US President Donald Trump and more than 200 House lawmakers backed proposals for an additional $25bn in federal aid for the airline industry last week, but analysts fear that may not be enough to ride out the pandemic.

During an interview with CNBC’s Trading Nation Steve Chiavarone from Federated Hermes and Matt Maley, chief market strategist for Miller Tabak, shared their views as to why this relief may still fall short of what these companies need to withstand the turmoil.

United Airlines, Southwest, Delta, American Airlines and JetBlue moved higher last week after the possibility of the extra cash was put on the table.

Airlines will need more money to survive the pandemic

Chiavarone highlighted the fact that carriers “are of strategic importance to the nation”, which plays in their favor in terms of getting further financial assistance.

However, the analyst emphasized that he does not think this $25bn relief will cover their costs, especially as the virus situation persists with airlines being unable to recover until that changes.

“I think it makes sense [to provide stimulus]. Is $25bn enough? Who knows? You may have to come back for another round”, said the Federated Hermes portfolio manager on Friday.

With air traffic still a quarter of what it was before a year ago in July and a slower-than-expected recovery reflected by data from the Transportation Security Administration (TSA) airlines still have a long way to go before they see a significant recovery in demand. Most observers say it will take between three and four years to hit 2019 revenues.

Meanwhile, Matt Maley said although the NYSE Airline Index (XAL) has dropped from its June peak, it is trading at a higher level than it was right after the pandemic sell-off took place.

“The thing that’s positive is that this range that we’re in now, the second range we’ve been in, is at a higher level. So we’re seeing a higher low and that bodes well for it”, said Maley.

How are airline stocks doing lately?

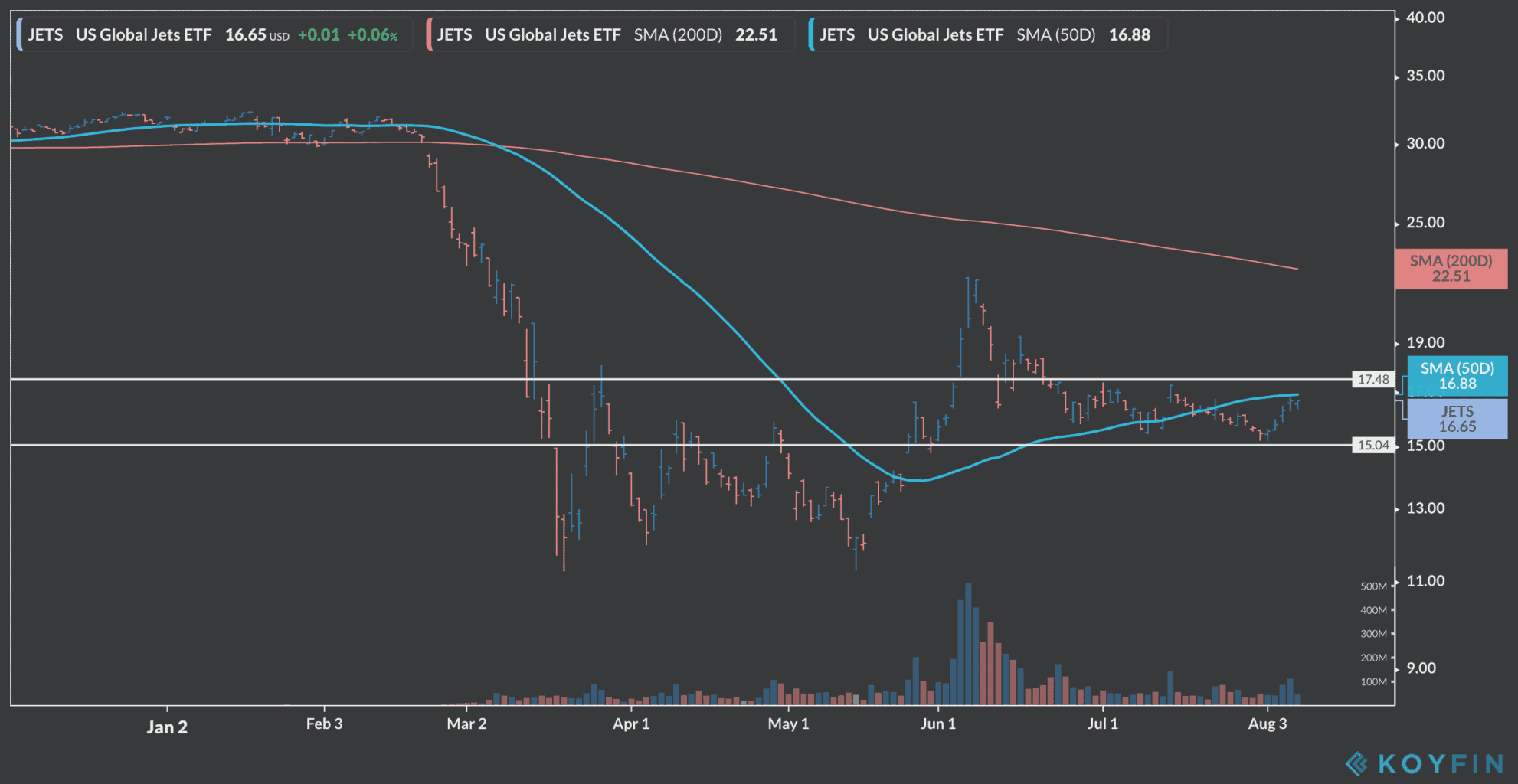

The US Global Jets ETF (JETS) has been trading within a relatively compressed range between $17.5 and $15 since it went down from its post-pandemic peak of early June, as the virus situation in the US continues to weigh on the price of airline stocks.

In the next sessions the price of JETS will be closing in on the ETF’s 50-day moving average of $17 and then it will have to break through a $17.5 resistance level to prove that some positive momentum is actually building up.

However, it is hard to see airlines going higher than perhaps their June peak, at least until the coronavirus situation in the US is successfully contained.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account