Taiwan Semiconductor Manufacturing Company or TSMC has increased its investment in the US and would now set up two chip plants in the country. Apple CEO Tim Cook said that the company would use chips produced at TSMC’s Arizona plants.

The event was also attended by President Joe Biden whose administration’s CHIPS and Science Act helped created the environment for TSMC’s $40 billion investment. The plants, at full capacity, would produce 600,000 wafers annually which the National Economic Council believes would suffice US demand and end the country’s reliance on chip imports.

Apple to use chips from TSMC’s Arizona plant

Meanwhile, Cook termed the event as “an incredibly significant moment.” He added, “And now, thanks to the hard work of so many people, these chips can be proudly stamped Made in America.”

While saying that it is only the beginning, Cook said, “Today we’re combining TSMC’s expertise with the unrivaled ingenuity of American workers. We are investing in a stronger brighter future, we are planting our seed in the Arizona desert. And at Apple, we are proud to help nurture its growth.” Cook tweeted that Apple would be the largest chip buyer from the plants

President Biden was also upbeat about TSMC’s chip plants

President Joe Biden was also upbeat about the plant. He said, “Apple had to buy all the advanced chips from overseas, now they’re going to bring more of their supply chain home.” Like his predecessor Donald Trump, Biden is also looking to revive US manufacturing.

However, while Trump cut the US tax rate to spur investment and imposed tariffs on several imports, including billions of dollars of Chinese goods, Biden has taken a different approach. The Biden administration is using a carrot-and-stick approach to lure companies to set up manufacturing plants in the US.

CHIPS Act

The CHIPS Act promised billions of dollars in incentives to chipmakers for setting up new plants in the country. Similarly, the Inflation Reduction Act of 2022 also had billions of dollars in aid to spur green energy adoption in the country. At the same time, in order to be eligible for the EV tax credit, the cars would need to be assembled in North America. There are also sourcing requirements for batteries.

Toyota doubled down its US investment in an apparent bid to qualify for the EV tax credit. Notably, Apple is also working on an electric car project which is codenamed Project Titan. Reports suggest that the company has further delayed the project and it is now expected only in 2026.

EVs and autonomous cars could be a key driver for Apple as the target market for mobility is way above that of consumer gadgets. Currently, Tesla is the market leader in the US EV market and the runner-up globally. The company has however lost market share in the US as legacy automakers have ramped up their EV production.

Apple is facing supply chain issues

Meanwhile, TSMC’s $40 billion investment in the US comes at a time when China’s COVID-19 restrictions have exposed the vulnerability of US supply chains, including that of Apple.

Last month, Apple warned that its iPhone 14 shipments would be hit due to the COVID-19 restrictions in China. Providing an update on the supply of iPhone 14, Apple said, “COVID-19 restrictions have temporarily impacted the primary iPhone 14 Pro and iPhone 14 Pro Max assembly facility located in Zhengzhou, China. The facility is currently operating at significantly reduced capacity.”

It added, “We are working closely with our supplier to return to normal production levels while ensuring the health and safety of every worker.”

After widespread protests, China did relax its COVID-19 restrictions. However, US companies are nonetheless contemplating diversifying their supply chain. Apple is reportedly looking to increase sourcing from Vietnam and India. India is offering various incentives to encourage electronics manufacturing. While the country is a major services exporter, it lags behind China big time when it comes to manufacturing.

Meanwhile, Counterpoint Research said that Apple would take years to diversify its supply chain from China.

Apple iPhone sales hit a record in the September quarter

Global shipments of both smartphones and PCs fell by double-digit in the third quarter. However, Apple said that iPhone sales increased almost 10% YoY to $42.63 billion in the quarter. The metric trailed analysts’ estimates of $43.21 billion though. On the company level, Apple’s September quarter revenues as well as profits beat estimates. Also, it was a new September quarter record in terms of iPhone sales as well as overall sales.

The iPhone 14 production issues have come at possibly the worst time for Apple as it would impact Apple’s sales in the December quarter. The quarter is seasonally strong due to holiday shopping. Several buyers were not able to buy iPhone 14 during the Cyber Week sale due to unavailability.

Analysts see iPhone supply easing

Meanwhile, analysts see Apple’s supply chain now getting better. Yesterday, UBS reiterated Apple stock as a buy. It said, “Utilizing UBS Evidence Lab data that tracks iPhone availability across 30 countries, wait times across most markets including the U.S. and China improved relative to both last week and two weeks ago indicating the supply chain disruptions are easing on the margin.”

JPMorgan also echoed similar views and said that its tracker shows that the worst is over for Apple’s supply chain woes. Morgan Stanley has a more nuanced view and said that the supply challenges would not lead to demand destruction and the sales would get shifted to the March quarter.

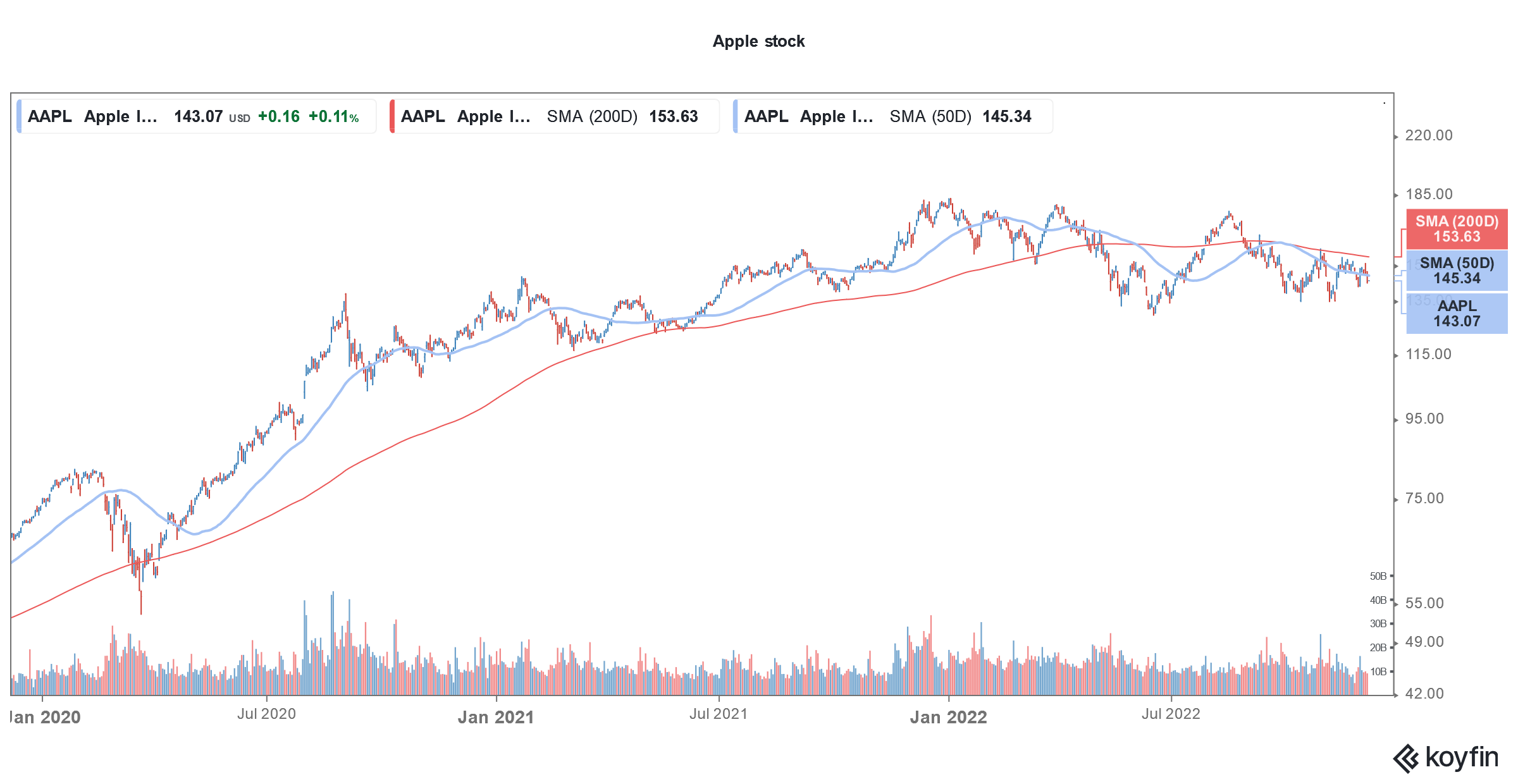

All said markets saw Apple as a safe bet which is also visible in its price action. The stock is outperforming FAANG peers this year. However, the recent weakness in Apple stock is reminiscent of the fragility of its supply chain and exposes the over-reliance on suppliers in China

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account