Bitcoin is eyeing all-time highs for the third time this year as the cryptocurrency keeps advancing today for the fifth consecutive day despite hedge funds managers seeing long positions in BTC as one of the most crowded trades in the markets right now.

Bitcoin (BTC) accumulates a 10% gain in only 5 days after the coin bounced strongly off the $17,500 level between 9 and 11 December while posting a higher low – which indicates that there is significant interest out there from either late or new buyers to buy dips.

Meanwhile, Bitcoin is advancing 1.7% this morning at $19,762 in early cryptocurrency trading activity, partially aided by a weaker US dollar along with the prospect of another round of stimulus from US Congress.

Notably, the Bank of America survey highlighted that shorting the US dollar is the second most crowded trade – followed by Bitcoin – a situation that has contributed to the depreciation of the North American currency while it has also resulted in a higher demand for Bitcoin as investors have started seeing the crypto asset as a hedge against the ongoing fiat currency debasement carried out by central banks during the pandemic.

The result of this survey, although often seen as a contrarian signal, indicates that Wall Street already has Bitcoin on its radar, a notion that coincides with the latest wave of institutional investors who have stepped up to support BTC as an asset class worth considering when building their investment portfolios.

In fact, multiple robo-advisors and passive-investing platforms have already incorporated Bitcoin – and a small selection of other crypto assets – to the asset classes that they typically incorporate in their pre-designed portfolios, effectively creating a new stream of demand coming from investors that have not traditionally seen BTC as an instrument to grow their capital over the long term.

What’s next for Bitcoin (BTC)?

Bitcoin’s strong rebound off the $17,500 is another interesting development in this latest bull run, as the rally has gained some strong legs to keep moving higher.

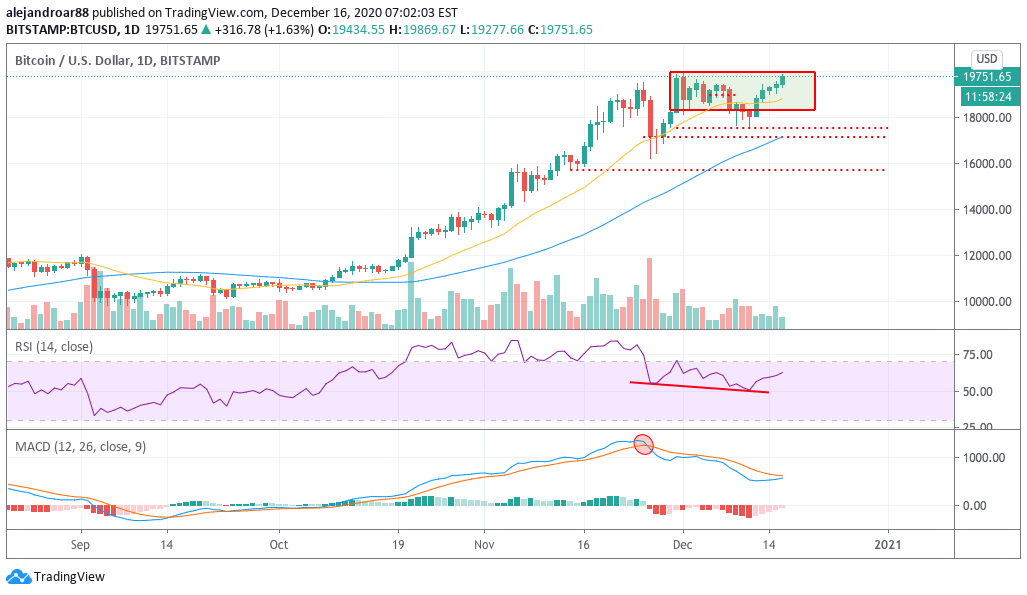

Although BTC stepped out of its consolidation rectangle briefly, the price went back up and it is now stopping at the very top of that formation today although it has not yet touched the intraday all-time highs recorded on 1 December.

Meanwhile, despite this furious 5-day uptick, it is very interesting that the MACD has not yet sent a buy signal, while the RSI posted a lower low despite the trend moving to a higher low.

That particular divergence is a bit troubling as it means that the downward momentum seen by BTC during the 9 December and 11 December period was actually stronger than it was during the big late November drop.

The combination of these two bearish signals – a weaker MACD and RSI – could mean that if the price fails to move above the $20,000 resistance bears might end up taking over the price action as bulls have spend sizable ammo in their latest effort to keep the price from collapsing to a lower low.

If that were to happen, the good news is that the rally has multiple legs to fall back on, including the following:

- $17,500 – intraday low from the early December pullback.

- $17,100 – 3-day closing price seen during the late November correction.

- $15,700 – intraday lows from mid-November.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account