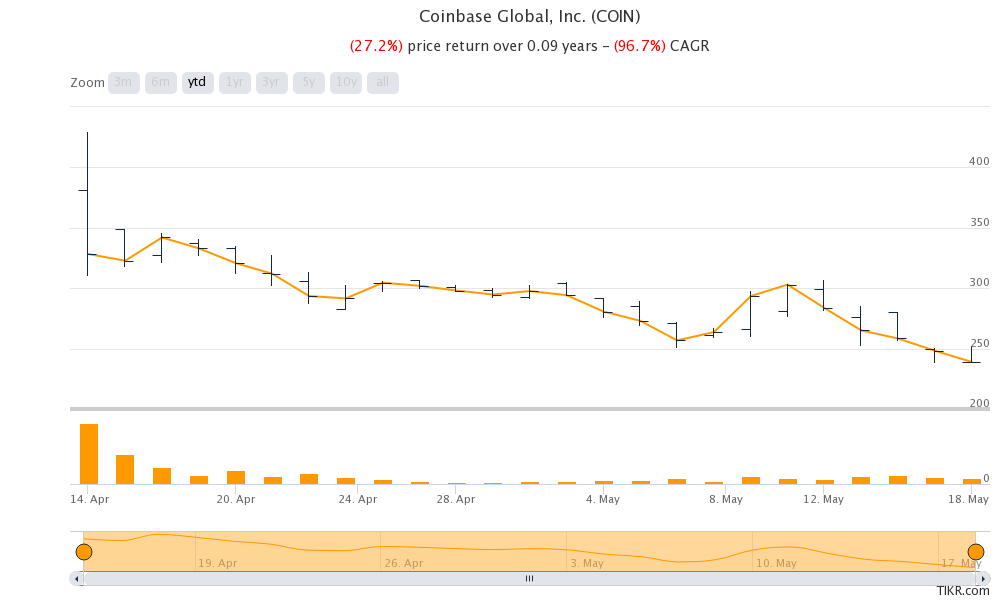

Coinbase stock has fallen to a new low today as the sharp decline in cryptocurrencies is taking a toll on the crypto exchange that listed last month only.

Bitcoin prices were anyways weak over the last couple of weeks after Tesla’s CEO Elon Musk said that the company would stop accepting them as payments. Now, China has barred its financial institutions from participating in crypto transactions.

National Internet Finance Association of China, the China Banking Association, and the Payment and Clearing Association of China in a joint statement said that cryptocurrencies “are not supported by real value.”

China bans financial institutions from dealing in cryptocurrencies

They added, “Recently, crypto currency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order.”

Meanwhile, the steep fall in cryptocurrencies is also reflecting in Coinbase stock. The crypto exchange fell to an all-time low of $208 today before recovering slightly. The company went public in a direct listing with a reference price of $250. While the stock soared on the listing day, it has since looked weak. Fears of higher competition and shrinking margins weighed heavy on Coinbase stock even as investors’ craze for cryptocurrencies was at an all-time high and some of the obscure digital assets also soared along with the more well-known ones like bitcoin and Ethereum.

Coinbase platform facing troubles today

Meanwhile, the Coinbase platform also faced troubles today as traders scrambled to sell crypto assets and limit their losses. In a statement to CNBC, the company said “We’re seeing some issues on Coinbase and Coinbase Pro and we’re aware some features may not be functioning completely normal.” It added, “We’re currently investigating these issues and will provide updates as soon as possible.”

Coinbase convertible note offering

Coinbase has also priced its convertible notes to up to $1.4 billion. The senior notes will mature in June 2026 and would accrue interest of 0.5% annually which would be payable semi-annually in arrears. The notes will be convertible at an initial conversion rate equivalent to $370.45.

According to Coinbase, “This capital raise represents an opportunity to bolster Coinbase’s already strong balance sheet with low cost capital that maintains operating freedom and minimizes dilution for Coinbase’s stockholders.” It added, “Coinbase intends to use the net proceeds from the offering for general corporate purposes, which may include working capital and capital expenditures, and to use approximately $78.4 million of the net proceeds to pay the cost of the capped call transaction.”

Coinbase direct listing

Notably, while Coinbase listed only recently it did not raise money in the offering as it was a direct listing where only existing shareholders sold their shares and the company did not issue new shares. Earlier this year, Roblox also listed through the same route. However, it also raised cash by selling shares in the private market ahead of the listing. The mechanism not only helped it raise capital but also helped justify the company’s valuations which were much above what it was valued in 2020 in private market funding.

Wall Street is bullish on Coinbase stock

Meanwhile, ahead of the crypto sell-off, most analysts covering Coinbase were bullish on the stock. Last week, Piper Sandler initiated coverage on the stock with an overweight rating and a $335 target price.

“In our view, COIN is the most scaled play in the crypto space, an asset class that has the potential, in our view, to reshape financial services and the technology underpinning it,” said Piper Sandler analyst in their note.

They added, “As COIN continues to grow its assets on platform and verified users count through (1) further adoption of crypto by the public and (2) increased market share, we believe Coinbase’s revenue potential has increased in optimal operating environments and raised their operating floor in subdued, non-volatile, markets.”

Oppenheimer sees massive upside in COIN stock

Earlier this month Oppenheimer also initiated coverage on Coinbase with a bullish narrative and a target price of $434. “We view COIN as an enabler of crypto innovation which solves some pain points in the existing financial system while leveraging its trading arm to monetize the success,” said analyst Owen Lau.

Lau added, “Given the recent volatility of crypto prices, increasing institutional (i.e., trading and treasury management) acceptance of crypto and higher demand for retail crypto products, we believe the earnings upside potential is significant, and in our view, current valuation provides an attractive entry point.”

Should you invest in Coinbase stock?

You can invest in Coinbase stock through any of the reputed online stockbrokers. Alternately, you can invest in ETFs to get exposure to COIN stock. By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

You may also choose from ETFs that invest in IPOs of newly listed companies. The Renaissance IPO ETF outperformed the S&P 500 by a wide margin in 2020 reflecting the strong performance of IPOs. However, it is underperforming in 2021 as newly listed IPOs have not done well.

Coinbase also forms part of Cathie Wood’s ARK Innovation ETF. However, the ETF has been under pressure amid the sell-off in growth names.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account