Bitcoin is dropping sharply today in early cryptocurrency trading activity after seeing four consecutive weeks of big gains that ended up pushing its value above the $40,000 level for the first time in its history.

The price of BTC is sliding for a third day, dropping 8.3% so far at $35,054 per coin, following another strong downtick seen yesterday when the cryptocurrency ended up trimming an early 14.7% loss to close the session with a less severe 5% retreat.

Meanwhile, the price has also bounced off this morning’s lows, as BTC lost as much as 15% of its value earlier in the session at $32,330 but then bounced back to nearly $35,000.

Other cryptocurrencies including Ethereum and Litecoin are seeing similar losses this morning, with ETH dropping nearly 14% while Litecoin is down 16.5% as traders continue to take profits from the latest market-wide upward push.

According to cryptocurrency data provider Datamish, nearly $100 million in Bitcoin (BTC) – approximately 2,850 coins – have been liquidated by investors with long positions in the past two days as market players could be perceiving the $40,000 mark as a plausible short-term top for the cryptocurrency.

That said, the number of short positions has not yet climbed in response to the three-day downtick, which indicates that traders are not yet believing that this will be a long-lived downturn.

What’s next for Bitcoin (BTC)?

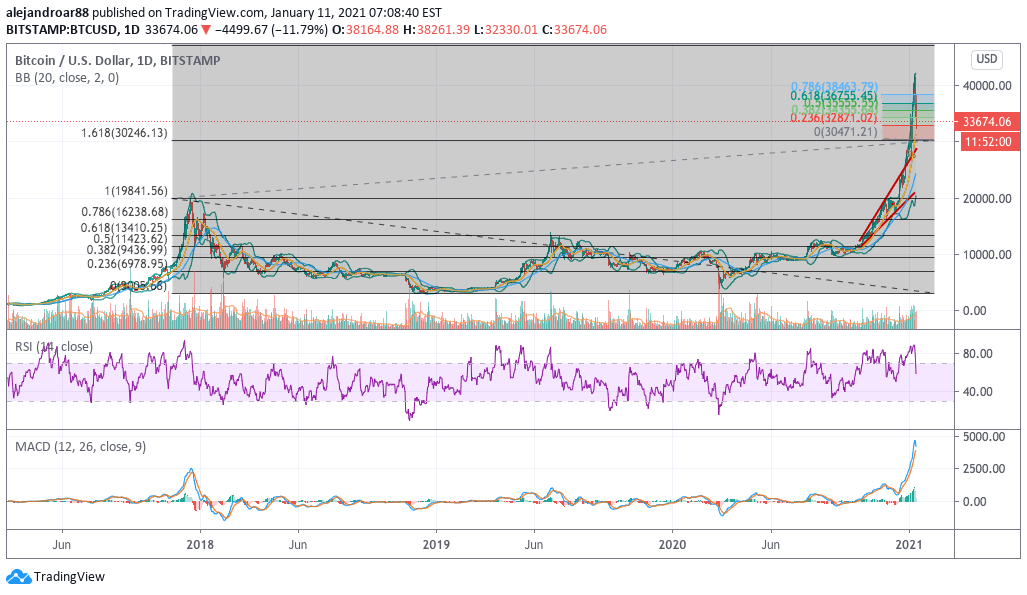

Bitcoin’s latest slide started only a day after the coin surpassed our recent short-term target, as the cryptocurrency reached a 38% extension over its 20-day moving average while it stepped out nearly 2% out of its upper Bollinger band.

Meanwhile, other indicators such as the RSI and the MACD were also flashing strong warning signals as BTC’s momentum seems to have gone too far too fast amid increased interest from both retail and institutional investors.

At this point, the fact that BTC short sellers are not yet ramping up their positions indicates that this was a widely-expected pullback, while the price has bounced strongly off its lows during the past two sessions after experiencing sharp double-digit corrections.

This bullish response to these two last dips is perhaps the most encouraging signal for those holding on to their long positions, as a healthy pullback could help in bringing a new wave of fresh capital towards the cryptocurrency.

Meanwhile, on the technical front, the price seems to have bounced off the 0.236 Fibonacci extension level shown in the chart, although it remains submerged below the 0.5 level – an indication that the downtrend may not be over yet.

If the price were to bounce back above the 0.5 Fibonacci of $35,555, chances are that the bull run might be resumed, once again eyeing to reach the 0.786 target of $38,463 for a 9.7% potential upside.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account