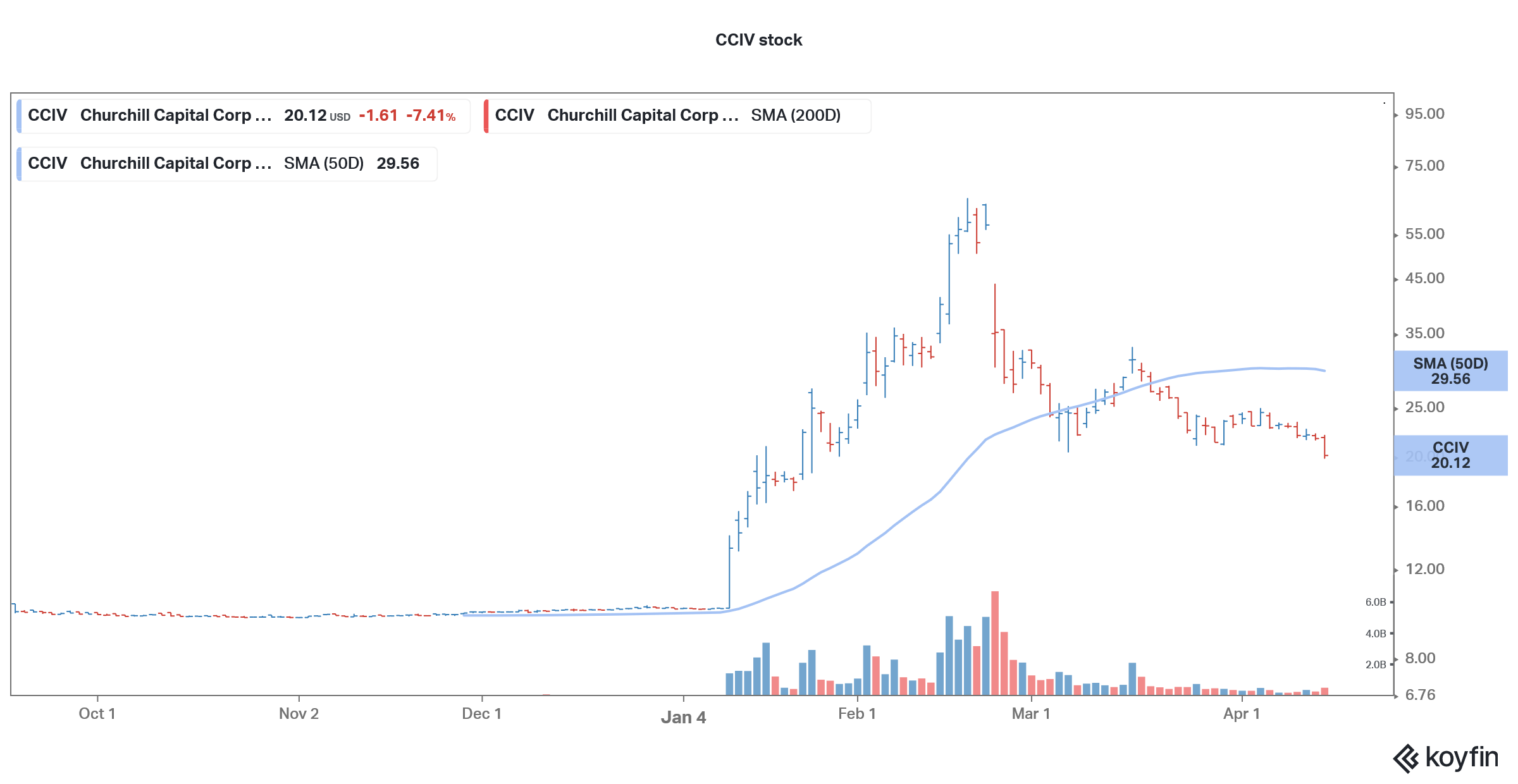

Churchill Capital IV (CCIV) stock fell 7.4% yesterday and is now down almost 70% from its 52-week week highs. The stock has been on a free fall ever since it announced a merger with Lucid Motors.

CCIV SPAC (special purpose acquisition company) stock had surged to almost $65 or a 550% premium before the merger with Lucid Motors was officially announced. The irrational exuberance over CCIV stock exemplified what was horrifically wrong with SPACs.

CCIV SPAC set to merge with Lucid Motors

Investors were betting on these blank cheque companies only based on the reputation of the sponsor and rumors floating around the merger targets. While all SPACs are speculative before the merger, the sharp rise in CCIV stock was hard to justify by all means of imagination.

This is what exactly happened when CCIV officially announced the merger with Lucid Motors. The merger transaction involved a $2.5 billion PIPE (private investment in public equity). To be fair to CCIV sponsors, they priced the PIPE at $15 or a 50% premium over CCIV’s IPO price of $10. The usual convention is to price the PIPE at the IPO price is $10 in almost all cases with Bill Ackman’s Pershing Square Tontine Holdings being an exception as it priced the SPAC IPO at $20.

CCIV PIPE investment

But then, while CCIV priced the PIPE at a premium to its IPO price, it was at a significant discount to the then stock price. The massive PIPE investment means a big dilution for CCIV shareholders and at the then stock price, Lucid Motors had a market capitalization of over $60 billion which was more than what some of the mainstream automakers like Ford are valued at.

Markets sent CCIV stock south due to the massive valuation for Lucid Motors that the stock price was implying. Here it is worth noting that Lucid Motors is currently not making any current revenues and would start delivering its Lucid Air only by the end of this year. Nikola, another electric vehicle startup company that went public through a SPAC merger last year, is also expected to start delivering vehicles this year.

Nikola had also tumbled after the SPAC merger

Nikola stock has also tumbled since the SPAC merger and the fall was only accelerated after Hindenburg Research accused the company of fraud. “We have gathered extensive evidence—including recorded phone calls, text messages, private emails and behind-the-scenes photographs—detailing dozens of false statements by Nikola Founder Trevor Milton. We have never seen this level of deception at a public company, especially of this size,” said Hindenburg.

Nikola denied the allegations and, in its release, called it “a false and defamatory report” with “opportunistic timing.” Incidentally, Hindenburg Research made the allegations days after General Motors announced a $2 billion investment in Nikola. However, as an aftermath of the allegations, the SEC opened an inquiry against Nikola while its founder Trevor Milton had to quit the company. General Motors also scaled down its partnership with Nikola after the allegations.

Coming back to Lucid Motors, it is led by a former Tesla engineer Peter Rawlinson and many compare Lucid Motors to Tesla. Lucid Motors is targeting premium EV cars like NIO but would pivot towards affordable cars in the future.

CCIV stock is falling

Now, there has been a sell-off in all electric vehicle stocks and CCIV is no exception. The euphoria over electric vehicle stocks is coming down now as legacy automakers are now expected to give a tough fight to pure-play electric vehicle companies like Tesla, NIO, and Lucid Motors.

Earlier this week, Mercedes-Benz unveiled its EQS. The all-electric model is expected to cost above $100,000 and analysts see it as a worthy competitor in the premium electric car market which Lucid Motors wants to target.

“The EQS is designed to exceed the expectations of even our most discerning customers,” said Mercedes-Benz and Daimler CEO Ola Kaellenius. He added, “That’s exactly what a Mercedes has to do to earn the letter ‘S’ in its name. Because we don’t award that letter lightly.”

Mercedes getting into premium electric cars

Jessica Caldwell, executive director of insights at Edmunds.com said that EQS “is going to have to have a hallmark to stand out. I think giving people that very futuristic feel that you’re actually driving something different will be appealing for some buyers.” She added, “But I think the simplistic design for Tesla has made a lot of people very happy.”

Brian Moody, executive editor at Autotrader is also optimistic about Mercedes’ success in the electric car industry and said “I think Mercedes Benz is going to do a great job on EVs (electric vehicles).

CCIV valuation

Now, as competition is heating up in the premium electric vehicle space, investors are getting apprehensive about CCIV’s valuation. There are also concerns over whether Lucid Motors would be able to execute its ambitious plans. Lucid Motors is setting up its own manufacturing facility following Tesla’s footsteps. Many of the startup electric vehicle companies would get their cars made at a third-party facility. Even NIO gets its cars made at a third-party facility.

As part of the merger with CCIV, Lucid Motors would get cash proceeds of $4.4 billion which it would use to invest in its facilities as it ramps up production. Meanwhile, financing should not be a concern for Lucid Motors as it is backed by Saudi Arabia’s Public Investment Fund (PIF), which is among the wealthiest sovereign wealth funds globally. The PIF also participated in CCIV PIPE investment.

How to buy CCIV stock

SPACs trade like normal stocks but their ticker changes after the merger is completed. You can trade in CCIV through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account