The market capitalization of Bitcoin (BTC) is surpassing the $1 trillion mark for the second time in its history only 3 days after the United States Senate moved to approve another round of fiscal stimulus for the country’s economy.

The price of the cryptocurrency has been booming for five consecutive sessions now, gaining 11% during that period as it advanced from $48,360 to $54,048 today in early cryptocurrency trading action.

The bulk of this bull run coincides with the approval of another historic $1.9 trillion stimulus bill passed by lawmakers on Saturday – a decision that could have strong effects on the US dollar as the government continues to print money to contain the economic fallout caused by the pandemic.

Meanwhile, the Federal Reserve’s balance sheet has continued to expand lately, with statistics indicating that the central bank printed another $150 billion during the 30-day period ended on 1 March as part of its effort to stabilize the financial markets during this volatile post-pandemic period.

The debasement thesis has been one of the key drivers for Bitcoin’s latest surge, as supporters believe that the decentralized nature of BTC and other crypto tokens should allow them to preserve their value against fiat currencies at a time when central bankers are rushing to print money to prevent chaos in the financial markets.

Moreover, the recent spike in US Treasury yields could end up forcing the hand of the US central bank, as a move near the 2% mark in the 10-year note can prompt a strong intervention that would result in another round of liquidity injected into the markets through the purchase of government and even private bonds.

Interestingly, the latest uptick in Bitcoin (BTC) has come alongside an uptrend in the value of the greenback, as reflected by Bloomberg’s US dollar index, with the benchmark moving 1.1% higher during the same period at 91.968.

For now, the debasement thesis seems to be the strongest argument for higher BTC prices, accompanied by increased institutional adoption. In this regard, Chinese app development company Meitu recently announced that it bought $40 million in cryptocurrencies broken down into $22 million in BTC and $18 million in Ethereum (ETH) to diversify its cash holdings.

What’s next for Bitcoin (BTC)?

The price of Bitcoin has bounced strongly off its 28 February lows, gaining as much as 20% since then against the US dollar as the prospect of the approval of another round of stimulus possibly helped in reversing the downtrend seen back then.

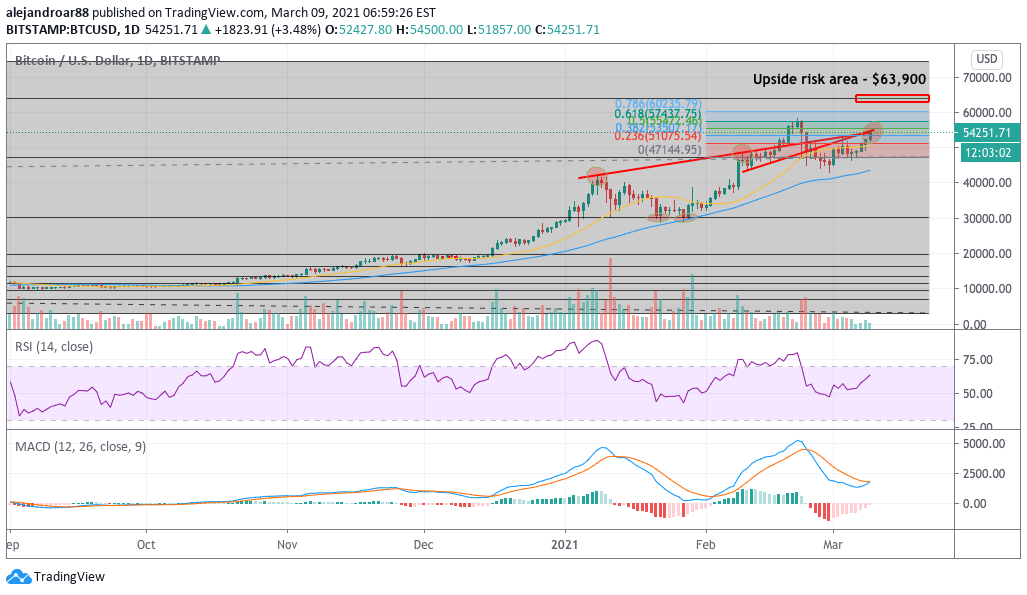

That said, the price action is encountering some though resistance this morning as it is tagging a confluence between the lower and upper trend line of a rising wedge that we previously outlined – a setup that anticipated Bitcoin’s latest downtick.

A rejection of this resistance could lead to a short-term pullback in this latest downtrend while a break could result in the continuation of the bull run – possibly eyeing the coin’s all-time highs from 21 February as a first target.

Meanwhile, if the price move above those levels, chances are that it might eye the $63,900 Fibonacci extension highlighted in the chart.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account