The price of Bitcoin moved higher in early cryptocurrency trading activity after news that Bitcoin miners have been struggling to secure the necessary equipment to keep minting the crypto token amid a shortage in chip units.

An exclusive report from Reuters highlighted that manufacturers of bitcoin mining equipment have not been able to secure as many chips as needed to keep up with an insatiable demand for their ‘miners’, since companies like Taiwan Semiconductor Manufacturing and Samsung Electronic have prioritized other sectors that they have deemed as ‘more stable’.

This disruption in the supply of chips for miner makers like Bitmain has led to a shortage of mining equipment, resulting in increased demand – and prices – for second-hand equipment dramatically.

Bitcoin’s strong rise from the low 10,000s in October to as much a $40,000 per coin in early January has been the main reason behind this short-term uptick in the demand for ‘miners’, primarily led by individuals and businesses in the United States, a country that now accounts for a higher percentage of the global BTC mining output.

Meanwhile, the price of Bitcoin (BTC) has advanced positively in response to the news, booking a 7% gain on Friday after the report was first published, while also advancing 2.4% today at $33,080 per coin.

This temporary shortage could reduce the speed at which more coins are minted around the globe, which would keep supply levels in check at a point when an imbalance marked by a seemingly insatiable demand from both retail and institutional investors could end up fueling the price to new highs in short notice.

What’s next for Bitcoin (BTC)?

The price of Bitcoin has advanced 13% since the year started, although it has also retreated 22% since it hit its $42,000 all-time high on 8 January.

These latest news in regards to a potential shortage in bitcoin mining equipment could catalyze a short-term push for BTC, as the imbalance between demand and supply grows.

Supporting this view, a recent SEC filing from the only exchange-traded fund (ETF) currently offering access to Bitcoin in the United States, the Grayscale Bitcoin Trust (GBTC), stated that the fund had purchased a total of $1.2 billion, or around 35,159.02 BTC, during the quarter ended on 21 January 2021.

That amount, although it only represents roughly 0.2% of Bitcoin’s total market capitalization, is still big enough to move the needle, especially since Bitcoin buyers have been more inclined to hold on to their coins than ever.

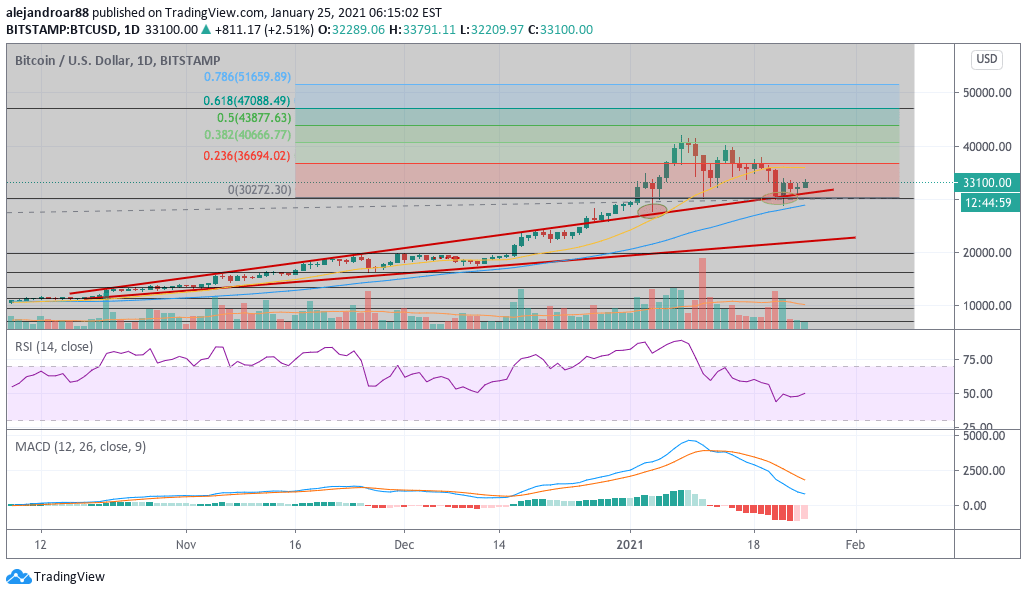

Meanwhile, from a technical standpoint, the price action seems to have bounced off the upper trend line of BTC’s latest parabolic move – an area that shows confluence with Bitcoin’s 1.618 Fibonacci extension dating back to the coin’s 2017 retracement.

In a previous article, we highlighted that this area of support was an important one to watch, as a strong bounce of it could lift the price of Bitcoin shortly after forming a double floor – a bullish pattern that often leads to a short-term spike in the price of a security.

If that were to happen, a first target for BTC could be set at $36,700, corresponding to the 0.236 Fibonacci extension shown in the chart above as well.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account