Chevron (NYSE: CVX) stock price plummeted to 52-weeks low after missing fourth-quarter estimates. The oil price selloff has also been negatively impacting CVX stock price. Oil prices lost almost 15% of value in January, marking the worst month in the past 30 years. Investors’ concerns over slowing demand from China due to the threat of coronavirus are likely to impact oil prices, according to market analysts.

Chevron stock price lost 11 per cent of value in the last month alone. CVX share price is currently trading at $106. The company reported lower than expected revenue for the fourth quarter and its earnings plunged sharply from the year-ago period.

Fourth Quarter Results Added to Investors Concerns

CVX missed fourth-quarter revenue by $2.63bn. The fourth-quarter revenue of $36bn declined 15% from the year-ago period. The company blamed lower oil and gas prices for revenue miss. Its fourth-quarter worldwide net oil-equivalent production remained unchanged from a year-ago period.

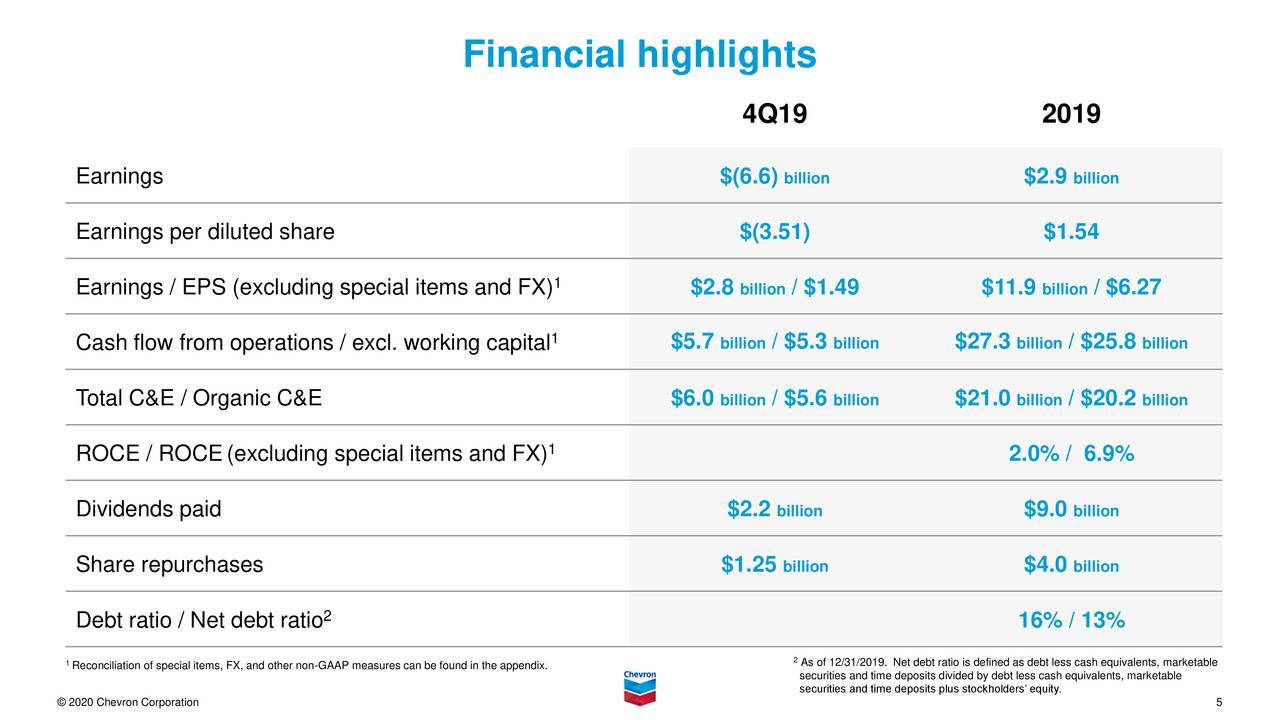

CVX reported a fourth-quarter loss of $6.6bn compared to earnings of $3.7bn in the year-ago period. Full-year earnings came in at $2.9bn, down from $14.8bn in fiscal 2018.

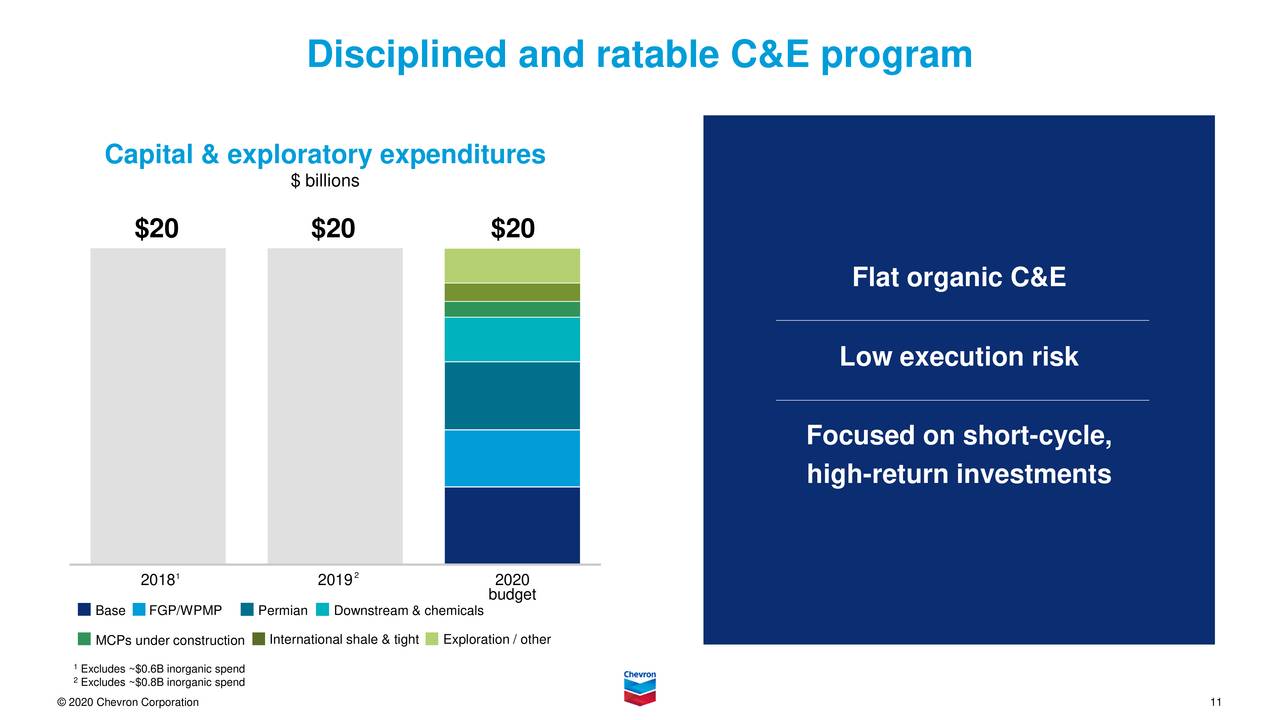

Contrary to Exxon (NYSE: XOM), Chevron has not been aggressively investing in growth opportunities. ”Organic capital spending held flat at $20 billion in 2019, further demonstrating our commitment to capital discipline. Within this program, we continued the ramp-up of the Permian Basin in Texas and New Mexico and progressed our other future growth projects,” said Michael K. Wirth, Chevron’s chairman of the board and chief executive officer.

Cash Generation is Declining

Along with a huge decline in earnings, CVX reported a significant year over year drop in cash flows. Its cash flows in fiscal 2019 stood around $27bn compared to capital investments of $20bn. Chevron’s free cash flows of $7 billion do not offer a complete cover to dividend payments. The company is using proceeds from assets sales for dividend payments.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account