Exxon Mobil (NYSE: XOM) stock price extended the downtrend into February after posting worst losses in January on record. XOM share price selloff is prompted by oil price volatility and dismissal fourth-quarter numbers. The entire energy sector is struggling to reverse the bearish trend that is provoked by the decline in energy and commodity price.

Oil prices are off to the worst start in the last thirty years. WTI crude oil plunged more than 15.6 per cent in January and the Brent price plummeted almost 12 per cent during the last month.

“After a strong December, E&P stocks have sharply fallen in January due in our view to demand concerns driven in part by mild winter weather and, more recently, the spread of coronavirus,” Goldman Sachs analysts wrote this week.

Fourth Quarter Numbers Negatively Impacted Exxon Mobil Stock

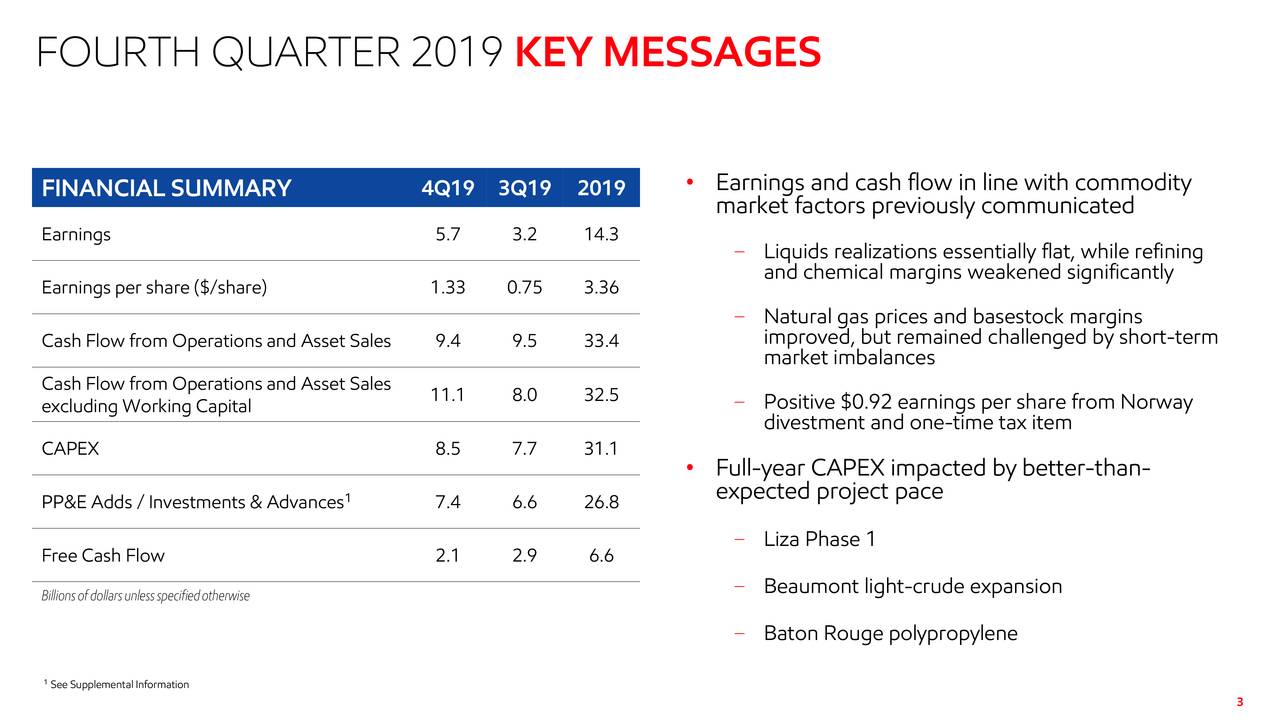

The company generated fourth-quarter revenue of $67bn, down 7% from the year-ago period. Lower oil price reduced its fourth-quarter revenue from the past year period. The company also reported a huge decline in earnings per share despite a $0.92 gain from sales of assets. It had reported earnings of $1.45 per share in the final quarter of 2018.

“Our operations performed well, while short-term supply length in the downstream and chemicals businesses impacted margins and financial results,” said Darren W. Woods, chairman, and chief executive officer.

XOM is Working on Aggressive Growth Strategy

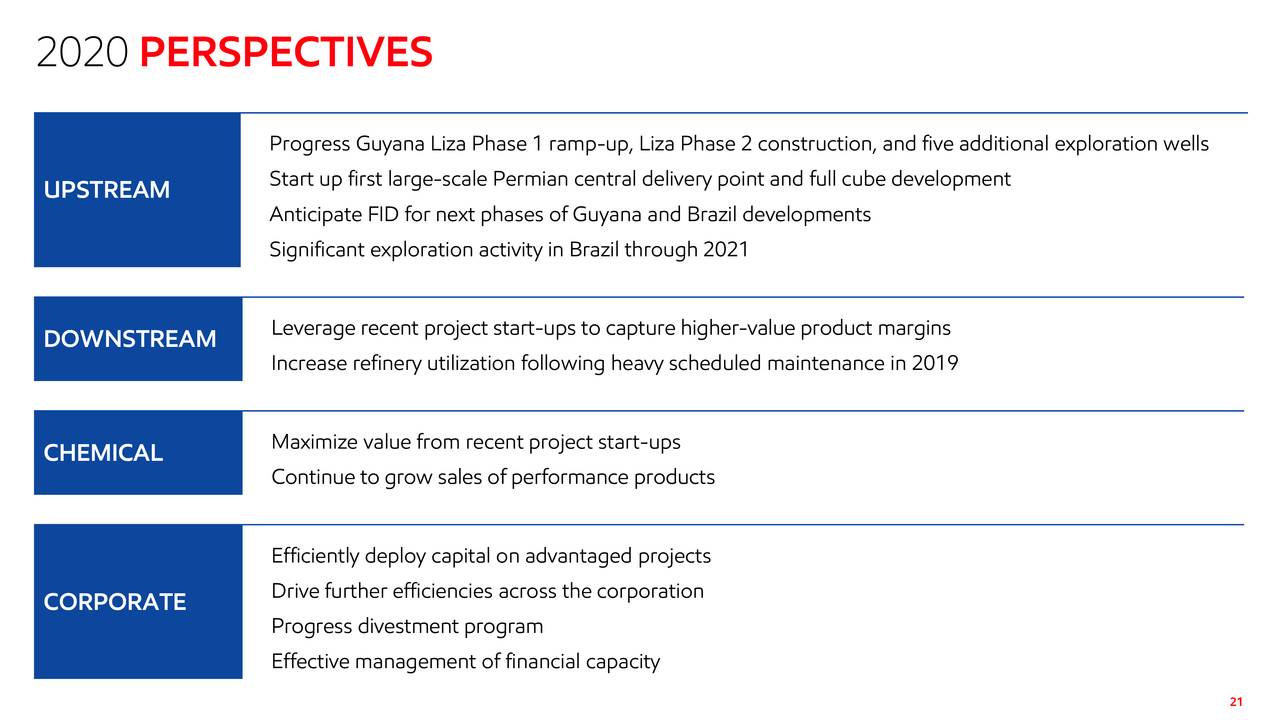

The company generated an operating cash flow of $30bn in fiscal 2019. The asset sales in the past few quarters supported its cash flows. The company is aggressively investing in growth opportunities to enhance its liquid production. XOM management is seeking to enlarge its annual production to 5M bbl/day; the company plans to invest $30bn annually in growth opportunities.

“Even though it appears the market has said ‘we don’t want you to outspend, we want you to do dividends, we want you to do buybacks,’ Exxon is saying ‘we take a longer view than anybody, if you don’t like it, then sell the stock,” Stoeckle said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account