Amazon (NYSE: AMZN) has overhauled its delivery network to optimize the mechanism which would not only lead to lower costs for the company but would also lead to faster deliveries for customers.

The company, which has historically worked on a national model and transported goods across the country, is now moving to a regional model.

The Wall Street Journal reported that Amazon has created eight regions across the US that mostly work self-sufficiently. The company said that 76% of the customer orders are now fulfilled within the region which is 14 percentage points higher than it was a year back.

Amazon optimizes delivery mechanism

Udit Madan, Amazon’s vice president of transportation said “When we offer faster speeds, customers are more likely to buy something.” Madan added that repeat customer orders also rise with faster deliveries.

Amazon’s warehouse footprint expanded during the COVID-19 pandemic as online sales surged.

Madan said that the increase in its warehouse capacity enabled it to move to the new delivery mechanism.

He added, “The doubling of footprint really allowed us to have a lot more facilities that were closer placed to customers.”

Amazon said that it has reduced “touchpoints” by 15% while has cut the distance a product travels from fulfillment centers to customers is down by 12%.

Amazon is witnessing a growth slowdown

The company was among the so-called “stay-at-home” winners and its sales rose 38% and 22% respectively in 2020 and 2021.

However, its sales growth slumped below 10% in 2022 amid the general slowdown in retail spending which was further compounded by higher footfalls and sales at physical retail stores.

AMZN stock fell after Q1 2023 earnings

The growth slowdown continues into 2023 and its sales growth was only about 9% in Q1 2023.

Looking at the different business segments, the company’s North America segment posted revenues of $76.9 billion – up 11% as compared to the corresponding quarter last year. Its International segment’s sales however rose only 1% to $29.1 billion.

The segment suffered from adverse currency movements and in constant currency terms, its sales rose 10%.

AWS sales rose 16% YoY to $21.4 billion. It is the slowest pace of growth in the segment. Also, for the past three quarters, AWS revenue growth has fallen to new lows.

The stock fell after the earnings release on fears of cloud slowdown and tepid guidance.

Cloud slowdown is hurting Amazon

Amazon expects its sales in the second quarter to be between $127 billion-$133 billion which would imply a YoY growth of 5-10%. The company forecast operating income between $0-$5.5 billion for the second quarter.

During the earnings call, Amazon CFO Brian Olsavsky said, “AWS sales and support teams continue to spend much of their time helping customers optimize AWS spend so they can weather this uncertain economy.”

He said, “As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter.”

Olsavsky warned, “We are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.”

Amazon is cutting costs

Like fellow tech peers, Amazon is also cutting costs amid slowing growth. It has announced two rounds of mass layoffs which impacted 27,000 corporate roles. In addition, last year it also fired warehouse employees as it found itself overstaffed.

Amazon has also paused the construction at its HQ2 in Virginia in an apparent bid to cut costs.

Wall Street analysts on AMZN earnings

While AMZN stock crashed after the Q1 2023 earnings release, Wall Street analysts mostly remain bullish on the stock.

Bank of America’s Justin Post maintained his buy rating on Amazon while raising the target price to $139.

“We are encouraged with retail progress and likely share gains and note Amazon’s investment cycle history suggests room for more margin upside,” said Post.

Goldman Sachs’ Eric Sheridan also reiterated similar views and said “With a nod to that market debate, we would focus investors’ attention to what increasingly looks to be a multiple year margin improvement story for AMZN as a much more material driver of stock price compounding.”

Notably, Amazon admitted to overinvesting in capacity amid the pandemic-fueled sales growth.

The overinvestment would also mean that in the near to medium term, it would need to spend less on capacity expansion than it would have otherwise done.

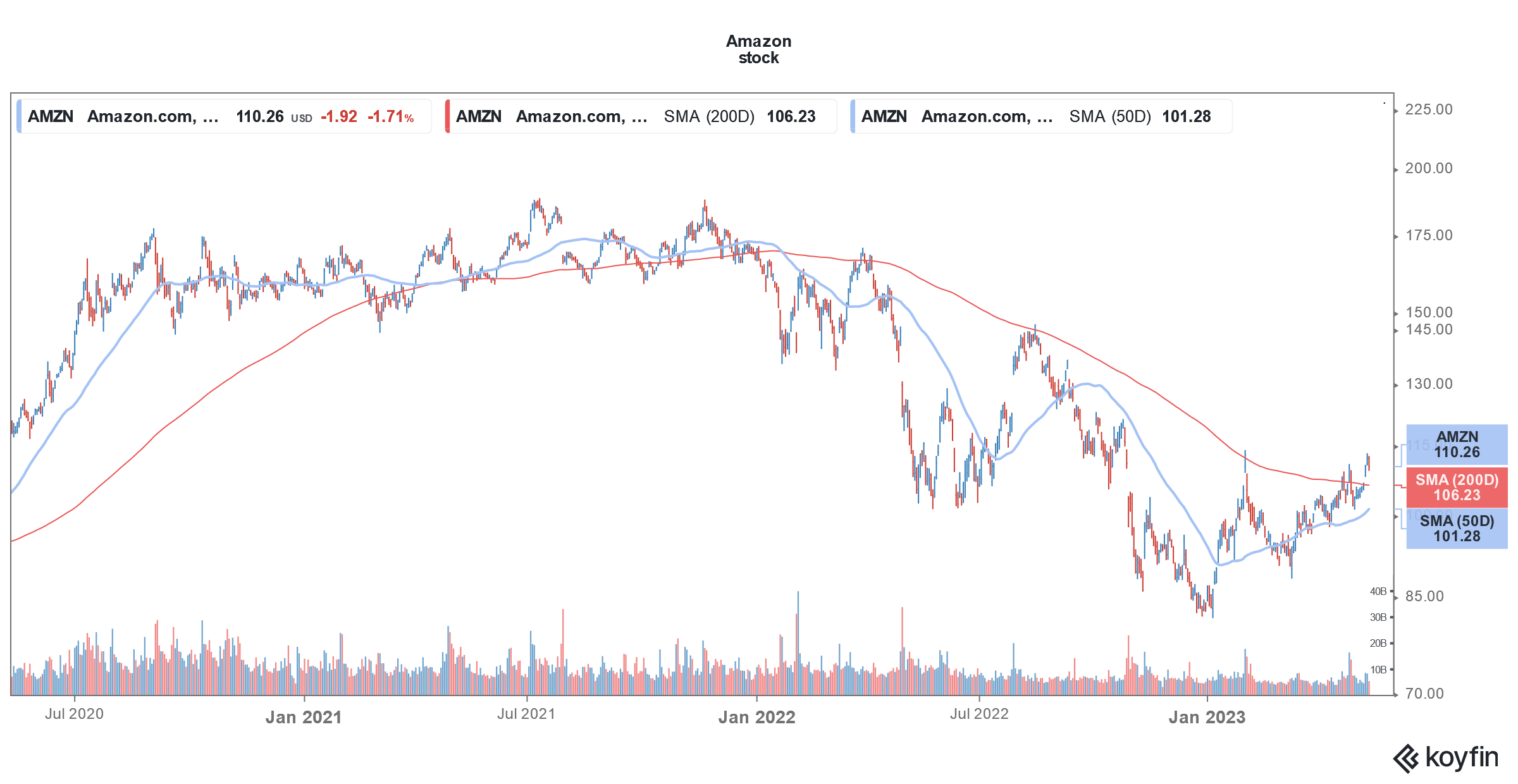

Amazon stock has recovered in 2023

Amazon stock fell almost 50% last year and was the third worst-performing FAANG stock of the year. It was barely in the green in 2021 and underperformed the FAANG peers by a wide margin.

In 2021, Amazon looked set to become a $2 trillion company but last year, its market cap fell even below $1 trillion. It became the first company ever to lose $1 trillion in market cap. Apple too joined it on the dubious list after the stock crashed on the first trading day of 2023.

Meanwhile, the stock has somewhat in 2023 and was particularly strong over the last two weeks. AMZN is now up 28.5% for the year and is outperforming the wider markets. It however remains well below its all-time highs like many other tech companies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account