The price of Bitcoin is sliding below $60,000 only two days after reaching that landmark level as news broke about India possibly moving to approve strong legislation against cryptocurrencies.

According to an exclusive report from Reuters, a source close to the government indicated that lawmakers of the fifth largest economy in the world are aiming to criminalise all activities concerning cryptocurrencies including mining, trading, and even plain holding.

The decision would come as part of the government’s agenda to launch a central-bank-backed digital currency while banning the use of private cryptocurrencies.

If such a bill were to be passed, India would become the first among the world’s top economies to impose a ban on holding cryptocurrencies, as other nations like China have only gone as far as to prohibit trading or mining – not possessing.

As of March 2021, India’s largest cryptocurrency exchange WazirX reportedly handled $2.3 billion in monthly trading volumes, representing a 360% jump compared to December last year. Meanwhile, the number of active crypto investors in the country is estimated to be 8 million.

The price of Bitcoin (BTC) reacted quite negatively to the report as it plunged 3.5% on Sunday – the day that the news broke – while it slid as much as 7.5% this morning in early cryptocurrency trading activity to then pare some of those losses as it is currently down 4.3% at $56,497 per coin.

In other news, the Federal Reserve’s Open Market Committee (FOMC) is expected to meet this week and traders will be keeping an eye on potential actions taken by the US central bank to curve the recent spike in Treasury yields – a situation that could affect Bitcoin’s valuation.

If the institution headed by Jerome Powell were to expand its current asset purchase program to support the bond market, chances are that cryptocurrency valuations could jump higher as a result of an expected deterioration in the value of the US dollar.

On the other hand, if the central bank were to remain silent in regards to the situation, bond traders could interpret this as a sign that there is no floor for bonds – which could lead to a sell-off and a corresponding jump in yields (yields move in the opposite direction to bond prices).

If yields were to move closer to 2% territory, riskier instruments – including cryptocurrencies – could face a sizable correction as investors might turn their eyes to the Treasury market to benefit from its decent low-risk interest rate.

What’s next for Bitcoin (BTC)?

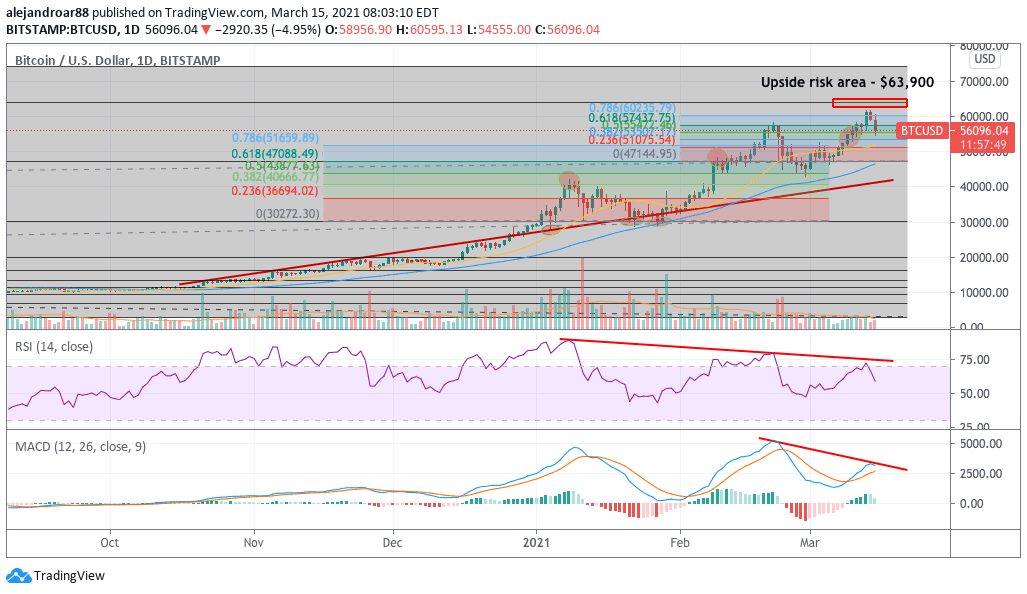

The price of Bitcoin (BTC) advanced near the target that we highlighted in a recent article two days ago to then retreat to its current levels, which indicates that market participants could just be taking a breather while using the India news as an excuse to take some profits off the table.

Interestingly, quant traders spotted a strong inflow to a major cryptocurrency exchange in the past few days, which is often interpreted as a sign of an upcoming decline in the price of BTC as a former holder could be getting ready to dump a sizable position – either by exchanging to fiat or to other crypto tokens.

Meanwhile, from a technical standpoint, there hasn’t been a spike in trading volumes just yet, which means that this could be a healthy pullback for BTC rather than a potential trend reversal signal.

That said, there is a worrying bearish divergence showing up in both the RSI and the MACD as a result of the recent downtick, although the MACD has not yet sent a sell signal to confirm the move.

If that were to happen, chances are that this two-day plunge could extend for a few more days before bargain hunters get back to the table.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account