US stock futures are slightly lower today in early futures trading action after world leaders reached a preliminary agreement on the implementation of a minimum global corporate tax rate while markets eye the release of May’s inflation numbers.

On June 5, the United Kingdom’s Finance Minister Rishi Sunak and the US Treasury Secretary Janet Yellen announced that the group of countries known as G-7 had reached an agreement to establish a minimum 15% global corporate tax rate.

The deal would be further pushed during an upcoming G-20 meeting scheduled to take place in July to be later on presented and promoted to more than 135 countries as a solution to level the playing field among nations while avoiding tax evasion at the corporate level.

Meanwhile, the markets will be eyeing Wednesday’s meeting of the European Central Bank (ECB), with no modifications expected to be made by the institution to benchmark interest rates although the press release from the meeting and the subsequent minutes will be closely scrutinized for chatter about a potential tapering of the ECB’s asset purchase program or regarding the situation on the inflation front.

Moreover, Thursday will be an important day for the markets as the US Bureau of Labor Statistics will publish what would be a thoroughly dissected inflation report, with economists expecting a 4.7% jump in the annualized advance of the consumer price index (CPI) – a figure that would be 50 basis points higher than last month’s report.

Similarly, core inflation for the past 12 months is expected to advance to 3.4% or 40 basis points higher than last month’s reading while the month-on-month variation of the CPI and Core CPI index is expected to land at 0.4%.

US stock futures are muted ahead of these important data points with E-mini futures of the tech-heavy Nasdaq 100 index heading down 0.14% at 13,749 while futures of the Dow Jones Industrial Average are up 0.14% at 34,789. E-mini futures of the S&P 500 are unchanged.

Meanwhile, the markets kicked off June with gains as the three major indexes advanced 0.6% while both the S&P 500 and the Dow Jones Industrial Average finished the shortened week near record levels.

This week, more than $100 billion in long-dated US Treasury bonds including 10-year and 30-years issues will be auctioned on Wednesday and Thursday respectively. Even though 10-year yields declined 0.5 basis points last week, a combination of weak demand for long-dated Treasuries and above-expected inflation readings could support a move higher for yields – a situation that could put pressure on equity markets.

What’s next for US stock futures?

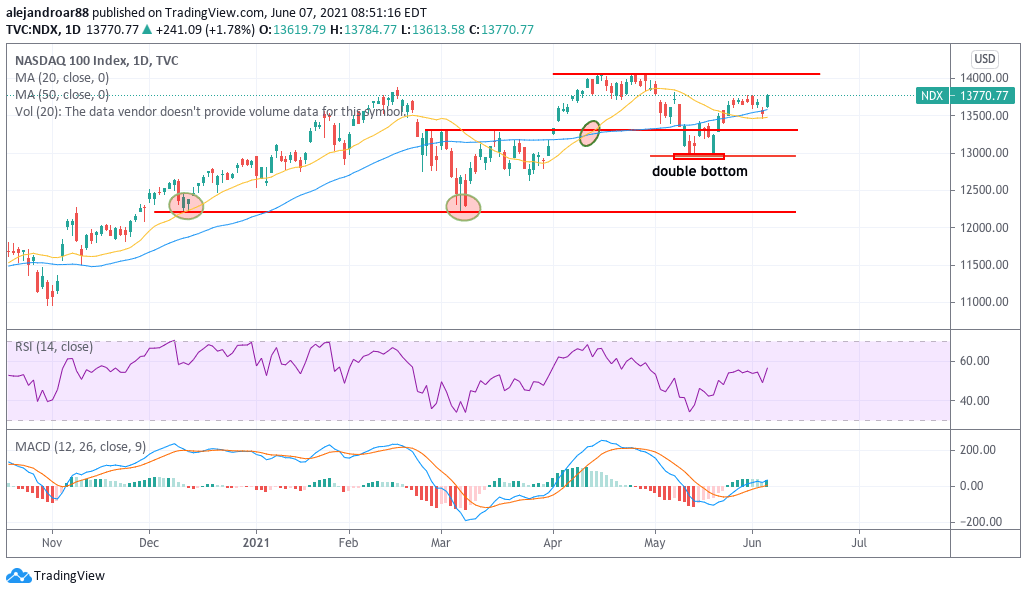

The outlook for the Nasdaq 100 index continues to be bullish on the back of a double-bottom price action pattern we spotted last week while momentum readings remain positive despite the headwind of a global corporate tax.

“I would assume that it [the tax deal] is not helping the market in the sense that these Internet giants are going to be taxed more … it has an impact on sentiment in equity markets, but the reality is, it has already been priced in” told Sebastien Galy, senior macro strategist at Nordea Asset Management, to Reuters this morning.

The Nasdaq’s short-term moving averages posted a death cross last week, which indicates that the uptrend could see some bumps along the way. For now, a weekly target for the tech-heavy index could be set at 14,050 for a 2% gain while the downside risk area could be set at 13,480 – the index’s 20-day moving average.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account