AMC Entertainment stock was trading sharply higher in early price action today as US stock markets look to recoup their losses from yesterday.

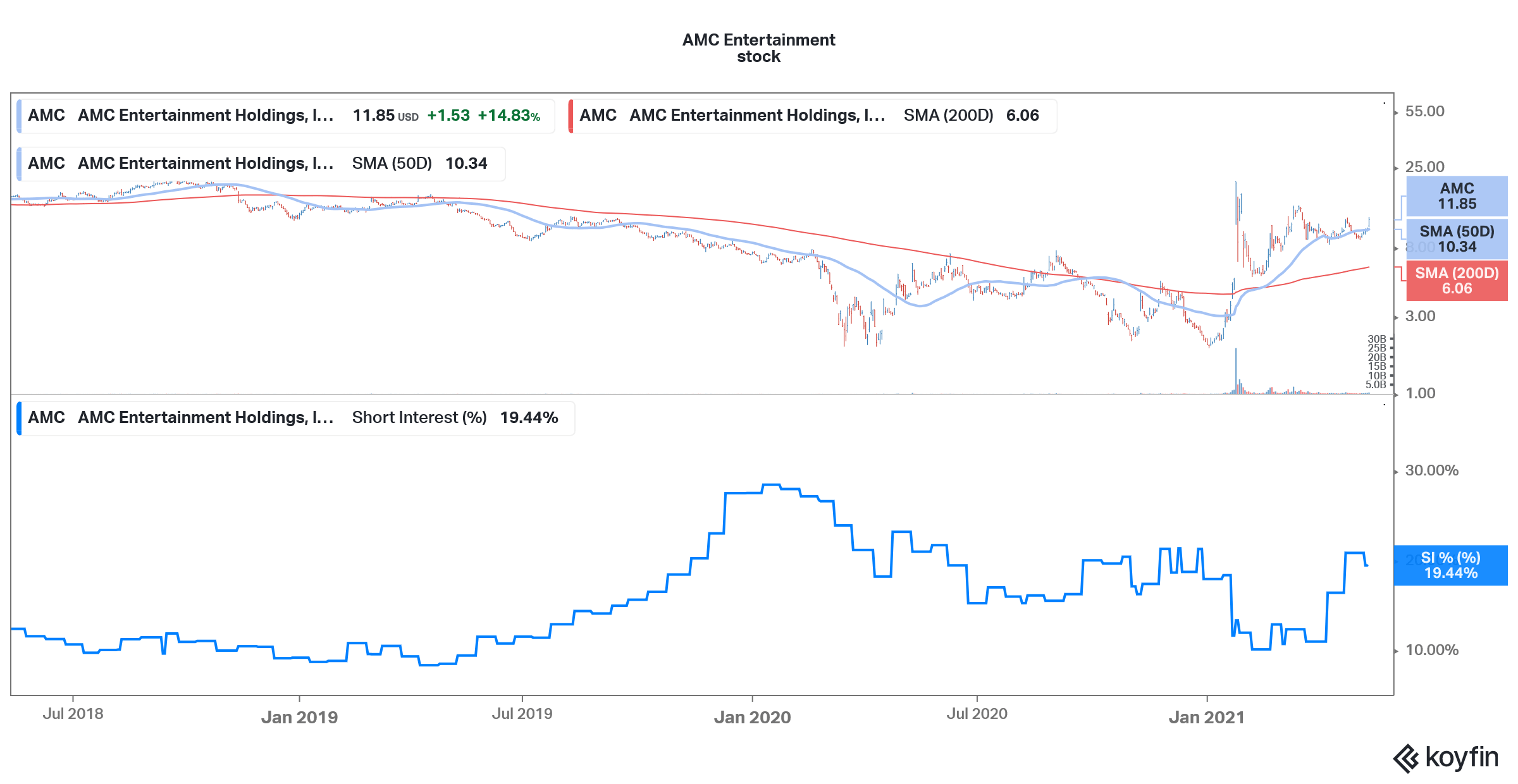

AMC Entertainment stock was among the favorite in the Reddit group WallStreetBets. The community of mainly retail traders took on the mighty Wall Street hedge funds and triggered an epic short squeeze in many stocks including AMC Entertainment, GameStop, and BlackBerry. The frenzied volatility in GameStop also caught the US SEC’s (Securities and Exchange Commission) eye and popular trading app Robinhood had to temporarily halt trading in some stocks.

WallStreetBets pumped AMC Entertainment stock

Meanwhile, like all the stocks pumped by WallStreetBets, AMC Entertainment is trading at a big discount to its 52-week highs. However, the company capitalized on the rise in its stock price and has raised a lot of cash by selling shares.

AMC Entertainment’s CEO Adam Aron acknowledged the faith that retail investors have put in the company. “These individual investors likely own a majority of our shares,” said Aron during the earnings call. He added, “They own AMC. We work for them. I work for them.”

Many retail investors who are bullish on AMC Entertainment stock call themselves “apes” based on the meme on the movie “Rise of the Planet of the Apes.”

Adam Aron

According to Aron, “Before when I wanted to talk to the company’s ownership, I could fly to Beijing and I could sit down with three or four people and they have 75% of the votes.” He added, “It’s going to be a little different now … so you’re going to see a lot more outreach to literally millions of investors in our company and it’s going to be quite public.”

Since the pandemic began, AMC Entertainment has raised $3 billion through a mix of debt and stock issuance. The company also got concessions from landlords and lenders and secured $150 million from governments in Europe. AMC Entertainment also sold some non-core assets and raised $80 million through asset sales.

Notably, AMC Entertainment was planning to seek approval from shareholders to raise more cash by selling shares but has since dropped the plans.

AMC Entertainment cash burn

The capital raise has helped it survive the cash burn which was over $100 million per month in the first quarter. The company expects the monthly cash burn to fall to $50 million in the third quarter. However, it expects to become cash neutral in the fourth quarter.

The response to new movie releases has been encouraging and if occupancy levels increase further in the second half of the year it would help lift AMC Entertainment’s earnings.

However, It would not be prudent to base the long-term outlook for moviegoing based on the release of few movies. More than a year into the COVID-19 pandemic, there is certainly huge pent-up demand for moviegoing. However, over the medium to long term, it remains to be seen how many consumers prefer moviegoing over streaming.

Streaming versus moviegoing

That’s said, it won’t be possible for streaming to fully replace moviegoing which is an experience in itself. However, at least for some consumers, streaming could be a good alternative to moviegoing.

For AMC Entertainment, the biggest headwind is the massive debt and equity issuance that has increased its debt pile and the outstanding shares. MKM Partners is among those who are bearish on the stock. MKM Partners analyst Eric Handler assigned a $1 target price to AMC Entertainment and according to his forecasts, the company’s adjusted EBITDA needs to rise 16% above the previous high to justify the valuation.

All said, while AMC Entertainment looks a good reopening stock, its current valuation multiples look on the higher side.

You can trade in AMC Entertainment stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account