Bed Bath & Beyond stock was trading sharply higher in US price action today after releasing its quarterly earnings. While the earnings were mixed, markets seem impressed with the company’s turnaround plans.

Bed Bath & Beyond reported revenues of $1.95 billion in the fiscal first quarter of 2021 which were ahead of the $1.87 billion that analysts were expecting. However, while the company posted a better than expected topline, its adjusted earnings per share of 5 cents were below the 8 cents that analysts were expecting.

Bed Bath & Beyond first-quarter earnings

Bed Bath & Beyond reported a core sales growth of 73% in the quarter. The company’s comparable sales increased 86% year-over-year. While the metrics look strong, they are among from a lower base as the company’s earnings were affected by the COVID-19 pandemic in the corresponding quarter in 2020. That said, the comparable sales increased 3% as compared to 2019 levels which look encouraging.

Comparable sales rise

Comparable sales are a key metric for retail companies as it shows sales growth at stores which have been operating for at least 12 months. As of 29 May, the company was operating 1,004 stores. The company reported gross margins of 32.4% in the quarter while the adjusted gross margin was 34.9%. The company reported an adjusted EBITDA of $86 million in the quarter which was inclusive of the higher marketing spend in the quarter.

Bed Bath & Beyond returned $130 million to shareholders in the form of share repurchases in the quarter. At the end of the quarter, it had $1.2 billion in cash and cash equivalents.

Bed Bath & Beyond transformation

“We have started the year in a position of strength and are clearly on track to accomplish our goals. 2021 marks the first year of our three-year transformation following the groundwork we laid in 2020 – a year of historic and necessary change for this organization against the backdrop of unprecedented challenges due to COVID-19,” said Mark Tritton, Bed Bath & Beyond’s President and CEO.

Online sales expand

Bed Bath & Beyond is working to enhance its online sales and digital sales accounted for 38% of its sales in the quarter. Brick and mortar companies have been pivoting to e-commerce in a bid to protect their ground from e-commerce companies. Also, a higher mix of online sales helps in margin expansion as companies typically club growing online sales with rationalizing their store footprint. Typically, online sales are a higher margin as compared to physical sales but they also mean massive investments in the short run.

Bed Bath & Beyond second-quarter guidance

Bed Bath & Beyond expects to post core revenues of $2.04-$2.08 billion in the fiscal second quarter of 2021. It said that “Sales also includes planned sales reductions from the Company’s store fleet optimization program of approximately 9% to 10%. On a Comparable Sales basis, the Company expects to achieve growth in the low-single digit range compared to the prior year period.” Bed Bath & beyond expects to post adjusted gross margins of 35-36% in the second quarter which is higher than the corresponding quarter last year.

Bed Bath & Beyond raises guidance

Bed Bath & Beyond raised its full-year 2021 guidance. It now expects to post revenues between $8.2 billion to $8.4 billion in the year which is $200 million higher than its previous guidance. “We are re-establishing our authority in home, recapturing market share and unlocking our full potential. We continue to execute quarter after quarter, and we are pleased to be raising our full year guidance outlook today,” said Tritton.

The company said that it expects to post adjusted EBITDA of $520 million to $540 million in the fiscal year 2021 which is ahead of the previous guidance of $500-$525 million.

Stock surges

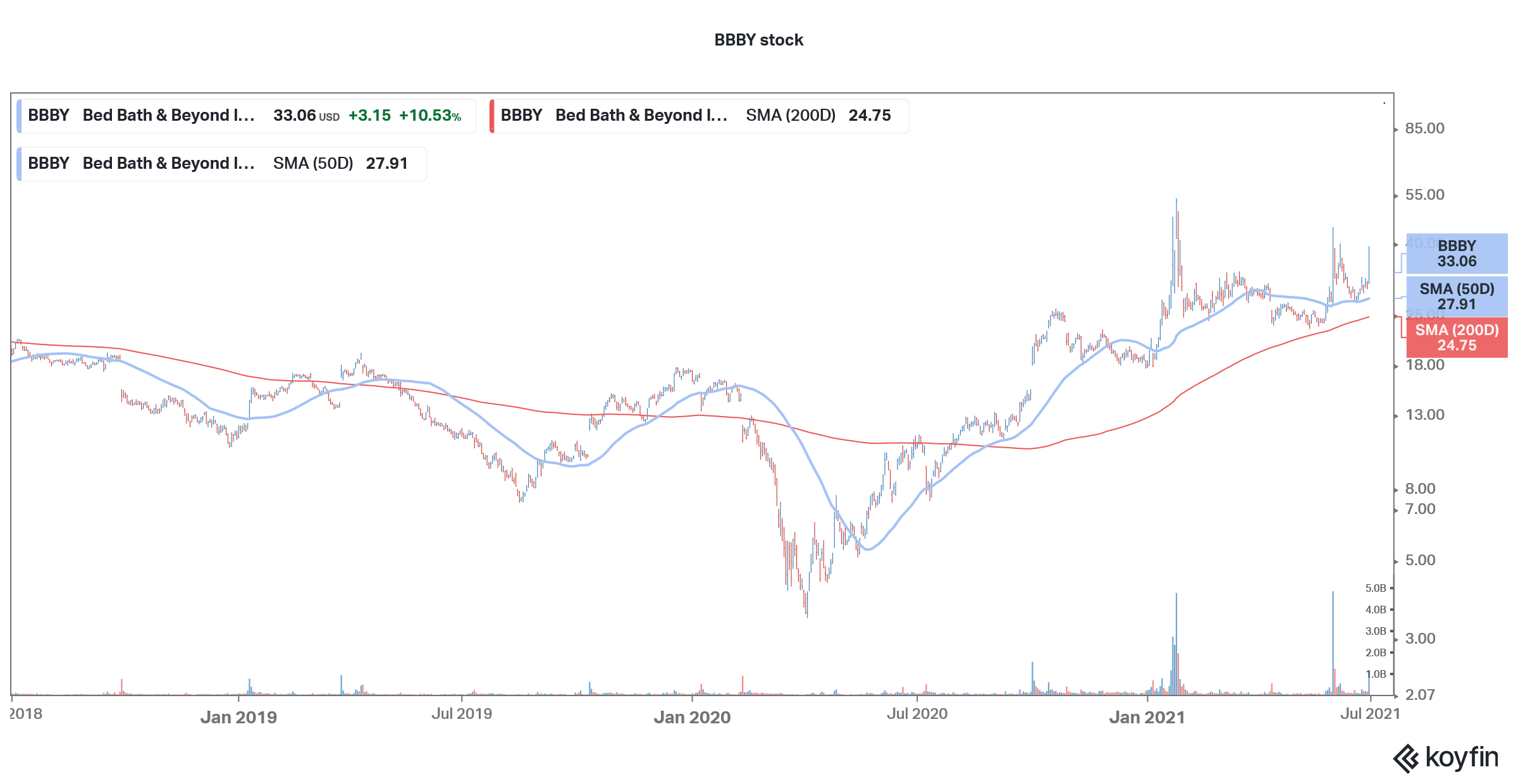

While Bed Bath & Beyond missed bottomline estimates, markets cheered the strong topline growth and the higher 2021 guidance. The company is among the meme stocks that were targeted by Reddit traders in 2021. The stock is up 84% so far in 2021. While brokerages are apprehensive about the rally in some of the meme stocks like GameStop and AMC Entertainment, they seem to be bullish on Bed Bath & Beyond stock.

CFRA upgraded the stock

CFRA upgraded the stock

Earlier this week, CFRA upgraded Bed Bath & Beyond stock to a buy and assigned a $40 target price. “We are confident the company is on right track with a turnaround plan that should generate higher EBITDA in FY 22,” said CFRA analyst Kenneth Leon.

He added, “We think BBBY can execute major brand introductions that will boost the digital experience, ration stores by closing low demographic locations, remodel most stores, and bring on new stores all in the new store layout with a website that showcases eight recently introduced brand product categories.”

You can invest in Bed Bath & Beyond stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

CFRA upgraded the stock

CFRA upgraded the stock