AMC stock defied financial theory yesterday after seeing its value rise by more than a quarter on the very day that the firm announced the sale of 164.7 million shares – a move that effectively diluted the stock.

AMC shares advanced 26% during yesterday’s stock trading session in New York, ending the day at $4.42 per share, while they are trading 10% higher in pre-market action this morning.

Meanwhile, the stock of the pandemic-battered American movie theater operator also ticked higher the day before yesterday, initiating what could be another epic short-squeeze of the likes of GameStop (GME), which surged almost 300% since 11 January after the firm announced changes to its Board of Directors.

This move in GameStop, one of Wall Street’s most shorted stocks amid the company’s fundamental weaknesses, has effectively pulled a short-squeeze – a move that aims to catalyze short-term spikes in the price of a security by forcing short-sellers to cover their positions by buying the stock after a strong uptick.

A similar situation can now be expected for AMC stock – also a heavily shorted security – if retail traders organize and jump in to buy the stock.

This view is reinforced by the fact that the stock furiously advanced despite the dilutive effect of yesterday’s share offering, with the company selling new shares at a price of $3.07 per share – roughly 12.5% lower than its closing price in the day that preceded the issuance.

On the other hand, it is also plausible to think that traders might just be reacting positively to the fact that the company effectively raised $506 million in equity along with a total of $411 million in debt through a European revolving credit facility – a liquidity injection that could ensure the company’s survival until the pandemic situation fully subsides.

In regards to the deal, AMC’s Chief Executive Adam Aron commented: “This means that any talk of an imminent bankruptcy for AMC is completely off the table”.

What’s next for AMC stock?

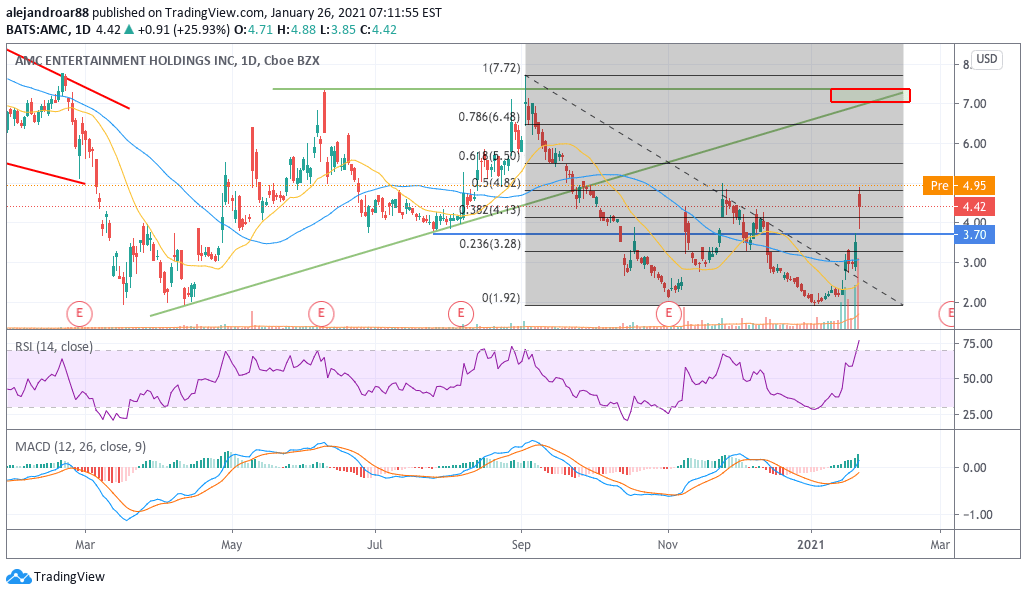

Given the percentage of short interest in AMC stock, currently standing at around 60% and 70% of its float, a short-squeeze of the likes of that seen by GameStop shares could end up pushing the stock price to the upside risk area highlighted in the chart.

If such a target were to be hit, traders could book a 57% short-term gain based on yesterday’s closing price, or 42% based on this morning’s pre-market quote.

It is, of course, unclear if the situation will get as wild as it has been for GameStop shares, but considering the positive momentum that the stock is seeing and these upbeat comments from the company’s CEO, chances are that AMC could be the next target for retail investors who appear to be ready to squeeze short-sellers out of their positions in a heartbeat.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account