount to any of their products because where else are the consumers spending their money but at the grocery store? So, I think you have exposure to this space, but you have to pick and choose your spots”, Baruch said.

Brokers at Jefferies upgraded beverage conglomerate Keurig-Dr Pepper and added Procter & Gamble to its list of franchise picks, saying the two are riding long-term “mega-trends” in consumer behavior.

However, Bernstein analysts, are bearish on some of the pantry plays that outperformed at the start of the coronavirus pandemic, downgrading General Mills, Campbell Soup, Kellogg and J.M. Smucker to “underperform.”

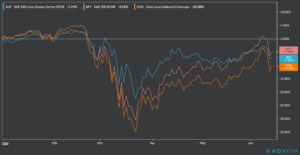

The consumer staples sector, as reflected by the S&P 500 Consumer Staple SPDR ETF, has recouped most of the losses it took during the pandemic sell-off of mid-February, even though it is still down 7.2% for the year.

The performance of the exchange-traded fund has outpaced that of the Dow Jones Industrial Average by nearly 3% while lagging behind the S&P 500 by 2% so far during 2020.

Ever since the coronavirus outbreak gained traction in the US, consumer staple stocks have rallied in response to higher sales, as consumers have no choice other than staying at home, while spending much of their money on groceries and other essential goods.

Baruch highlighted that not all of the players in this industry are favorably positioned to take advantage of this trend, citing General Mills (GIS) as a potential pick due to a positive price setup based on the stock’s technical indicators.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account